The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx, Indigenous, and Asian people, who are struggling due to deep financial disparities. Today’s disparities are built on, and exacerbated by, long-standing inequities created by structural racism, sexism, and classism, which have limited financial security and overall well-being for those affected. This brief responds to the urgency of this moment, reimagining and building on past recommendations to map more just paths to economic resilience moving forward.

The multiplying movement: the state of the children’s savings field 2022

The Multiplying Movement: The State of the Children’s Savings Field 2022 shares findings from Prosperity Now’s 2022 Children’s Savings Account (CSA) program survey. The report highlights the incredible growth of the field with over 4.9 million children and youth with CSAs across the US. In addition, this report analyzes trends among CSA programs and spotlights new programs across the country. As you will see in the report, the CSA field shows no signs of slowing down.

Why care about care? Our economy depends on it

This brief lays out how care impacts economic recovery, family economic security and asset building, equity and justice, and the well-being of children, older adults, and people with disabilities. COVID-19 highlighted the importance of caregivers, as parents have become remote learning facilitators and professional caregivers have become front-line workers. Investing $77.5 billion per year in the care economy would support more than two million new jobs— 22.5 million new jobs over 10 years. And that number does not include return of family caregivers to the workforce, enabled by adequate support. A $77.5 billion annual investment in new jobs translates into $220 billion in new economic activity. Read the brief Watch the webinar View the webinar slides

Annual report 2022

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 18 years, AFN has provided a forum for grantmakers to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects their work over the past year working across 7 issues areas:

Financial Literacy for Black and African American Students

In honor of Black History Month, BestColleges in the United States interviewed financial expert Terrance Dedrick to help curate a financial literacy resource for Black and African Americans. This article includes links to these organizations in the United States that cater to Black and African Americans: "Brown Ambition": A popular podcast for Black and African American students covers important financial literacy topics and provides advice from others who have learned financial literacy and used it successfully. Urban Wallet: A selection of free guides and resources to help students learn about spending and budgeting, investing in cryptocurrencies, and using credit cards responsibly. Association of African American Financial Advisors (AAAFA): for Black and African American students looking to work with a financial advisor to learn more about money. Operation HOPE: This nonprofit works with students and other adults alike to provide financial dignity through financial literacy training, coaching, and other services to build confidence and resilience. Building Bread: Designed for Black students and young professionals, Building Bread provides a free financial planning course along with other low-cost advanced classes.

Weathering the storms: modernizing the U.S. benefits system to support household financial resilience

For most households in America, financial shocks are inevitable. The car will break down. The house will need a repair. A key earner for a household will be laid off. These shocks can be devastating to household finances. And while the COVID-19 pandemic, which we are still recovering from, was a once-in-a-generation economic and health shock for households and our economy, we also know that it is just one example of the uncertainty and volatility of the world we now live in. When public and private benefits—such as unemployment insurance and paid sick leave—are not accessible and not designed or delivered in a timely manner to effectively support families in weathering financial shocks, families suffer. To effectively modernize our benefits system to help people weather financial shocks—both small and large— requires an evidence-based framework focused on what households need to be financially resilient and on opportunities for benefit leaders to address those needs. This paper lays out the framework by:

The impact of COVID-19 on financial capability and asset building services.

The forced transition from in-person to online activities as a result of the COVID-19 pandemic has had a profound impact on how families and communities buy groceries, acquire medical care, and utilize social services. This rapid shift has raised important questions about how to address access and equity. AFN and the University of Wisconsin-Madison Center for Financial Security (CFS) conducted this study to better understand the transition to remote services among financial capability and asset building (FCAB) programs, which includes financial education, counseling, coaching, emergency assistance, benefits navigation, housing supports, workforce development, and other related services. The insights from this study can inform strategies for FCAB services going forward. This brief reviews recommendations for funders and organizations seeking to learn from the financial capability service delivery models employed in the COVID-19 pandemic, especially related to replication of findings that lead to more equitable delivery practices, improved accessibility of services, and greater financial improvements for clients. Six region-specific briefs complement the national findings - Indiana, Louisiana, North and South Carolina, Oregon, Texas, and Washington. This brief is generously supported by JPMorgan Chase & Co., MetLife Foundation, and Wells Fargo. If you missed the live webinar, watch the recording here.

Accessible financial services incubator

Drive through a low-income neighborhood in virtually any American city and it quickly becomes apparent that the area’s financial health is at risk. The giveaway? The abundance of payday lenders. According to the St. Louis Federal Reserve, there are now more than 20,000 of these organizations across the country—which tops even the ubiquitous McDonald’s storefront by roughly 40%.1 These alternative financial services providers offer short-term loans at interest rates that can top 400%. They appeal to desperate consumers with no access to traditional, more affordable credit and offer an immediate fix that can lead to months, if not years, of financial pain. In its Payday Lending in America series, the Pew Charitable Trusts reports that Americans spend roughly $7.4 billion (B) on payday loans each year. Could traditional financial institutions find a way to deliver credit to this consumer niche without compromising their own health? The Filene Research Institute, a consumer finance think-and-do tank, hypothesized that the answer was yes. Read the full report.

Advancing equity: the power and promise of credit building

Credit is an essential ingredient for economic security and mobility. Without a high credit score and affordable, available capital, it is nearly impossible to get by financially, let alone get ahead. Our economic system, and the American Dream it is supposed to feed, is based on the belief that anyone has access to credit and can build economic security, wealth, and intergenerational transfer. This brief will analyze what is not working within our credit system and identify what philanthropy can do to reimagine a system that builds economic security and mobility for everyone, especially people of color and immigrants. An equitable credit system would create pathways to narrow the racial wealth gap instead of continuing to widen it. Solutions include nonprofit organizations and community A webinar is also available and you can view the webinar slides here.

development financial institutions (CDFIs) delivering financial products that are designed for the people who have been most excluded from the credit system, seeding their journey toward economic security, as well as systemic changes to make economic security and mobility more fairly attainable.

Evaluating the impact of income volatility benefits on gig workers

Gig workers account for approximately 25 to 35% of the national workforce. When considering workers earning low to moderate incomes (LMI), these percentages are likely higher. Gig work provides reported advantages including flexibility, supplemental income, and independence. However, it also brings unique financial challenges such as complicated taxes, low and unpredictable wages, and difficulty accessing benefits. Due to these barriers to financial security, gig workers are often unable to build an emergency savings reserve. Commonwealth launched the Financial Benefits Project pre-pilot to further explore the financial needs of gig workers and to outline recommendations for employer benefits that reduce the impact of income volatility. In combination with schedule stability and predictable wages, income volatility benefits have the potential to help workers earning LMI manage from day to day, particularly given the reduction of COVID-19 supports. Across two cohorts, Commonwealth evaluated the impact of three interventions on financial hardships for 138 gig workers enrolled in the project. Participants were eligible for up to $1,000 in funds over a four-month period through weekly stipends, emergency grants, and emergency loans.

