The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx, Indigenous, and Asian people, who are struggling due to deep financial disparities. Today’s disparities are built on, and exacerbated by, long-standing inequities created by structural racism, sexism, and classism, which have limited financial security and overall well-being for those affected. This brief responds to the urgency of this moment, reimagining and building on past recommendations to map more just paths to economic resilience moving forward.

English

Introduction

Section Two: Protecting yourself

Section Three: Supporting Health and Well-being

Additional Resources

French

Introduction

Tresser la seconde mèche : se protéger

Tresser la troisième mèche : favoriser la santé et le bien-être

Tresser la troisième mèche : favoriser la santé et le bien-être

Activité 5 : Mon journal de bien-être financier

Activité 6 : Mon argent est une médecine

Activité 7 : Visualisez vos objectifs financiers

Activité 8 : Mon plan d’investissement

Activité 9 : Partagez vos rêves avec votre famille et vos amis

Ressources supplémentaires

English

Soaring with savings - Tips and tools to help you save

SWS Worksheet #1 – The importance of saving (Fillable PDF)

SWS Worksheet #2 – Create a savings goal (Fillable PDF)

SWS Worksheet #3 – Savings support network (Fillable PDF)

SWS Worksheet #4 – Saving for emergencies (Fillable PDF)

SWS Worksheet #5 – Saving for unstable income (Fillable PDF)

SWS Worksheet #6 – Saving for education (Fillable PDF)

SWS Worksheet #7 – Saving for retirement (Fillable PDF)

Soaring with Savings- Full booklet

Soaring with savings - Training tools

French

Encourager l’épargne - Conseils et outils pour vous aider à épargner

Encourager l’épargne - l’aide d’animation

Ressources

CELI calculatrice, La Commission des valeurs mobilières de l’Ontario

REER, La Commission des valeurs mobilières de l’Ontario

Épargnez plus facilement, CVMO

Investir et épargner pendant une récession, La Commission des valeurs mobilières de l’Ontario

English

Investing with interest: tips and tools for maximizing your savings

IWI – Worksheet #1: What do you want to save for?

IWI – Worksheet #2: Tracking your income and expenses

IWI- Worksheet #3: Are you ready to invest?

IWI- Worksheet #4: What can you invest in?

IWI-Worksheet #5: Where can you get advice?

IWI-Worksheet #6: Watch out for investment frauds and scams

IWI-Worksheet #7: Tips for success

Resources

Crypto Quiz, OSC

Grandparent scams and how to avoid them, OSC

Compound interest calculator, OSC

Emergency fund calculator, OSC

Tips to keep your credit card safe, OSC

Investment products, OSC

Types of fraud, OSC

Multilingual financial resources for Ontarians, OSC

Pay down debt or invest tool, OSC

Reporting fraud, OSC

Introduction to investing, OSC

Scam spotter tool, OSC

Your trusted person and why they matter, OSC

Getting Your Money Back; An Investor’s Guide to Navigating Canada’s Complaint System, FAIR Canada

Study explores Canadian attitudes about Crypto, OSC

How the stock market works, OSC

The basics of personal finance, Credit Canada

What is risk tolerance in investing, OSC

Eight common investment scams and how to spot them, OSC

4 signs of investment fraud, OSC

Evolution of the fraud pitch , Canadian Anti Fraud Centre

Saving or investing for short-term goals, OSC

Investor questionnaire, CIRO

Fees matter, MFDA

Fee calculator, OSC

Annual information about your investment fees, OSC

Investing basics, CIRO

The many faces of elder abuse, OSC

How to Read Your Account Statement and the Things to Focus on, CIRO

Long-haul scammers: Fraudsters who invest time to take your money, OSC

Cybersecurity and Fraud, CIRO

Investor’s guide: cryptocurrencies, CIRO

Artificial intelligence and investor behaviour, OSC

Loan and Trust, FSRA

Fighting Fraud 101: Smart tips for investors, First Nations Development Institute

Financial Planners and Financial Advisors, FSRA

Glossary of common investing terms, CIRO

Invest smart: Taxes and investing, CIRO

Investing charts, OSC

French

L’intérêt d’investir: Conseils et outils pour maximiser votre épargne

Ressources

Questionnaire sur les cryptoactifs, Commission des valeurs mobilières de l’Ontario

Les arnaques des grands-parents et comment les éviter, Commission des valeurs mobilières de l’Ontario

Calculatrice épargne REER, Commission des valeurs mobilières de l’Ontario

Calculatrice intérêts composés, Commission des valeurs mobilières de l’Ontario

Calculatrice fonds d’urgence, Commission des valeurs mobilières de l’Ontario

Astuces pour garder votre carte de crédit en toute sécurité, Commission des valeurs mobilières de l’Ontario

Produits d’investissement, Commission des valeurs mobilières de l’Ontario

Types de fraude, Commission des valeurs mobilières de l’Ontario

Ressources financières multilingues pour les Ontariennes et les Ontariens, Commission des valeurs mobilières de l’Ontario

Calculatrice rembourser des dettes ou investir, Commission des valeurs mobilières de l’Ontario

Signaler une escroquerie, Commission des valeurs mobilières de l’Ontario

Planification de la retraite, Commission des valeurs mobilières de l’Ontario

Questionnaire préparation des investisseurs, Commission des valeurs mobilières de l’Ontario

Introduction au placement, Commission des valeurs mobilières de l’Ontario

Outil détecteur d’escroquerie, Commission des valeurs mobilières de l’Ontario

Votre personne de confiance et les raisons qui expliquent son importance, Commission des valeurs mobilières de l’Ontario

Une étude explore les attitudes des Canadiens à l’égard de la cryptomonnaie, Commission des valeurs mobilières de l’Ontario

Le fonctionnement de la bourse, Commission des valeurs mobilières de l’Ontario

Académie d’investissement, Commission des valeurs mobilières de l’Ontario

Quelle est votre tolérance au risque en matière d’investissement? CVMO

Huit escroqueries courantes en matière d’investissement et comment les repérer, CVMO

Quatre signes de fraude liée aux placements, CVMO

Bulletin : Évolution des types de fraudes, Centre centreantifraude du Canada

Épargner ou investir pour réaliser des objectifs à court terme, CVMO

Questionnaire de l’investisseur, OCRI

Calculateur de frais, CVMO

Information annuelle sur vos frais de placement, CVMO

Principes de base en matière de placement, OCRI

Choisir un conseiller, OCRI

Les nobreuses facettes de l’exploitation financière envers les personnes âgées, CVMO

Comment lire votre relevé de compte et les éléments particuliers qu’il contient, OCRI

La cybersécurité et la fraude, OCRI

Intelligence artificielle et comportement des investisseurs, CVMO

Planificateurs financiers et conseillers financiers, ARSF

Glossaire des placements, OCRI

Investir judicieusement : les impôts et les placements, OCRI

Ten frugal habits to save money

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said they would put it in savings or invest it. With inflation as high as it has been in over 40 years, saving money is becoming increasingly difficult for some. This article lists ten frugal habits to help you save.