Rising adoption of contactless payments and digital wallets: 3 key takeaways

Over the last two years, digital payment solutions, including peer-to-peer apps, digital wallets, and contactless payment solutions, have grown in popularity and adoption. With 125 million American mobile payment users predicted by 2025 Commonwealth sought to understand the potential for these payment apps as a channel to advance inclusive and equitable financial access.

Emergency savings preparedness and perceptions

According to Employee Benefit Research Institute (EBRI), workers with household incomes of $75,000 or more are more than twice as likely to say they feel they can handle an emergency expense than those with household incomes of less than $35,000. This report outlines the results of the 2022 survey that polled nearly 2700 Americans 25 and older.

The impact of the enhanced child tax credit on lower-income households

The American Rescue Plan, one of the most significant policy responses to alleviate child poverty in decades, made fundamental changes in enhancing the Child Tax Credit (CTC). In response to the pandemic, the law expanded the CTC for tax year 2021 to ensure a minimum level of economic support to all families raising children. Commonwealth, SaverLife, and Neighborhood Trust Financial Partners followed up with CTC-eligible families after most filed their 2021 tax returns. We conducted interviews and surveys to assess the impact of the enhanced credit on families’ financial health. Although we focused on the second half of the CTC payment, which was delivered as a lump sum payment as part of the tax refund, we also asked recipients about their tax filing experience and what a continuation of an expanded credit would mean for their families.

Emergency savings features that work for employees earning low to moderate incomes

Workers earning low to moderate incomes (LMI) continue to face challenges in financial security. The COVID-19 pandemic exacerbated the financial situation of many workers earning LMI. Along with the current macroeconomic environment, it has become even more challenging to build liquid savings for unexpected expenses. In this brief, we will share insights from our latest research with DCIIA Research Retirement Center on how employers and service providers can build and offer emergency savings solutions that are inclusively designed for workers earning LMI.

How to build financial health in Native communities

American Indian and Alaska Native (AI/AN) peoples have long faced barriers to asset building. More than half of AI/AN populations are un- or underbanked, financial services often don’t operate on reservations, and access to capital is difficult. Native peoples have been excluded from financial wealth accumulation through government asset stripping, industry redlining, and simple neglect, thanks to historic (and ongoing) discrimination, exclusion, and racism baked into government and private-sector policies. Solutions are within reach. Recently, the Financial Security Program, the Oklahoma Native Assets Coalition, Inc (ONAC), and the Center for Native American Youth hosted an event featuring Native leaders representing various geographies, experiences, and tribal affiliations. The group discussed experiences in building assets and Indigenous perspectives on generational financial wealth. Finally, the speakers gave recommendations on how foundations, corporations, non-profits, and others can partner with tribal governments and Native-led nonprofits to build financial wealth in Native communities. ONAC has produced a “List of Eighteen Suggestions to Better Support Native Practitioners Administering Asset Building Programs in their Communities”.

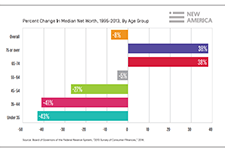

101 solutions for inclusive wealth building

Having wealth, or a family’s assets minus their debts, is important not just for the rich— everyone needs wealth to thrive. Yet building the amount of wealth needed to thrive is a major challenge. Nearly 13 million U.S. households have negative net worth. Millions more are low wealth; they do not have the assets or liquidity needed to maintain financial stability and invest in themselves in the present, nor are they on track to accumulate the amount of wealth they will need to have financial security in retirement. This report examines what it will take to create truly shared prosperity in the United States. It is focused on solutions that would grow the wealth of households in the bottom half of the wealth distribution, and it explores reparative approaches to building the wealth of Black, Indigenous, and other people of color (BIPOC).

Together, these groups represent at least half of all U.S. households.

Financial wellness tools

The National Disability Institute's Financial Wellness Toolkit is full of free resources for disability service providers, nonprofits, financial professionals and municipalities, including Financial Education Handouts and Quick Reference Guides. This infographic highlights income, banking and credit inequality based on disability, race and ethnicity.

Hunger, Poverty, and Health Disparities During COVID-19 and the Federal Nutrition Programs’ Role in an Equitable Recovery

The health and economic crises brought on by the coronavirus 2019 (COVID-19) pandemic has made the federal nutrition programs more important than ever. An unacceptably high number of people in America do not have enough to eat, and it is likely that the economic recovery for families who struggle to put food on the table will take years.

Recovery will be particularly challenging for those groups that have suffered disproportionate harm from COVID-19. Inequities, also referred to as disparities, “adversely affect groups of people who have systematically experienced greater obstacles […] based on their racial or ethnic group; religion; socioeconomic status; gender; age; mental health; cognitive, sensory, or physical disability; sexual orientation or gender identity; geographic location; or other characteristics historically linked to discrimination or exclusion.”

Translated financial terms

The Consumer Finance Protection Bureau has developed resources to help multilingual communities and newcomers in a selection of languages. The translated financial terms are available in Chinese, Spanish, Vietnamese, Korean and Tagalog. This website has many other multi-lingual resources, covering a range of topics from opening a bank account, money transfers, money management, debt collection and many others. Some terms are US based but most are universal.

Mapping the road toward increased accessibility to the child tax credit

Last year, the expanded Child Tax Credit (CTC) helped to lift nearly four million children out of poverty and provided economic relief to millions of struggling households. However, many first-time and lapsed filers from underserved and vulnerable populations missed out on these critical benefits. Locating and serving eligible low-income youth, formerly incarcerated individuals, people experiencing homelessness, immigrants, survivors of domestic violence, and isolated tribal populations has presented a challenging opportunity to free tax prep service providers across the country. This research highlights the key findings and recommendations to increase the accessibility to the CTC.

Annual report 2021

AFN's 2021 Annual Report gives a high level review of our work last year, including some snapshots into the place-based initiatives in our regions. Across our regions, AFN is working with grantmakers on collaborative efforts to advance equitable wealth building and economic mobility. One example the Annual Report highlights is the Bay Area Small Business Vulnerability Mapping Project. Last year, Bay Area AFN worked with the Urban Displacement Project to develop an online mapping tool highlighting vulnerable businesses owned by people of color. The multistage process also explores the feasibility of a permanent infrastructure for collecting data, monitoring business health, and recommending policies.