Spending habits calculator

Use this calculator to see how changes to your spending habits can impact your budget and help you save more of your money.

Crypto Quiz

Are you considering investing in crypto assets, but aren’t sure whether it’s right for you, legal or just a scam? Test your crypto knowledge and learn how to spot the warning signs of fraud using OSC's quiz.

Investment knowledge quiz

Most people know a little about investing, but they need to know more to be able to manage their investments to meet their goals. Try this quiz by the FCAC to see if your knowledge is basic or more advanced.

Start Your Investment Journey

Before you start investing, it is important to consider your budget and financial goals, and how much risk you are comfortable taking on. Like many things in life, investing comes with its own share of risks and rewards. You can do this on your own or with the help of an advisor.

Connecting families initiative

Daily aspects of Canadians' lives are increasingly touched by digital technology, and access to high-speed Internet has become an essential service and a key driver for improving our economic and social well-being. The Government of Canada originally announced Connecting Families in Budget 2017 to help bridge the digital divide for Canadian families who struggled to afford access to home Internet. Learn more about the next phase of this initiative.

Investing and saving during a recession

If a recession seems likely, consider how your investing and savings plans may be affected. Increases in the cost of living and borrowing, combined with the overall financial uncertainty over the impact of a potential recession, can be enough to cause personal and financial stress. There is no single best way to respond to such times.

Investment recovery calculator

This calculator will help you find out how long it will take for your investment to recover its value after a market downturn and identify how long it will take to get back on track to reach your original goal.

Research study: Crypto assets 2022

This study by the Ontario Securities Commission examines Canadians’ crypto ownership and knowledge. It found 13% of Canadians currently own crypto assets or crypto funds. The study also found most Canadians did not have a working knowledge of the practical, legal and regulatory dimensions of crypto assets. Crypto assets were believed to play a key role in the financial system by 38% of those surveyed. The study provides a profile of crypto owners, their reasons for purchasing crypto assets or crypto funds, the role of financial advice, impact of advertising, and the experience of crypto owners with crypto trading platforms.

Resources

Presentation slides, handouts, and video time stamps

Read the presentation slides for this webinar.

Download resources provided by webinar speakers:

Time-stamps for the video recording:

3:24 – Agenda and Introductions

6:36 – Audience poll questions

9:33 – FAIR Canada presentation (speaker: Tasmin Waley)

24:07 – Ontario Securities Commission presentation (speaker: Christine Allum)

39:10 – Investor Protection Clinic at Osgoode Hall Law School (speaker: Brigitte Catellier)

51:34 – Q&A

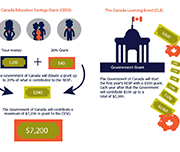

About the Canada Learning Bond

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools, colleges, or universities. Learn more about eligibility requirements and the application process using this website.

Emergency savings preparedness and perceptions

According to Employee Benefit Research Institute (EBRI), workers with household incomes of $75,000 or more are more than twice as likely to say they feel they can handle an emergency expense than those with household incomes of less than $35,000. This report outlines the results of the 2022 survey that polled nearly 2700 Americans 25 and older.

Investment products

There are many investment products, here's some information about them: Annuities: a contract with a life insurance company. Annuities are most commonly used to generate retirement income. Bonds: when you buy a bond, you’re lending your money to a company or a government for a set period of time. In return, the issuer pays you interest. On the date the bond becomes due, the issuer is supposed to pay back the face value of the bond to you in full. Complex investments: these investments may have the potential for higher gains, but carry greater risks. ETFs: when you buy a share or unit of an ETF, you’re investing in a portfolio that holds a number of different stocks or other investments. GICs: when you buy a guaranteed investment certificate (GIC), you are agreeing to lend the bank or financial institution your money for a set number of months or years. You are guaranteed to get the amount you deposited back at the end of the term. Mutual funds & segregated funds: when you buy a mutual fund, your money is combined with the money from other investors, and allows you to buy part of a pool of investments. Real estate: While real estate investments can offer a range of benefits, there is no guarantee that you will earn an income or profit and, like any investment, there are a number of risks and uncertainties that you need to carefully consider before investing. Stocks: The stock market brings together people who want to sell stock with those who want to buy stock. When you buy stock (or equity) in a company, you receive a piece of the company and become a part owner. Pensions & saving plans: if your employer offers contributions to your retirement or other savings plan, take advantage. Cannabis: Emerging sectors like the cannabis industry have often attracted investors hoping to be among the first to capitalize on the potential growth and high returns of what they believe are untapped markets or products that may be popular in the future. Cryptoassets: Cryptoassets primarily designed to be a store of value or medium of exchange (e.g., Bitcoin) are often referred to as “digital coins.

A guide to the best robo-advisors in Canada for 2022

Robo-advisors first arrived in Canada in the beginning of 2014 presenting young and middle-income investors the option of having their savings passively managed in a bundle of exchange-traded funds (ETFs) matched to their goals and risk tolerance for about a penny on the dollar per year: A perfect set-it-and-forget it solution for people with better things to do. Fast forward to today and the honeymoon atmosphere has dissipated. Against the backdrop of an extraordinarily long-lived bull market in stocks, active management has made a comeback (not least in the ETF space), exotic asset classes like cryptocurrency are on the rise, and new competition is coming from asset-allocation ETFs that do the job of portfolio management all in one security. Suddenly robo-advisors find themselves having to prove their worth anew, all the while trying to establish a profitable business model in a low-margin corner of the investment universe. It’s surprising, really, because amid all the competition their fee structures and value proposition are as good as or better than ever. Investors now must probe deeper in their choice of robo-advisor, asking tough questions around performance, risk and the composition of portfolios. The 2022 survey of the Canadian robo industry shows, they’re not all the same.

TFSA Calculator

A Tax-Free Savings Account (TFSA) can be used to save for any goal. You put after-tax dollars into a TFSA, but your investments grow tax-free and you won’t pay any tax on withdrawal. Use this calculator to estimate the value of the investments in your TFSA when you’re ready to withdraw them, and compare this amount to the value of your investments in a non-registered plan to see your overall estimated tax savings.

Take the stress out of budgeting

Making a budget is one of the most helpful financial tools you can use on a regular basis. A budget can give you a clear picture of where your money is going. It’s easier to plan for the life you want, when you know how much money you have for saving, spending and paying off debt. If you’ve never made a budget, or have not created one in a long time, it can be an intimidating reality check. Don’t let stress or worry keep you from creating a budget. The best budgeting method to use is the one that works for you.