Annual report of credit and consumer reporting complaints: an analysis of complaint responses by Equifax, Experian and TransUnion

This report summarizes the information gathered by the Consumer Financial Protection Bureau (CFPB) regarding certain consumer complaints transmitted by the CFPB to the three largest nationwide consumer reporting agencies - Equifax, Experian and TransUnion.

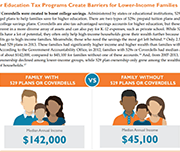

Children’s savings accounts: a core part of the equity agenda

Education after high school, or postsecondary education (PSE), is an important determinant of individuals’ future opportunities, as well as their health and even lifespan. Children’s Savings Accounts (CSAs) are programs that aim to increase access to PSE by building parents’ and children’s educational expectations and a “college-bound identity” starting early in children’s lives. CSAs are a vital part of the equity agenda that remain critically important even as other strategies are put in place to broaden postsecondary access. CSAs programs provide children with savings accounts and financial deposits for the purpose of education after high school or other asset building. CSA program designs, enrollment procedures, and financial incentives vary widely across the U.S. CSAs have been flourishing at the local, city, and state levels over the past two decades. CSAs’ unique value comes down to programs’ financial investment in children coupled with their capacity to bring children and families into frequent contact with information about planning for PSE, savings, and high expectations for the future.

It’s time to get ready for taxes!

Intuit is committed to helping students across the country work towards a more prosperous financial future by equipping them with the education they need to feel confident about their taxes. Through the Intuit TurboTax Simulation, we are helping students overcome the fear of Tax Day. You do not need to be an expert to teach taxes, and we recommend teaching to grade levels 9-12.

Financial Coaching Initiative: Results and Lessons Learned

In 2015, the Consumer Financial Protection Bureau launched the Financial Coaching Initiative, a pilot program that provided financial coaching services to veterans and economically vulnerable consumers. Professional coaches were embedded into 60 host sites across the country, where they provided free, one-on-one help to consumers to address their personal financial goals. A range of organizations served as host sites, such as one-stop career centers, social services organizations, and legal aid groups. Over four years, the Financial Coaching Initiative served over 23,000 consumers, demonstrating that financial coaching can be successfully implemented at scale in many different settings for a wide range of consumers. This report and summary brief describe the basic structure of the Initiative, present data about the program’s results, and summarize key lessons learned for practitioners and organizations interested in coaching.

Start at the Beginning; a Person-Centered Design and Evaluation Framework for Policies to Boost Household Cashflow and Beyond

The financial hardships households faced in the midst of the pandemic reveals the scale of the precarity that millions of households were experiencing well before the crisis began. This highlights the urgency of the need to reimagine our system of benefits—both public and private—to effectively and equitably support households to recover from this pandemic and build security for the future. The Aspen Institute Financial Security Program (Aspen FSP)’s Benefits 21 initiative is dedicated to integrating and modernizing the American system of benefits to ensure all households have financial security and can live economically dignified lives.

Medical-Financial Partnerships: Cross-Sector Collaborations Between Medical and Financial Services to Improve Health

Financial stress is the root cause of many adverse health outcomes among poor and low-income children and their families, yet few clinical interventions have been developed to improve health by directly addressing patient and family finances. Medical-Financial Partnerships (MFPs) are novel cross-sector collaborations in which health care systems and financial service organizations work collaboratively to improve health by reducing patient financial stress, primarily in low-income communities. This paper describes the rationale for MFPs and examines eight established MFPs providing financial services.

Practitioner tools for navigating financial exchanges with family and friends

Financial educators are particularly aware of the prevalence of these types of financial arrangements – otherwise known as family financial exchanges (FFEs). To support practitioners helping clients through these often sensitive conversations about these arrangements, the Consumer Financial Protection Bureau released the Friends and Family Exchanges Toolkit , a four-part guide for coaching clients in asking for financial help or changing an existing agreement due to their own financial hardship.

Why the Time is Right for a Guaranteed Income with an Equity Lens

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders involved in GI initiatives including practitioners, government representatives and philanthropy were heard. Panelists shared outcomes and new research results from some of the most successful GI pilots in the country (Stockton and Mississippi); goals for the newly launched Mayor’s for Guaranteed Income; how philanthropy can play a catalytic role and what this moment tells us about the future of guaranteed income initiatives.

Guaranteed Income Community of Practice resources

The Guaranteed Income Community of Practice (GICP) convenes guaranteed income stakeholders, including policy experts, researchers, community and program leaders, funders, and elected officials to learn and collaborate on guaranteed income pilots, programs and policy. The GICP website includes resources on:

CFPB Consumer Education Resources

Resources to provide consumers up-to-date information to protect and manage their finances during the coronavirus pandemic. Resources include: And resources for specific audiences, including:

The Economic Reality of The Asian American Pacific Islander Community Is Marked by Diversity and Inequality, Not Universal Success

By most measures of economic success—whether it be income, education, wealth or employment—Asian Americans are doing well in the United States, both when compared to other communities of color as well to White households. But while these measures of success are noteworthy, the way they are collected, analyzed and presented all too often masks the disparate financial situations of the dozens of ethnic subgroups categorized as “Asian American.” This brief explores some of the misconceptions that feed into broadly held beliefs that all members of the AAPI community are part of one large homogenous and successful group.

Innovations in Financial Capability: Culturally Responsive & Multigenerational Wealth Building Practices in Asian Pacific Islander (API) Communities

The Innovations in Financial Capability report is a collaborative report by National CAPACD and the Institute of Assets and Social Policy (IASP) at Brandeis University’s Heller School for Social Policy and Management, in partnership with Hawaiian Community Assets (HCA), and the Council for Native Hawaiian Advancement (CNHA). This survey report builds upon the 2017 report Foundations for the Future: Empowerment Economics in the Native Hawaiian Context and features the financial capability work of over 40 of our member organizations and other AAPI serving organizations from across the US. IASP’s research found that AAPI leaders are adopting innovative multigenerational and culturally responsive approaches to financial capability programming, but they want and need more supports for their work.

3 Principles for an Antiracist, Equitable State Response to COVID-19 — and a Stronger Recovery

COVID-19’s effects have underscored the ways that racism, bias, and discrimination are embedded in health, social, and economic systems. Black, Indigenous, and Latinx people are experiencing higher rates of infection, hospitalization, and death, and people of color are also overrepresented in jobs that are at higher infection risk and hardest hit economically. Shaping these outcomes are structural barriers like wealth and income disparities, inadequate access to health care, and racial discrimination built into the health system and labor market. This article discusses three recommended principles for guiding policymakers in making equity efforts.