101 solutions for inclusive wealth building

Having wealth, or a family’s assets minus their debts, is important not just for the rich— everyone needs wealth to thrive. Yet building the amount of wealth needed to thrive is a major challenge. Nearly 13 million U.S. households have negative net worth. Millions more are low wealth; they do not have the assets or liquidity needed to maintain financial stability and invest in themselves in the present, nor are they on track to accumulate the amount of wealth they will need to have financial security in retirement. This report examines what it will take to create truly shared prosperity in the United States. It is focused on solutions that would grow the wealth of households in the bottom half of the wealth distribution, and it explores reparative approaches to building the wealth of Black, Indigenous, and other people of color (BIPOC).

Together, these groups represent at least half of all U.S. households.

Investing basics

Whether you’re a first-time investor, thinking of saving for your education, or planning for your retirement, FAIR Canada's investing basics may help you on your investing journey.

Compound interest calculator

Using OSC's online calculator, find out how your investment will grow over time with compound interest.

Emergency fund calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Ideally, this fund would provide enough money to cover your essential living expenses so you can avoid taking on debt. Use OSC's calculator to estimate how much money should be set aside to pay for financial emergencies.

Introduction to investing: A primer for new investors

Whether you’re new to investing, or new to Canada, InvestingIntroduction.ca can help. Visit the Ontario Securities Commission's refreshed website and find resources to help you make more informed investment decisions and better protect your money. The information is available in 22 languages.

Investor readiness quiz

Investing is an important part of planning for a financially secure future. It can battle the effects of inflation on your savings, grow your wealth, and provide sources of income in retirement. The sooner you invest, the longer compound interest can work to grow your savings exponentially. However, there are some important milestones to achieve and questions to consider before you start investing. Are you ready to invest? Take this quiz to find out!

Living your retirement

These resources from the Ontario Securities Commission are oriented towards planning for retirement. Resources include tips on insurance planning, government benefits, RRSP calculator, and more.

Innovations in Financial Capability: Culturally Responsive & Multigenerational Wealth Building Practices in Asian Pacific Islander (API) Communities

The Innovations in Financial Capability report is a collaborative report by National CAPACD and the Institute of Assets and Social Policy (IASP) at Brandeis University’s Heller School for Social Policy and Management, in partnership with Hawaiian Community Assets (HCA), and the Council for Native Hawaiian Advancement (CNHA). This survey report builds upon the 2017 report Foundations for the Future: Empowerment Economics in the Native Hawaiian Context and features the financial capability work of over 40 of our member organizations and other AAPI serving organizations from across the US. IASP’s research found that AAPI leaders are adopting innovative multigenerational and culturally responsive approaches to financial capability programming, but they want and need more supports for their work.

Get Smarter About Money: Financial Literacy 101 videos

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos covers different financial literacy topics., including:

Children’s Savings Account: Survey of Private and Public Funding 2019

Children’s Savings Account (CSA) programs offer a promising strategy to build a college-bound identity and make post-secondary education an achievable goal for more low- and moderate-income children. CSAs provide children (starting in elementary school or younger) with savings accounts and financial incentives for the purpose of education after high school. Beyond their financial value, CSAs are associated with beneficial effects for children and parents, including improved early child development. child health, maternal mental health, educational expectations, and academic performance. Many of these benefits are strongest for children from low-income families. This report shares a snapshot of the scale and makeup of the funding for the CSA field in 2019. It follows similar AFN reports on CSA funding in 2014-2015 and 2017 and captures the following data on CSA programs’ financial support in calendar year 2019:

Investing and The COVID-19 Pandemic: Survey of Canadian Investors

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and trading activity of retail investors. Key findings include that 32 per cent of investors have experienced a decline in their financial situation during the pandemic while 16 per cent have experienced an improvement. Half of investors have not done any trading during the pandemic, but of those who have been trading, 63 per cent have increased their holdings.

Creating Financial Security: Financial Planning in Support of a Relative with a Disability

This handbook covers the following topics:

Money Mentors – Savings & Debt Resources

Collection of money management resources, including how create effective budgets, realistic spending plans, deal with your debts, save more money, build a stronger credit rating, and prepare for retirement.

Recordkeepers’ Role in Providing Emergency Savings for an Inclusive Recovery

In this webinar, Commonwealth in partnership with DCIIA Retirement Research Center (RRC) and SPARK Institute present findings from our new research about drivers and considerations of recordkeeper-provided emergency savings and host a discussion with industry experts.

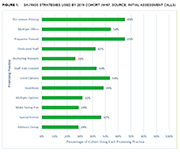

Tax Time: An opportunity to Start Small and Save Up

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being. This paper also provides a few examples of how Volunteer Income Tax Assistance (VITA) programs creatively used Bureau tools, resources and technical assistance to encourage savings as well as some of the results they reported. It provides insights from a subgroup of the programs in the cohort that collected additional information from consumers on their intent to save, the various types of accounts into which they saved, and the goals they were striving for by saving. Finally, this paper offers recommendations on some strategies that can be employed to increase people’s interest and commitment to saving during the tax preparation process.

Planning for tax-time savings

This report presents the results of a large-scale field experiment that the tax preparation company H&R Block (the Company) conducted in collaboration with the Consumer Financial Protection Bureau (the CFPB). The field experiment investigated whether customers could be encouraged, through consumer communications with and without the offer of a small financial incentive, to use a savings feature on a prepaid card to save a portion of their tax refunds from all sources, including state and federal refunds. The CFPB was particularly interested in whether consumers who receive the Earned Income Tax Credit (EITC) would be receptive to messages about saving.

Financial Life Stages of Older Canadians

This study, commissioned by the Ontario Securities Commission (OSC) and conducted by the Brondesbury Group, provides some insights on the knowledge that older Canadians have about the financial realities of retirement and how they would apply that knowledge earlier in life if they are able to do so. The top financial concerns and main financial risks of older Canadians are identified for each life stage and how they are being managed are discussed.

Encouraging Retirement Planning through Behavioural Insights

This research report identifies behaviourally informed ways that government, regulators, employers, and financial institutions can encourage retirement planning. Thirty different initiatives and tactics that could be implemented by a variety of stakeholders to encourage retirement planning are proposed, and interventions are organized around four primary challenges people face in moving from having the intention to create a retirement plan to the action of making a plan: (1) it’s hard to start, (2) it’s easy to put off, (3) it’s easy to get overwhelmed and drop out, and (4) it’s hard to get the right advice. The report also includes the results of a randomized experiment that evaluated several of the approaches proposed in the report. This report was published as part of the Ontario Securities Commission’s strategy and action plan to respond to the needs and priorities of Ontario seniors.

Cash Value: How The Financial Clinic Puts Money into the Pockets of Working Poor Families

Practitioners engaged in the nascent field of financial development lack a shared system of tracking and analyzing customer progress toward financial security. Practice leaders—ranging from direct service organizations such as the Chicago-based LISC to NeighborWorks America of Washington, D.C.—define customer progress by their individual outcomes frameworks. But without uniform outcomes measures to assess our customers’ progress—and thus, our own performance—the field as a whole is handicapped. Many factors contribute to this problem, two being most prominent: organizations are grounded in distinct theories of change, are funded by a variety of sources with their own expectations, and lack of clarity about how to measure aspects of our work.

Change Matters Volume 2: Assets

This is the second brief in a new series from The Financial Clinic. Change Matters leverages the data gathered through our revolutionary financial coaching platform, Change Machine, alongside the voices, wisdom, and lived experiences of Change Machine customers. We hope that our action oriented analysis will lead to positive social change. We believe we have a responsibility to ask the right questions, to use our data for good, and to inspire products, practice, and policy innovations that centralize the needs of the working-poor in building economic mobility.

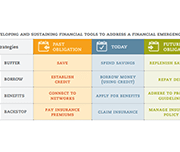

Achieving Financial Resilience in the Face of Financial Setbacks

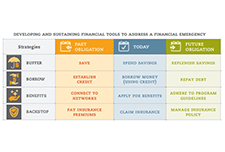

Financial shocks like these happen to financially vulnerable families every day. Such shocks destabilize household finances and can create hardships that threaten overall well-being. Having tools to manage financial emergencies is critical for people’s long-run financial security. The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Clipped Wings: Closing the Wealth Gap for Millennial Women

AFN’s latest report, in collaboration with the Closing the Women’s Wealth Gap (CWWG) and the Insight Center for Community Economic Development reveals the current economic reality for millennial women and the primary drivers contributing to their wealth inequities. The report, Clipped Wings: Closing the Wealth Gap for Millennial Women is the second in a series of publications that builds off AFN’s 2015 publication, Women & Wealth, exploring how the gender wealth gap impacts women.

From Surviving to Thriving – Ensuring the Golden Years Remain Golden for Older Women

This brief explores the drivers of economic insecurity for older women and sets forth a number of strategies and promising practices for funders to consider which address the needs of older women. Doing so will ensure this generation and future generations of men and women in this country can age financially secure and with dignity. This publication is the fourth in a series of briefs that build on AFN’s publication, Women & Wealth, to explore how the gender wealth gap impacts women, particularly low-income women and women of color, throughout their life cycle, and provides responsive strategies and best practices that funders can employ to create greater economic security for women.

Women and Wealth: Insights for Grantmakers

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for Grantmakers examines the causes and dimensions of the women’s wealth gap and provides recommendations and best practices for grantmakers to reduce the women’s wealth gap and improve women’s access to the wealth escalator. Improving women’s ability to build wealth is not only good for women, but is essential for the economic well-being of children, families, and our nation. The webinar, included Mariko Chang, PhD, K. Sujata, President and CEO, Chicago Foundation for Women, and Dena L. Jackson, PhD, Vice President – Grants & Research, Texas Women’s Foundation.

Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help

More than 44 million people in America have taken on student debt to pursue a post-secondary education. These borrowers collectively owe around $1.6 trillion in student loan debt. Borrowers exist in every community, but some are particularly vulnerable to its impact. Women hold two-thirds of all outstanding student debt and Black and Latinx borrowers disproportionately struggle with repayment. This webinar discussed the disparate impact of student loan debt on black and Latinx students and the following topics:

Making Safety Affordable: Intimate Partner Violence is an Asset-Building Issue

This brief explores three existing unmet needs that contribute to survivors’ inability to build wealth: money, tailored asset-building support, and safe and responsive banking and credit services. Within each identified need, specific issues facing survivors, strategic actions in response to those issues, as well as innovative ideas and existing promising practices to help funders take action to prioritize survivor wealth are discussed.

Set a Goal: What to Save For

America Saves, a campaign managed by the nonprofit Consumer Federation of America, motivates, encourages, and supports low- to moderate-income households to save money, reduce debt, and build wealth. Information and tips for setting a savings goal, making a savings plan, how to save automatically, and other tools and resources are included.

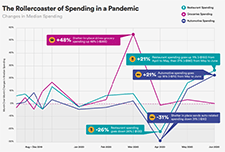

The Economic Toll of COVID-19 on SaverLife Members

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their savings program members during the COVID-19 pandemic from March to August of 2020.

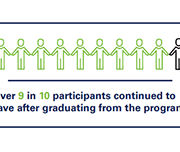

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

English

Introduction to asset building

Asset building for your future (fillable PDF)

Asset building for your future (print version)

My long-term goal action plan (fillable PDF)

My long-term goal action plan (print version)

Introduction to savings accounts

Registered savings accounts

Investing in registered accounts

Seven tips to help you stick to your goals

Glossary – asset building

Resources – asset building

Making it easier to save

Types of investments and types of accounts

Investing basics

How to manage financial stress and avoid burnout

Education savings

RESPs and how they can help

Before you open an RESP

Individual, family and group RESPs

Federal education grants and bonds

Provincial education grants and bonds

Family income to receive RESP government incentives

RESP sample scenarios

Plan for your RESP bank visit

My RESP action plan (fillable PDF)

My RESP action plan (print version)

Glossary – education savings

Resources – education savings

Employment and Social Development Canada (ESDC) resources for the Canada Learning Bond (CLB):

Canada Learning Bond Application for Adult Beneficiaries

Q&A about the Canada Learning Bond for adult beneficiaries

Revised income brackets for Canada Learning Bond (July 2022 to June 2023)

French

L‘accumulation d’actifs

L’accumulation d’actifs pour votre avenir – fillable

L’accumulation d’actifs pour votre avenir – nonfillable

Mon plan d’action axé sur mon objectif à long terme – fillable

Mon plan d’action axé sur mon objectif à long terme – nonfillable

Introduction aux comptes d’épargne

Comptes d’épargne enregistrés (REEI, REEE, REER et CELI)

Investir dans les comptes enregistrés :les options et les questions à poser à votre banque

Sept conseils pour vous aider à respecter vos objectifs

Glossaire – Accumulation d’actifs

Epargne-études

Les REEE : comment peuvent-ils vous aider?

Comment choisir entre unREEE individuel, familial et collectif

Les subventions et les bons d’études du gouvernement fédéral

Les subventions et les bons d’études du gouvernement provincial

Le REEE : comment peut-il vous aider à faire fructifier vos épargnes pour les études?

Arrivez préparé à votre rendez-vous à la banque pour ouvrir un REEE

Mon plan d’action en matière de REEE – fillable

Mon plan d’action en matière de REEE – nonfillable

Prosperity Now Scorecard

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to jump-start a conversation about solutions and policies that put households on stronger financial footing across five issue areas: Financial Assets & Income, Businesses & Jobs, Homeownership & Housing, Health Care and Education.

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of parents opening RESP accounts has increased steadily over time, as of 2016, participation rates remained more than twice as high among parents in the top income quartile (top 25%) compared with those in the bottom quartile. This study provides insight into the factors behind the gap in (RESP) participation between higher and lower-income families.