Measuring the Financial Well-Being of Hispanics: 2018 Financial Well-Being Score Benchmarks

This report provides a foundational set of benchmarks of the financial well-being of Hispanics ages 18 and older in the United States in 2018, as measured by the CFPB Financial Well-Being Scale, that practitioners and researchers can use in their work. The benchmarks were developed using data from the FINRA Foundation’s 2018 National Financial Capability Survey. This report specifically shows financial well-being score patterns for Hispanic adults by socio-demographics, financial inclusion, safety nets, and financial literacy factors. The report highlights key findings in the data and the implications for organizations that are planning to use the benchmarks.

Tax Credit Outreach Resources

The Get It Back Campaign helps eligible workers in the United States claim tax credits and use free tax filing assistance to maximize tax time. A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial institutions to conduct outreach nationally. For 30 years, these partnerships have connected lower and moderate-income workers to tax benefits like the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and Volunteer Income Tax Assistance (VITA). Their website contain a variety of outreach materials that can be adapted for your organization, including:

Responding to Client’s “Now, Soon, & Later” Needs

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their current and future needs are discussed.

Intersectionality and Economic Justice

Widespread financial precarity for women of color with disabilities existed before the pandemic. Rooted in existing systemic inequities, COVID worsened the situation and created new access barriers. Race, gender, and disability impact financial stability in complex ways. Having a disability may increase living costs and limit economic opportunities. At the same time, women of color face significant disparities in education, income, employment, financial services, and wealth. Faced with institutional barriers that limit earning and wealth building, disabled women of color are more likely to be unbanked, use alternative financial services, have medical debt, lack access to affordable health care, and experience food insecurity. Given these challenges and the dire need to address them, this webinar explored:

Racial Equity In Philanthropy: Closing the Funding Gap

The Bridgespan Group is a social impact consultant and advisor to nonprofits and NGOs, philanthropists, and investors. This collection of resources discuss the barriers that leaders of color face in securing philanthropic funding.

Tax Prep Dispatch: Alternative Service Delivery Tips!

Tips and considerations for providing alternative tax filing service delivery.

Tax Prep Dispatch: The Drop-Off Process

Considerations and best practices for drop-off and virtual tax filing services.

Virtual VITA Toolkit: Program Strategies

Program strategies grounded in an understanding of your community can increase the likelihood of engagement and follow-through. The following resources are intended to support VITA programs with implementation strategies at key program stages, like outreach and intake, and offer examples of how other virtual VITA programs have addressed critical challenges.

2019 Financial Coaching Network Bi-Monthly Peer Call Series

These calls, featuring guest practitioners, cover a variety of topics most pressing to the financial coaching field, provide useful tips and resources and serve as a peer-learning platform. Topics include:

Communicating on Race and Racial Economic Equity

This document is a compilation of best practices and recommendations from a wide range of resources that Prosperity Now’s Racial Wealth Divide Initiative (RWDI) and Communications teams thought would be helpful for naming, framing, defining and understanding the issue of racial economic equity. Design guidelines on visually depicting diverse communities and definitions of important terms and concepts for understanding the nuance and complexity of racial economic equity, the racial wealth divide and racial wealth equity are provided.

Children’s Savings Account: Survey of Private and Public Funding 2019

Children’s Savings Account (CSA) programs offer a promising strategy to build a college-bound identity and make post-secondary education an achievable goal for more low- and moderate-income children. CSAs provide children (starting in elementary school or younger) with savings accounts and financial incentives for the purpose of education after high school. Beyond their financial value, CSAs are associated with beneficial effects for children and parents, including improved early child development. child health, maternal mental health, educational expectations, and academic performance. Many of these benefits are strongest for children from low-income families. This report shares a snapshot of the scale and makeup of the funding for the CSA field in 2019. It follows similar AFN reports on CSA funding in 2014-2015 and 2017 and captures the following data on CSA programs’ financial support in calendar year 2019:

GFLEC – Finlit Talks

This video series offers concise summaries of in-depth academic and practitioner presentations, in plain English, for dissemination to a worldwide audience. For convenient viewing, most videos are between three and six minutes long.

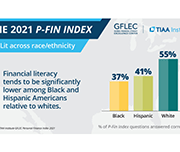

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index)

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) measures knowledge and understanding that enable sound financial decision making and effective management of personal finances among U.S. adults. The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with Greenwald & Associates. It is unique in its breadth of questions and its coverage of the topics that measure financial literacy. The index is based on responses to 28 questions across eight functional areas: earning, consuming, saving, investing, borrowing/managing debt, insuring, comprehending risk, and go-to information sources.

Housing insecurity and the COVID-19 pandemic

CFPB released their first analysis of the impacts of the COVID-19 pandemic on housing in the United States. Actions taken by both the public and private sector have, so far, prevented many families from losing their homes during the height of the public health crisis. However, as legal protections expire in the months ahead, over 11 million families — nearly 10 percent of U.S. households — are at risk of eviction and foreclosure.

Social Listening: Covid-19, Social Media, and The Path to a Better Safety Net

This brief outlines how beneficiaries are using online platforms to identify breakdowns in public services, celebrate the positive impact of public policy and urge reform. Ways in which government can capitalize on widespread social media feedback and begin to build long-term measures to center people’s experience as an important component of policy design are explored.

Financial Well-being among Black and Hispanic Women

This paper provides an in-depth examination of the financial well-being of Black and Hispanic women and the factors contributing to it, using the 2018 wave of the National Financial Capability Study. Differences between Black and Hispanic women versus White women are documented, in that the former are more likely to face economic challenges that depress financial well-being. Controlling for differences in socio-demographic characteristics, there are important differences in the factors that contribute to financial well-being for Black and Hispanic women compared to White women. This includes distinct impacts of education, family structure, employment, and financial literacy. Results imply that extant financial education programs inadequately address the needs of Black and Hispanic women.

Fearless Woman: Financial Literacy and Stock Market Participation

Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. This survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response option is unavailable, they often choose the correct answer. The authors find that about one-third of the financial literacy gender gap can be explained by women’s lower confidence levels. Both financial knowledge and confidence explain stock market participation.

Testing the use of the Mint app in an interactive personal finance module

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s effectiveness at improving students’ financial knowledge, attitudes, and behavior. Students at the George Washington University participated in a half-day budgeting workshop and were exposed to either Mint, which is a real-time, automated platform, or Excel, which is an offline, static tool. The authors found that participation in both workshops was associated with improved preparedness to have conversations about money matters with parents, a greater sense of financial autonomy, and an increased awareness of the importance of budgeting, but that participants in the Mint workshop were more likely to have a positive experience using the budgeting tool, to feel confident that they could achieve a financial goal, and to be engaged in budgeting one month after the workshop. Results show that even short financial education interventions can meaningfully influence students’ financial attitudes and behavior and that an interactive tool like Mint may have advantages over a more static tool like Excel.