Low Income Retirement Planning

This booklet contains information on retirement planning on a low income. Topics include four things to think about for low income retirement planning, a background paper on maximizing the Guaranteed Income Supplement (GIS), and determining Old Age Security (OAS) and GIS eligibility for people who come to Canada as adults.

How to use your tax refund to build your emergency savings

If you file your taxes in the United States, you can learn how your tax return can kickstart your savings. This guide from the Consumer Financial Protection Bureau walks you through some fast and easy ways to use your tax refund to increase your savings. This guide covers multiple topics including: why save your tax return, how to save money fast, affordable ways to file your taxes, and how to protect yourself from tax fraud.

Canada Learning Bond – Get $500 for your child’s future

This two-page brochure describes the benefits of acting now to receive $500 to help start saving for a child's education after high school. The brochure is also available in the following Indigenous languages:

English

Getting started

Budgeting

The five Ws and H of budgeting

How to make a budget step by step

Income tracking sheet – PDF

Income tracking sheet – fillable PDF

Expenses tracking sheet – PDF

Expenses tracking sheet – fillable PDF

Simple budget template- PDF

Simple budget template – fillable PDF

Five different budgeting methods

Cashflow budget template – PDF

Cashflow budget template – fillable PDF

Ten ways to trim expenses

Resources

Budgeting and saving resources (as a printable handout)

Online budgeting tools and calculators:

Budget planner – Financial Consumer Agency of Canada (FCAC)

Financial tools and calculators – Government of Canada

Get smarter about money: calculators & tools – Ontario Securities Commission (OSC)

My expenses calculator – Office of Consumer Affairs (OCA)

Tools to help when you can’t pay your bills – Consumer Financial Protection Bureau (CFPB)

Compound interest – Canadian Investment Regulatory Organization (CIRO)

Information on budgeting and saving:

An essential guide to building an emergency fund – Consumer Financial Protection Bureau (CFPB)

COVID-19: managing financial health during challenging times – Financial Consumer Agency of Canada (FCAC)

Get smarter about money: budgeting – Ontario Securities Commission (OSC)

Glossary of budgeting and saving terms – Prosper Canada

Managing your money – Financial Consumer Agency of Canada (FCAC)

My money in Canada – Prosper Canada

Setting up an emergency fund – Financial Consumer Agency of Canada (FCAC)

Preparing for financial emergencies – Ontario Securities Commission (OSC)

Planning for retirement – Ontario Securities Commission (OSC)

How to prepare for a financial emergency – Ontario Securities Commission (OSC)

Resources to help clients with money management:

Connecting families – Government of Canada

Managing your money booklet – Prosper Canada

Start small, save up – Consumer Financial Protection Bureau (CFPB)

Resources to help clients with budgeting at the grocery store:

Food sense, healthy cooking on a budget – Family Services of Greater Vancouver (FSGV)

Beating the grocery store blues – Family Services of Greater Vancouver (FSGV)

French

Matière de budget

Cinq questions à se poser en matière de budget

Comment faire un budget : un guide étape par étape

Fichier de suivi des revenus (PDF)

Fichier de suivi des revenus (PDF à remplir)

Fichier de suivi des dépenses (PDF)

Fichier de suivi des dépenses (PDF à remplir)

Modèle de budget simple (PDF)

Modèle de budget simple (PDF à remplir)

5 façons différentes de faire un budget

Budget de caisse (PDF)

Budget de caisse (PDF à remplir)

10 façons de réduire ses dépenses

Infographic: Avoid financial stress, save for emergencies

This infographic illustrates the importance of having an emergency fund and how to build one.

Retirement Literacy Website

The ACPM Retirement Literacy Program complements the financial literacy education efforts by the federal and provincial governments, and other organizations. The website contains a series of quizzes to help improve your knowledge of pensions and retirement savings plans as well as links to financial literacy resources.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

Canada’s Colour Coded Income Inequality

Canada’s population is increasingly racialized. The 2016 census counted 7.7 million racialized individuals in Canada. That number represented 22% of the population, up sharply from 16% just a decade earlier. Unfortunately, the rapid growth in the racialized population is not being matched by a corresponding increase in economic equality. This paper uses 2016 census data to paint a portrait of income inequality between racialized and non-racialized Canadians. It also looks at the labour market discrimination faced by racialized workers in 2006 and 2016. These data provide a glimpse of the likely differences in wealth between racialized and non-racialized Canadians. This paper also explores the relationship between race, immigration and employment incomes. Taken together, the data point to an unequivocal pattern of racialized economic inequality in Canada. In the absence of bold policies to combat racism, this economic inequality shows no signs of disappearing.

Investor Protection Clinic and Living Lab: 2019 Annual Report

The Investor Protection Clinic, the first clinic of its kind in Canada, provides free legal advice to people who believe their investments were mishandled and who cannot afford a lawyer. The Clinic was founded together with the Canadian Foundation for Advancement of Investor Rights (FAIR Canada), an organization that aims to enhance the rights of Canadian shareholders and individual investors. The 2019 Annual Report summarizes the work of The Clinic, including description of the work and types of cases, example case scenarios of the clients who benefited from The Clinic's services, client data and demographics, and recommendations.

Budget Planner

The Financial Consumer Agency of Canada (FCAC)'s online tool helps you create a customized budget.

Emergency Fund Calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Use this calculator to estimate how much money should be set aside to pay for financial emergencies.

Canada Education Savings Program: Choosing the right RESP

This printable brochure from the Government of Canada explains the key details you need to know when choosing a Registered Education Savings Plan (RESP) for your child's education savings.

Canada Education Savings Program: Frequently Asked Questions

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans (RESPs).

Incentivized Savings: An Effective Approach at Tax Time

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through a dedicated collaboration with ATB Financial, Aspire Calgary, Sunrise Community Link Resource Centre, Centre for Newcomers, and First Lutheran Church Calgary that made it all possible. This report shares results and highlights from the 2018 Tax Time Savings program. 93% of participants earned the maximum match of $500.

Helping Families Save to Withstand Emergencies

This brief identifies policy solutions to help American families build savings to withstand emergencies that threaten their financial stability.

Removing Savings Penalties for Temporary Assistance for Needy Families

This brief discusses the savings penalties in public assistance programs in the United States, also known as asset limits, and that actions that can be taken to eliminate these limits and the barriers towards building savings for families living on low income.

Saving for Now and Saving for Later: Rainy Day Savings Accounts to Boost Low-Wage Workers’ Financial Security

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial shocks.

Giving Savings Advice

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at a specific point in the tax preparation process: when entering dependent information. The video also includes examples of commonly heard reasons tax filers give for not wanting to save, and possible responses.

Talking About Savings

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video discusses why promoting savings at tax time is a critical component of VITA volunteers.

Expanding Educational Opportunity Through Savings

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and impact.

Spurring Savings Innovations: Human Insight Methods for Savings Programs

This brief uses the experiences of participants in a service design process called the Savings Innovation Learning Cluster (SILC) to gather key insights into client perspectives and how it can be used to better program design. Four human insights research and design methods are explored—client interviews, client journey mapping, concept boards and prototyping—which can be used to develop more effective savings programs.

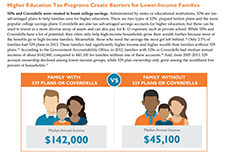

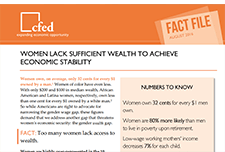

Fact File: Women Lack Sufficient Wealth to Achieve Economic Stability

Women own, on average, only 32 cents for every $1 owned by a man in America. Women of color have even less. Both the gender wage gap and the gender wealth gap need to be taken into account to address threats to women's economic security.

My money in Canada

Are you a newcomer to Canada, or someone who works with newcomers? This online tool will help you explore five money modules to better manage your finances in Canada. Learn about the financial system in Canada, income and expenses, setting goals and saving, credit and credit reports, and filing taxes. Updated July 26, 2022: My money in Canada provides important information about Canada’s financial system and promotes positive money management habits to support Canadians to succeed financially. Interactive exercises and checklists support you to make informed choices and to create a customized financial plan that works for you. Originally designed to support newcomers to Canada as they settle and establish themselves financially, My money in Canada has been updated to serve all Canadians, including those who are new to Canada.

RDSP calculator

Enhance the quality of life for a family member with a disability. By answering a few simple questions, the RDSP Calculator can help you project the estimated future value of an RDSP, and the approximate value of future withdrawal payments. Run various scenarios to see how it would affect the value of your RDSP. The RDSP Calculator is a tool to help you assess the potential of opening and contributing to an RDSP. The estimates provided by the Calculator are for information purposes only. The profile of your RDSP may differ from the RDSP Calculator projection.

Tax Time: An opportunity to Start Small and Save Up

The Consumer Financial Protection Bureau’s continuing effort to encourage saving at tax time is now part of a larger Bureau initiative to support people in building liquid savings. The new initiative is called Start Small, Save Up. The vision for Start Small, Save Up is to increase people’s financial well-being through education, partnerships, research, and policy or regulatory improvements that increase people's opportunities to save and empower them to realize their personal savings goals. This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being.

It pays to plan for a child’s education

This fact sheet from ESDC explains how to open an RESP and access the Canada Learning Bond.

Proliteracy.ca: Plan Finances for University or College

Proliteracy.ca analyzes historical living expenses from over 160 cities and tuition from over 100 universities and colleges in Canada to predict the cost of post secondary education in the future. Their tool suggests financing options based on your profile. Learn about RESP, grants, scholarships and various government and commercial programs with their online resources.

Accessing the Canada Learning Bond: Meeting Identification and Income Eligibility Requirements

Not having a Social Insurance Number (SIN) and not filing taxes may represent challenges to access government programs and supports such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). Limited data availability has prevented a full assessment of the extent of these access challenges. This study attempts to address this knowledge gap by analyzing overall differences in SIN possession and tax-filing uptake by family income, levels of parental education, family type and Indigenous identity of the child and age of children using the 2016 Census data augmented with tax-filing and Social Insurance Number possession indicator flags.

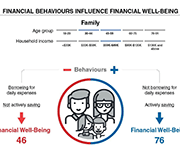

Backgrounder: Preliminary findings from Canada’s Financial Well-Being Survey

This backgrounder reports preliminary findings from a survey of financial well-being among Canadian adults. Preliminary analysis of the survey data indicates that two behaviours are particularly important in supporting the financial well-being of Canadians. First, our analysis indicates that Canadians who practice active savings behaviour have higher levels of financial resilience as well as higher levels of overall financial well-being. In other words, regardless of the amount of money someone makes, regular efforts to save for unexpected expenses and other future priorities appears to be the key to feeling and being in control of personal finances. Secondly, Canadians who often use credit to pay for daily expenses because they have run short of money have lower levels of financial well-being. While this behaviour is likely symptomatic of low levels of financial well-being, our analysis indicates that a person can substantially improve their financial resilience and financial well-being by implementing strategies to reduce the frequency of running out of money and of having to rely on credit to get by.

Retirement 20/20: The 2019 Fidelity Retirement Survey

The Fidelity Retirement Survey is focused on how Canadians near, and already in, retirement approach the next stage of their lives. This is the 14th year of the survey. The results indicate Canadians are retiring earlier than expected. They also show 46% of pre-retirees expect to have some long-term debt when they retire, and that 70% believe they will be working in retirement, among other results.

Promise Accounts: Matched Savings to Help Families Get Ahead

This report from Prosperity Now shows the importance of matched savings programs called 'Promise Accounts' which help families successfully save for their futures. They are especially important for households of color as compared to white households. Decreasing economic inequality and closing the racial wealth divide means creating saving pathways for low-income households to build wealth. Promise Accounts make some key changes to traditional matched savings programs. Specifically, these accounts would have features including:

Short-term financial stability: A foundation for security and well-being

Short-term cushions are key to longer-term financial security and well-being. This report shines a light on the central role that short-term financial stability plays in a person’s ability to reach broader financial security and upward economic mobility, a measurement of whether an individual moves up the economic ladder over one’s lifetime or across generations. The insights presented in this report draw primarily on evidence provided by members of the Consumer Insights Collaborative (CIC), a group of nine leading nonprofits across the United States convened by the Aspen Institute Financial Security Program. These diverse organizations offer a window into the financial lives of the low- and moderate-income individuals they serve.

Accessing the Canada Learning Bond: Meeting Identification and Income Eligibility Requirements

Introduced in 1998, the Canadian Education Savings Program (CESP) was designed as an incentive to encourage education savings for the post-secondary education of a child. The program is centred on Registered Education Savings Plans (RESPs), where savings accumulate tax-free until withdrawn, to pay for full- or part-time postsecondary studies such as a trade school, CEGEP, college, or university, or in an apprenticeship program. The CLB was introduced in 2004 specifically for children from low income families. CLB provides, without family contribution being required, eligible families with an initial RESP payment which may be followed by annual payments up until the child is aged 15 years old. The objective of this paper is to assess the extent to which not tax-filing and not having a SIN for a child could pose a challenge to accessing the CLB and the CESG. This study will address the knowledge gap by analyzing overall differences in SIN and tax-filing uptake by family income, levels of parental education, family type and Indigenous identity of the child. The findings will help understand access issues related to the CLB but also to other programs with similar administrative conditions. En francais: Accéder au Bon d’études canadien: l’atteinte des critères d’identification et d’éligibilité selon le revenu.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

Do Tax-Time Savings Deposits Reduce Hardship Among Low-Income Filers? A Propensity Score Analysis

A lack of emergency savings renders low-income households vulnerable to material hardships resulting from unexpected expenses or loss of income. Having emergency savings helps these households respond to unexpected events, maintain consumption, and avoid high-cost credit products. Because many low-income households receive sizable federal tax refunds, tax time is an opportunity for these households to allocate a portion of refunds to savings. We hypothesized that low-income tax filers who deposit at least part of their tax refunds into a savings account will experience less material and health care hardship compared to non-depositors. Six months after filing taxes, depositors have statistically significant better outcomes than non-depositors for five of six hardship outcomes. Findings affirm the importance of saving refunds at tax time as a way to lower the likelihood of experiencing various hardships. Findings concerning race suggest that Black households face greater hardship risks than White households, reflecting broader patterns of social inequality.