Recordkeepers’ Role in Providing Emergency Savings for an Inclusive Recovery

In this webinar, Commonwealth in partnership with DCIIA Retirement Research Center (RRC) and SPARK Institute present findings from our new research about drivers and considerations of recordkeeper-provided emergency savings and host a discussion with industry experts.

Investing in Financial Coaching with a Racial Equity Lens

In this moment, it is pivotal for philanthropy to support communities of color in achieving financial well-being. Combined with systems-change efforts that would create fairer economic opportunities and conditions, financial coaching is a vital component of providing needed support. Through background information, case stories, and key investment considerations, this brief focuses on financial coaching with a racial equity lens as an important strategy for helping people of color achieve equitable outcomes.

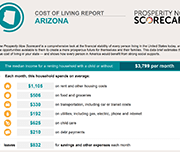

Prosperity Now Scorecard Cost-Of-Living Profiles by State

Prosperity Now has created state-level Cost-of-Living profiles as new features on their Scorecard website. The Prosperity Now Cost of Living profiles provide a comprehensive look at the financial stability of every person living in the United States. Each state profile can be downloaded and used to determine the true cost of living is in the state, based on median monthly income and discretionary spending left at the end of each month after expenses. These values determine what is left over for emergency expenses and long-term aspirational expenses. This video presents the cost of living in Georgia.

Pandemic to Prosperity – January 21, 2021: One year after the first announcement of Covid on U.S. soil

The National Conference on Citizenship (NCoC) developed the Pandemic to Prosperity series. It builds on NCoC’s data infrastructure and advocacy network developed for its national Civic Health Index, with The New Orleans Index, which informed many public and private decisions and actions post-Katrina. This series is designed to enable a solid understanding of the damage to lives and livelihoods as the pandemic continues to unfold, as the United States enters the era of vaccines, and the nation grapples with new shocks and stressors such as disasters and civil unrest; it will also examine aspirational goals around strong and accountable government, functioning institutions from child care to internet access to local news availability, effective civic participation, and outcomes for people by race regarding employment, health, housing, and more. With each new report in the series, indicators will change as the recovery transitions. This report highlights mostly state-level metrics with breakdowns by race, gender, and age where available, relying on both public and private data sources.

Attitudes Toward Debt and Debt Behavior

This paper introduces a novel survey measure of attitude toward debt. Survey results with panel data on Swedish household balance sheets from registry data are matched, showing that debt attitude measure helps explain individual variation in indebtedness as well as debt build-up and spending behavior in the period 2004–2007. As an explanatory variable, debt attitude compares well to a number of other determinants of debt, including education, risk-taking, and financial literacy. Evidence that suggests that debt attitude is passed down along family lines and has a cultural element is also presented.

Taking Stock and Looking Ahead: The Impact of COVID-19 on Communities of Color

Nearly a year since the outbreak began, and eight months since it was declared a global pandemic, COVID-19 has devastated hundreds of thousands of lives and millions of people’s economic prospects throughout the country. To date, the effects of this crisis have been wide-reaching and profound, impacting every individual and sector throughout the U.S. For communities of color, however, the pandemic has been particularly damaging as these communities have not only been more likely to contract and succumb to the virus, but also more likely to bear the brunt of the many economic impacts that have come from it—including more likely to be unemployed and slower to regain jobs lost. The Asset Building Policy Network and a panel of experts discuss the impact COVID-19 has had on communities of color, the fiscal policy measures congress has enacted to curtail those impacts and what can be done through policy and programs to foster an equitable recovery and more inclusive economy moving forward.

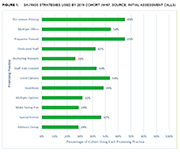

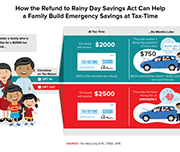

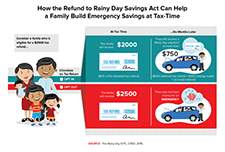

Tax Time: An opportunity to Start Small and Save Up

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to longer term financial well-being. This paper also provides a few examples of how Volunteer Income Tax Assistance (VITA) programs creatively used Bureau tools, resources and technical assistance to encourage savings as well as some of the results they reported. It provides insights from a subgroup of the programs in the cohort that collected additional information from consumers on their intent to save, the various types of accounts into which they saved, and the goals they were striving for by saving. Finally, this paper offers recommendations on some strategies that can be employed to increase people’s interest and commitment to saving during the tax preparation process.

2019 Financial Literacy Annual Report

The 2019 Financial Literacy Annual Report of the Consumer Financial Protection Bureau highlights the Bureau’s Start Small, Save Up campaign, the Office of Financial Education’s foundational research, in conjunction with the Office of Older Americans, to understand the pathways to financial well-being, the Office of Servicemembers Affairs’ Misadventures in Money Management online training program, the Office of Older Americans’ Managing Someone Else’s Money guides, and the Office of Community Affairs’ Your Money, Your Goals toolkit, along with other direct to consumer tools, community outreach channels, and areas of research.

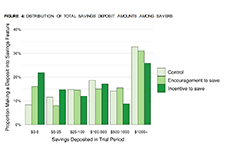

Planning for tax-time savings

This report presents the results of a large-scale field experiment that the tax preparation company H&R Block (the Company) conducted in collaboration with the Consumer Financial Protection Bureau (the CFPB). The field experiment investigated whether customers could be encouraged, through consumer communications with and without the offer of a small financial incentive, to use a savings feature on a prepaid card to save a portion of their tax refunds from all sources, including state and federal refunds. The CFPB was particularly interested in whether consumers who receive the Earned Income Tax Credit (EITC) would be receptive to messages about saving.

2020 Financial Literacy Annual Report

The 2020 Financial Literacy Annual Report details the United States' Bureau of Consumer Financial Protection's financial literacy strategy and activities to improve the financial literacy of consumers. Congress specifically charged the Bureau with conducting financial education programs and ensuring consumers receive timely and understandable information to make responsible decisions about financial transactions. Empowering consumers to help themselves, protect their own interests, and choose the financial products and services that best fit their needs is vital to preventing consumer harm and building financial well-being. Overall, this report describes the Bureau’s efforts in a broad range of financial literacy areas relevant to consumers’ financial lives. It highlights our work, including the Bureau's:

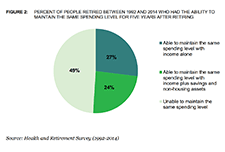

Retirement Security and Financial Decision-making: Research Brief

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level of spending for at least five consecutive years after retiring. The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring. In addition, the Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years. The study helps identify ways to protect retirees from overspending their savings in early retirement.