Why Community Foundations Make Perfect Partners for Children’s Savings Account Programs

In this brief, we articulate why collaboration between community foundations and CSA programs is in their mutual interest. We describe the variety of roles that community foundations can play in promoting the growth and success of CSA programs, and then identify the primary challenges encountered by community foundations in supporting CSAs. The brief concludes with key lessons learned about collaboration between community foundations and CSA programs. This brief was designed primarily to educate CSA practitioners and community foundation staff about the benefits of collaboration. It may also be of interest to a wider audience in the fields of asset building and philanthropy. The ideas and findings in this brief are based primarily on in-depth interviews and in-person meetings with board members, executives and senior staff from three community foundations.

Video: Additional CPP

This short video from the Canadian Pension Plan Investment Board explains the new additional Canada Pension Plan (CPP).

Evaluation of the Guaranteed Income Supplement

The Old Age Security program is the largest statutory program of the Government of Canada, and consists of the Old Age Security pension, the Guaranteed Income Supplement, and the Allowance. The Guaranteed Income Supplement is provided to low-income seniors aged 65 years and over who receive the Old Age Security pension and are below a low-income cut-off level. This evaluation examines take-up of the Guaranteed Income Supplement by various socioeconomic groups, the characteristics of those who are eligible for the Supplement but do not receive it, and barriers faced by vulnerable groups.

Debt and assets among senior Canadian families

Using data from the Survey of Financial Security (SFS), this article looks at changes in debt, assets and net worth among senior Canadian families over the period from 1999 to 2016. It also examines changes in the debt-to income ratio and the debt to-asset ratio of senior families with debt. This study finds that the proportion of senior families with debt increased from 27% to 42% between 1999 and 2016.

Are Low-Income Savers Still in the Lurch? TFSAs at 10 Years

The introduction of Tax-Free Savings Accounts (TFSAs) in 2009 transformed how Canadians save. One of the main reasons for creating TFSAs was to provide a taxassisted savings instrument for low-income Canadians to enable them to improve their retirement income. Now, 10 years later, many low-income savers are still not using TFSAs in ways that would allow them to benefit fully from the government transfer programs intended for them in retirement, such as the Guaranteed Income Supplement. Consequently, intended benefits from TFSAs are going untapped. Improving public education and financial literacy may be part of the solution to this problem, but built-in policy nudges and tax adjustments will be more effective.

Analyzing the Landscape of Saving Solutions for Low-Income Families

To address challenges around savings, the asset building and financial services fields have developed an array of solutions that attempt to support savings and wealth accumulation. However, the landscape of savings solutions is complex, difficult for households to navigate, and full of solutions that are not designed specifically for low-income and low-wealth households. This brief examines the savings challenges that households face, their underlying causes, and a vision for new solutions.

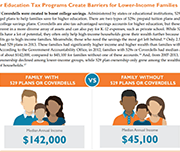

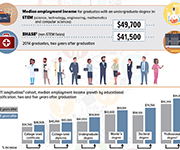

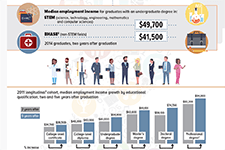

Infographic: Labour market outcomes for college and university graduates, 2010 to 2014

This infographic from Statistics Canada shows the labour market outcomes for college and university graduates between 2010 and 2014. It shows the median employment income achieved by graduates of different education levels, 2 years and 5 years post-graduation. Overall, it shows that people with higher levels of post-secondary education report higher employment income post-graduation.

RRSP Savings Calculator

Use this tool by the OSC to estimate how much your registered retirement savings plan (RRSP) will be worth at retirement and how much income it will provide each year.

TFSA Calculator

This calculator will help you estimate the value of the investments in your TFSA when you’re ready to withdraw them, and compare this amount to the value of your investments in a non-registered plan to see your overall estimated tax savings.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

Brief: Matched Savings programs – webinar handout (Momentum)

Matched Savings programs chart – webinar handout (Momentum)

Budget Tracker – webinar handout (Credit Counselling Sudbury)

Monthly Budget – webinar handout (Credit Counselling Sudbury)

Time-stamps for the video-recording:

3:26 – Agenda and introduction

6:17 – Audience polls

9:41 – Reasons to save (Speaker: Glenna Harris)

12:08 – Effectiveness of Matched Savings (Speaker: Dean Estrella from Momentum)

32:10 – Savings strategies for clients on low incomes (Speaker: John Cockburn from Credit Counselling Sudbury)

47:50 – Q&A

Better Borrowing: How State-Mandated Financial Education Drives College Financing Behaviour

As student loan reform continues to dominate national discourse, a NEFE-funded study shows that financial education in states with state-mandated personal finance graduation requirements causes students to make better decisions about how to pay for college. It increases applications for aid, federal aid taken, and grants — all while decreasing credit card balances. Put simply, financial education makes better borrowers. This study examines positive effects of state-mandated financial education graduation requirements. As of 2017, 25 states have implemented mandates for personal finance education prior to graduation.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar:

RESP case plan – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP tracking sheet – webinar handout (from Credit Counselling Sault Ste. Marie)

RESP quick reference sheet – webinar handout (from FSGV)

RESP sample letter to schools – webinar handout (from Credit Counselling Sault Ste. Marie)

Time-stamps for the video recording:

3:00 – Agenda and introductions

5:05 – Audience polls

9:00 – Importance of education savings (Speaker: Glenna Harris)

16:00 – Credit Counselling Services Sault Ste. Marie and District (Speaker: Allyson Schmidt)

33:00 – Family Services of Greater Vancouver (Speaker: Rocio Vasquez)

54:45 – Q&A

Asset Building: An Effective Poverty-Reduction Strategy

This brief explains the asset-building approach to poverty reduction. While many families who live on low incomes struggle to meet basic needs, they miss out on opportunities to save and invest - opportunities that are critical in overcoming poverty. Without income, people are unable to get by and without assets, people are unable to get ahead. At Momentum, we call opportunities to save or invest, Asset Building.