Cash Value: How The Financial Clinic Puts Money into the Pockets of Working Poor Families

Practitioners engaged in the nascent field of financial development lack a shared system of tracking and analyzing customer progress toward financial security. Practice leaders—ranging from direct service organizations such as the Chicago-based LISC to NeighborWorks America of Washington, D.C.—define customer progress by their individual outcomes frameworks. But without uniform outcomes measures to assess our customers’ progress—and thus, our own performance—the field as a whole is handicapped. Many factors contribute to this problem, two being most prominent: organizations are grounded in distinct theories of change, are funded by a variety of sources with their own expectations, and lack of clarity about how to measure aspects of our work.

The Pivotal Role of Human Service Practitioners in Building Financial Capability

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American experience—is one that far too often ensnares people at the insecurity stage, particularly those communities or neighborhoods that have historically been marginalized and deliberately excluded from the traditional pathway towards prosperity. Fraught with debt and credit crises, alongside a myriad of predatory products and lending practices, to a sense of stigma and shame many Americans feel because of their economic status, financial insecurity involves navigating a world on a daily basis where everyday needs are at the mercy of unjust and uncontrollable variables.

Connecting to Reimagine: Money & COVID-19 webinar series

This webinar series released by the Global Financial Literacy Excellence Center (GFLEC) features speakers from the public, private, and academic sectors. Past and upcoming webinar topics include: Optimizing National Strategies for Financial Education Crafting Policies that Address Inequality in Saving, Wealth, and Economic Opportunities Investor Knowledge and Behaviors in Times of Crisis Increasing Financial Knowledge for Better Rebuilding Designing an Inclusive Recovery Millennials: Buttressing a Generation at Risk

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

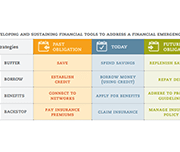

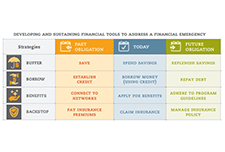

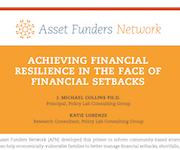

Achieving Financial Resilience in the Face of Financial Setbacks

Financial shocks like these happen to financially vulnerable families every day. Such shocks destabilize household finances and can create hardships that threaten overall well-being. Having tools to manage financial emergencies is critical for people’s long-run financial security. The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

COVID-19 Resources for people with disabilities

National Disability Institute (NDI)'s Financial Resilience Center offers resources and assistance to help those with disabilities and chronic health conditions navigate financially through the COVID-19 crisis. Resource topics include:

Real Money, Real Experts Podcasts

Real Money, Real Experts is a personal finance podcast written and produced by AFCPE (Association for Financial Counseling & Planning Education). Their membership community offers a place for financial counsellors and financial fitness coaches to share best practices, solve similar struggles, and access tools and resources. Recent episodes include the following topics:

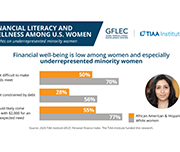

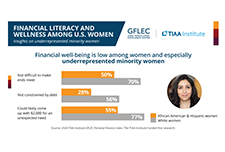

Financial Literacy and Wellness Among U.S. Women: Insights on Underrepresented Minority Women

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined understanding of financial literacy among women, including areas of strength and weakness and variations among subgroups, can inform initiatives to improve financial wellness, particularly as the United States moves forward from the pandemic and its economic consequences.

COVID-19 Financial Resilience Hub

The Global Financial Literacy Excellence Center (GFLEC) focuses on financial literacy research, policy, and solutions. This toolkit contains suggestions and resources for managing personal finances and protection against the financial emergencies caused by COVID-19.

Millennials and money: Financial preparedness and money management practices before COVID-19

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed over the ten years following the Great Recession of 2008 and the situation they were in on the cusp of the current economic crisis (in 2018) due to the COVID-19 pandemic. Findings from the National Financial Capability Study (NFCS) show that millennials tend to rely heavily on debt, engage frequently in expensive short- and long-term money management, and display shockingly low levels of financial literacy. Moreover, student loan burden and expensive financial decision making increased significantly from 2009 to 2018 among young adults.

Financial literacy and financial resilience: Evidence from around the world

This study presents findings from a measurement of financial literacy using questions assessing basic knowledge of four fundamental concepts in financial decision making: knowledge of interest rates, interest compounding, inflation, and risk diversification. Worldwide, just one in three adults are financially literate—that is, they know at least three out of the four financial concepts. Women, poor adults, and lower educated respondents are more likely to suffer from gaps in financial knowledge.

Financial wellness: What is it? How do we make it happen?

Achieving financial wellness takes more than just financial resources. It also requires the ability to make good financial decisions and engage in sound money- management practices. To inform policies and programs that promote financial wellness—including those sponsored by employers—the TIAA Institute and the Global Financial Literacy Excellence Center held a roundtable discussion featuring a range of experts. This report presents the key findings and recommendations that emanated from the discussion. To learn more about the roundtable itself, visit TIAA Institute events page.

Financial Consumer Protection responses to COVID-19

This policy brief provides recommendations that can assist policy makers in their consideration of appropriate measures to help financial consumers, depending on the contexts and circumstances of individual jurisdictions, during the COVID-19 crisis. These options are consistent with the G20/OECD High Level Principles on Financial Consumer Protection that set out the foundations for a comprehensive financial consumer protection framework.

Supporting the financial resilience of citizens throughout the COVID-19 crisis

This policy brief outlines initial the measures that policy makers can make to increase citizen awareness about effective means of mitigation for the impact of the COVID-19 pandemic and its potential consequences on their financial resilience and well-being.

National Strategies for Financial Education: OECD/INFE Policy Handbook

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools to support policy makers and public authorities to design and implement national strategies for financial education. This handbook provides an overview of the status of national strategies worldwide, an analysis of relevant practices and case studies and identifies key lessons learnt. The policy handbook also includes a checklist for action, intended as a self-assessment tool for governments and public authorities.

G20/OECD INFE Core Competencies Framework on financial literacy for Adults (aged 18+)

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to inform the development of a national strategy on financial education, improve programme design, identify gaps in provision, and create assessment, measurement and evaluation tools.

Clipped Wings: Closing the Wealth Gap for Millennial Women

AFN’s latest report, in collaboration with the Closing the Women’s Wealth Gap (CWWG) and the Insight Center for Community Economic Development reveals the current economic reality for millennial women and the primary drivers contributing to their wealth inequities. The report, Clipped Wings: Closing the Wealth Gap for Millennial Women is the second in a series of publications that builds off AFN’s 2015 publication, Women & Wealth, exploring how the gender wealth gap impacts women.

From Surviving to Thriving – Ensuring the Golden Years Remain Golden for Older Women

This brief explores the drivers of economic insecurity for older women and sets forth a number of strategies and promising practices for funders to consider which address the needs of older women. Doing so will ensure this generation and future generations of men and women in this country can age financially secure and with dignity. This publication is the fourth in a series of briefs that build on AFN’s publication, Women & Wealth, to explore how the gender wealth gap impacts women, particularly low-income women and women of color, throughout their life cycle, and provides responsive strategies and best practices that funders can employ to create greater economic security for women.

Women and Wealth: Insights for Grantmakers

The women’s wealth gap has been largely overlooked in discussions of women’s economic security, yet wealth is the most comprehensive indicator of financial health. Without wealth, families are one paycheck away from financial disaster. The brief Women and Wealth: Insights for Grantmakers examines the causes and dimensions of the women’s wealth gap and provides recommendations and best practices for grantmakers to reduce the women’s wealth gap and improve women’s access to the wealth escalator. Improving women’s ability to build wealth is not only good for women, but is essential for the economic well-being of children, families, and our nation. The webinar, included Mariko Chang, PhD, K. Sujata, President and CEO, Chicago Foundation for Women, and Dena L. Jackson, PhD, Vice President – Grants & Research, Texas Women’s Foundation.

Pressure Creates Diamonds: Money Management During Coronavirus

The town hall with CFPB Director Kraninger and Pro Linebacker Brandon Copeland includes steps, and tools to help people plan and persevere during financial challenges. The page also includes access to free resources on a number of topics including mortgage help, dealing with student loans, paying bills, building savings and more.

Achieving financial resilience in the face of financial setbacks

The Asset Funders Network (AFN) developed this primer to inform community-based strategies that can help economically-vulnerable families to better manage financial setbacks, shortfalls, and shocks. The goal of this brief is to provide a common understanding and language for funders and financial capability programs as part of a financial emergency toolkit.

Race, Ethnicity, and the Financial Lives of Young Adults: Exploring Disparities in Financial Health Outcomes

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults, focusing on Black and Latinx young adults, in order to inform policies, programs, and solutions that can improve financial health for all.

Quarterly Consumer Credit Trends: Recent trends in debt settlement and credit counseling

This report used a longitudinal, nationally-representative sample of approximately five million de-identified credit records maintained by one of the three nationwide consumer reporting agencies. Trends in debt settlement and credit counseling during the Great Recession and in recent years are presented. This report shows that nearly one in thirteen consumers with a credit record had at least one account settled through a creditor or had account payments managed by a credit counseling agency from 2007 through 2019. Since 2016, the number of debt settlements has increased steadily, while credit counseling numbers are relatively unchanged.

Targeting credit builder loans: Insights from a credit builder loan evaluation

This report presents the results of a Consumer Financial Protection Bureau (CFPB) funded evaluation of a Credit Builder Loan (CBL) product. CBLs are designed for consumers looking to establish a credit score or improve an existing one, while at the same time giving them a chance to build their savings. The study used random assignment to explore four research questions:

The Early Effects of the COVID-19 Pandemic on Credit Applications

This report documents the early effects of the COVID-19 pandemic on credit applications, which are among the very first credit market measures to change in credit report data in response to changes in economic activity. Using the Bureau’s Consumer Credit Panel, how applications for auto loans, mortgages, credit cards, and other loans changed week-by-week during the month of March, compared to the same time in previous years was studied.

Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help

More than 44 million people in America have taken on student debt to pursue a post-secondary education. These borrowers collectively owe around $1.6 trillion in student loan debt. Borrowers exist in every community, but some are particularly vulnerable to its impact. Women hold two-thirds of all outstanding student debt and Black and Latinx borrowers disproportionately struggle with repayment. This webinar discussed the disparate impact of student loan debt on black and Latinx students and the following topics:

Making Safety Affordable: Intimate Partner Violence is an Asset-Building Issue

This brief explores three existing unmet needs that contribute to survivors’ inability to build wealth: money, tailored asset-building support, and safe and responsive banking and credit services. Within each identified need, specific issues facing survivors, strategic actions in response to those issues, as well as innovative ideas and existing promising practices to help funders take action to prioritize survivor wealth are discussed.

Wealth and Health Equity: Investing in Structural Change

Building on the Asset Funders Network’s the Health and Wealth Connection: Investment Opportunities Across the Life Course brief, this paper details: On September 29th, AFN hosted a webinar to release the paper with featured speakers: Dr. Annie Harper, Ph.D., Program for Recovery and Community Health, Yale School of Medicine

Joelle-Jude Fontaine, Sr. Program Officer, Human Services, The Kresge Foundation

Dedrick Asante-Muhammad, Chief of Race, Wealth, and Community, National Community Reinvestment Coalition

Human Insights Tools & Resources

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from clients’ point of view, designing solutions to meet those needs, and testing your ideas to ensure they bring about the needed change. Tools and resources are presented for each of the discover, design, and test phases.

Lifting the Weight: Consumer Debt Solutions Framework

Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified seven specific consumer debt problems that result in decreased financial insecurity and well-being. Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees. This report presents a solutions framework to address all seven of these problems. The framework includes setting one or more tangible goals to achieve for each problem, and, for each goal, the solutions different sectors (financial services providers, governments, non-profits, employers, educational or medical institutions) can pursue.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Set a Goal: What to Save For

America Saves, a campaign managed by the nonprofit Consumer Federation of America, motivates, encourages, and supports low- to moderate-income households to save money, reduce debt, and build wealth. Information and tips for setting a savings goal, making a savings plan, how to save automatically, and other tools and resources are included.

Serving Individuals With Disabilities – A Day in the Life of an American Job Center

The Disability and Employment eLearning Task Force in collaboration with the Employment and Training Administration (ETA) released three eLearning Training Modules to help support the professional development needs of the workforce development staff across the United States. The first module provide tools and resources to support front-line American Job Center staff effectively serve customers with disabilities, covering strategies for effective communication and interaction with individuals with disabilities.

Global Learning Partners: Shareable Resources

Global Learning Partners (GLP) helps individuals and organizations to learn by providing practical expertise in learning assessment, design, facilitation and evaluation. Their shareable resources cover a variety of topics in learning, taking a learning-centered approach, including: Learning Design, Needs Assessment, Facilitation, Evaluation, and others.