With financial assets, individuals can pay down debt, save more, earn a good credit rating, save for a down payment on a home, and build a sustainable livelihood.

Improving Education Outcomes through Children’s Education Savings

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career expectations, and future financial capability. This brief explains why RESPs are so important, and how parents can use RESPs to save for their children's education.

Increasing Take-Up of the Canada Learning Bond

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible population. The Impact and Innovation Unit (IIU), in collaboration with the Learning Branch and the Innovation Lab at Employment and Social Development Canada (ESDC) conducted a randomized controlled trial to test the effectiveness of behavioural insights (BI) in correspondence sent to primary caregivers of children eligible for the CLB. This trial demonstrates the effectiveness of BI interventions tailored to the particular behavioural barriers that affect specific populations in increasing take-up of programs like the CLB. If scaled across the eligible population, the best performing letter would result in thousands more children receiving this education savings incentive on an annual basis.

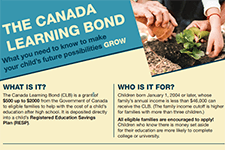

The Canada Learning Bond: What you need to know

This one-page fact sheet tells you everything you need to know to make your child's future possibilities grow! The Canada Learning Bond (CLB) is a grant of $500 up to $2000 from the Government of Canada to eligible families to help with the cost of a child’s education after high school. It is deposited directly into a child’s Registered Education Savings Plan (RESP). Children born January 1, 2004 or later, whose family’s annual income is less than $46,000 can receive the CLB.

The Omega Foundation and the SmartSAVER Program, Lessons in Taking Social Innovations to Scale

This case study is about the Omega Foundation’s SmartSAVER program. It has effectively elevated the Canada Learning Bond (a post-secondary education savings program for low income families) from a struggling idea to a fully-fledged and well-utilized national resource. In so doing, Omega and SmartSAVER have created new pathways out of poverty for thousands of Canadians. This story gives us significant insight into the process of bringing an innovative idea to life. It offers important observations about the barriers to launching and scaling innovative ideas. It also offers insights into the solutions that can overcome these barriers.

Group RESP Educational Materials

This document explains the basics of group RESPs, including what they are, what they may cost, what you need to know about your group RESP if you are already enrolled in a plan, and how to figure out your options. Read more about the research behind these materials here.

The Regulation of Group Plan RESPs and the Experiences of Low-Income Subscribers

Through the Group RESP Research and Education Project, SEED Winnipeg, Momentum (Calgary), the Legal Help Centre of Winnipeg, and an interdisciplinary research team studied the regulation of group plan RESPs and the experiences of low-income subscribers, and developed public legal education materials to support low-income RESP subscribers in understanding and making informed decisions about their RESP investments. This report presents the research component of this project. This report shows that group plan RESPs are complex, and while they can be beneficial, participation in a group plan may be detrimental to a subscriber's financial well-being if the plan is not well aligned with the subscriber's needs. Low-income subscribers continue to be significantly represented in RESPs held by group plan promoters.

SmartSAVER: Canada Learning Bond Infographic

An infographic highlighting how to attend post-secondary education with no student debt. It shows how a family eligible for the Canada Learning Bond, with average family savings, student earnings and available grants can cover the cost of post-secondary education (PSE) with no need to borrow.

A Much Closer Look: Enhancing Savings Counseling at Financial Empowerment Centers

Building savings is a fundamental strategy for empowering individuals and families with low incomes. Even relatively small amounts of savings can serve as a buffer against inevitable financial shocks that can otherwise undermine social service efforts and successes – and short-term savings offer realistic first steps toward building longer-term savings and acquiring assets. The CFE Fund conducted a research pilot at municipal Financial Empowerment Centers to better understand how clients are saving, and inform new savings indicators for financial counseling success. This report explains the insights of this research pilot, and client outcomes in savings and goal setting.

Savings for the Future Solving the Savings Puzzle for Low Income Households

People manage their money in a variety of different ways, sometimes in ways that others fail to understand, but that work well for them. The research in this new report focuses on one of those ways: informal saving. Informal saving can take many forms: saving in cash at home (sometimes literally in jam jars), careful spending and shopping, letting a current account balance mount up, savings stamps and over-payment on prepayment meters. However, there has been very little research carried out into what motivates people to save informally. This report plugs that gap. In so doing we find that low income individuals and households employ a variety of informal savings techniques that help them to be more financially resilient, particularly with budgeting and preparing for unforeseen expenses. Overall this report helps to dispel the myth that people on a low income do not have savings methods or personal techniques to build financial resilience.

Investing in a Post Secondary Education Delivers a Stellar Rate of Return (TD Economics Topic Paper)

A Growing Movement: The State of the Children’s Savings Field 2016

The Children’s Savings Account (CSA) movement has taken off in the past few years. These programs provide long-term savings or investment accounts and savings incentives to help children build savings for their future. In 2016, CSA initiatives started in a diverse range of locations, such as Durham, NC; Boston, MA; and Worcester, MA. In 2017, we expect several more program launches, including in places like Oakland, CA, and Milwaukee, WI. Based on a recent survey, this document offers a snapshot of this growing field, illustrating the range of program models being customized to meet the needs of the communities and states these programs serve.

Cities and States Developing Creative Approaches to Fund Children’s Savings Accounts

Children’s Savings Accounts (CSA) are proving to be a powerful tool for growing college funds and building children’s aspirations for their future. CSAs are long-term, incentivized savings or investment accounts for post-secondary education that help promote economic mobility for children and youth. Advocates have found that the idea and goals of CSAs can be appealing to policymakers from across the political spectrum. However, while able to generate initial interest from policymakers, advocates often find that their efforts can stall when it comes to the question of how to fund a program. This paper provides advocates and policymakers with several funding options—including examples from the city and state-levels—for establishing publicly-supported CSA programs. For more information about CSAs in general, please visit savingsforkids.org.

Examining the Canadian Education Savings Program and its Implications for US Child Savings Account (CSA) Policy

This report analyzes the Canadian experience with education savings programs, as the US moves towards more comprehensive Children's Savings Account policy.

“We’re Going to Do This Together”: Examining the Relationship between Parental Educational Expectations and a Community-Based Children’s Savings Account Program

This paper presents quantitative and qualitative evidence of the relationship between exposure to a community-based Children’s Savings Account (CSA) program and parents’ educational expectations for their children. First, we examine survey data collected as part of the rollout and implementation of The Promise Indiana CSA program. Second, we augment these findings with qualitative data gathered from interviews with parents whose children have Promise Indiana accounts. Though results differ by parental income and education, the quantitative results using the full sample suggest that parents are more likely to expect their elementary-school children to attend college if they have a 529 account or were exposed to the additional aspects of The Promise Indiana program (i.e., the marketing campaign, college and career classroom activities, information about engaging champions, trip to a University, and the opportunity to enroll into The Promise).