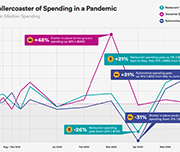

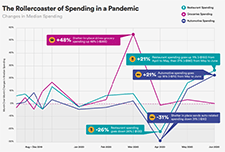

The Economic Toll of COVID-19 on SaverLife Members

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their savings program members during the COVID-19 pandemic from March to August of 2020.

Meeting the Emergency Moment: Key Takeaways from Delivering Remote Municipal Financial Counseling Services

Local governments across the United States are working to help their residents weather the health and financial impacts of the COVID-19 pandemic. In many cities and counties, that means deploying their Financial Empowerment Centers (FECs), which provide professional, one-on-one financial counseling as a public service. Local leaders were able to offer FEC financial counseling as a critical component of their emergency response infrastructure; the fact that this service already existed, and was embedded into the fabric of municipal anti-poverty efforts, meant that it could quickly pivot to meet new COVID-19 needs, including through offering remote financial counseling. This brief describes how FEC partners identified the right technology; developed skills to deliver counseling remotely; messaged the availability of FEC services as part of their localities’ COVID-19 response; and shared lessons learned with their FEC counterparts around the country.

Race to Lead: Women of Color in the Nonprofit Sector

This report reveals that women of color encounter systemic obstacles to their advancement over and above the barriers faced by white women and men of color. Education and training are not the solution—women of color with high levels of education are more likely to be in administrative roles and are more likely to report frustrations about inadequate and inequitable salaries. BMP’s call to action focuses on systems change, organizational change, and individual support for women of color in the sector.

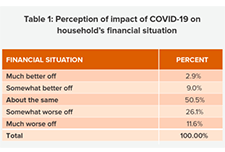

How Are the Most Vulnerable Households Navigating the Financial Impact of COVID-19?

The COVID-19 pandemic has already had an unprecedented impact on the financial lives of households across the United States. During June and July 2020, Prosperity Now conducted a national survey of lower-income households to better understand the circumstances these households are confronted with and the strategies they use to secure resources to navigate this crisis.

Weathering Volatility 2.0: A Monthly Stress Test to Guide Savings

In this report, the JPMorgan Chase Institute uses administrative bank account data to measure income and spending volatility and the minimum levels of cash buffer families need to weather adverse income and spending shocks. Inconsistent or unpredictable swings in families’ income and expenses make it difficult to plan spending, pay down debt, or determine how much to save. Managing these swings, or volatility, is increasingly acknowledged as an important component of American families’ financial security. This report makes further progress toward understanding how volatility affects families and what levels of cash buffer they need to weather adverse income and spending shocks.

U.S. Financial Health Pulse: 2019 Trends Report

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning -- to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable”. The data in the Pulse report provide critical insights that go beyond aggregate economic indicators, such as employment and market performance, to provide a more accurate picture of the financial lives of people in the U.S.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Credit Characteristics, Credit Engagement Tools, and Financial Well-Being

This report presents results from a joint research study between the Consumer Financial Protection Bureau (CFPB) and Credit Karma. The purpose of the study is to examine how consumers’ subjective financial well-being relates to objective measures of consumers’ financial health, specifically, consumers’ credit report characteristics. The study also seeks to relate consumers’ subjective financial well-being to consumers’ engagement with financial information through educational tools.

From the Margins to Center: Responding to COVID-19 with an Equity and Gender Lens

On June 30th, AFN presented an Expert Insights briefing on what it takes to center women of color in the relief, recovery, and rebuild plans for the current health and economic crisis and beyond. The speaker is Dominique Derbigny, deputy director of Closing the Women’s Wealth Gap (CWWG) and author of the report, On the Margins: Economic Security for Women of Color through the Coronavirus Crisis and Beyond. Learn why women of color are suffering severely from the COVID-19 public health and economic crisis, opportunities to advance gender economic equity in near-term recovery efforts, and possible strategies to prevent wealth extraction and foster long-term economic security for women of color.

Expert Insights: Preventing Evictions in Communities of Color During COVID-19

COVID-19 is radically reshaping many aspects of people’s financial health in America, including their housing security. The economic fallout is disproportionately impacting communities of color due to systemic inequities related to race, housing, employment, and more. As the protections put in place at the start of the pandemic fade away, the United States are facing an eviction tsunami that will disparately displace Black and Latinx families. On August 25, AFN’s summer Expert Insights briefed attendees on rental risks and evictions related to COVID-19. Speakers were Solomon Greene with The Urban Institute and Dr. Christie Cade of NeighborWorks America.

Understanding the Pathways to Financial Well-Being

The National Financial Well-Being Survey Report is the second report in a series from the Understanding the Pathways to Financial Well-Being project. In order to measure and study the factors that support consumer financial well-being, in 2015, the Bureau of Consumer Financial Protection (the Bureau) contracted with Abt Associates to field a large, national survey to collect information on the financial well-being of U.S. adults. The present report uses data collected from that survey to answer a series of questions on the relationship among financial well-being and four key factors: objective financial situation, financial behavior, financial skill, and financial knowledge. In this study, we aim to enhance understanding of financial well-being and the factors that may support it by exploring these relationships.

Beware of scams related to the coronavirus

Scammers are taking advantage of the coronavirus (COVID-19) pandemic to con people into giving up their money. Though the reason behind their fraud is new, their tactics are familiar. It can be even harder to prevent scams right now because people 62 and older aren’t interacting with as many friends, neighbors, and senior service providers due to efforts to slow the spread of disease. This blog post presents consumer protection toolkit resources produced by Consumer Financial Protection Bureau in addition to tips for consumers regarding COVID-19 related scams.

New Risks and Emerging Technologies: 2019 BBB Scam Tracker Risk Report

The Better Business Bureau Institute for Marketplace Trust (BBB Institute) is the 501(c)(3) educational foundation of the Better Business Bureau (BBB). BBB Institute works with local BBBs across North America. This report uses data submitted by consumers to BBB Scam Tracker to shed light on how scams are being perpetrated, who is being targeted, which scams have the greatest impact, and much more. The BBB Risk Index helps consumers better understand which scams pose the highest risk by looking at three factors—exposure, susceptibility, and monetary loss. The 2019 BBB Scam Tracker Risk Report is a critical part of BBB’s ongoing work to contribute new, useful data and analysis to further the efforts of all who are engaged in combating marketplace fraud. Update February 24, 2022: BBB Scam Tracker- Risk Report 2020

Prosperity Now Scorecard

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to jump-start a conversation about solutions and policies that put households on stronger financial footing across five issue areas: Financial Assets & Income, Businesses & Jobs, Homeownership & Housing, Health Care and Education.

Income Volatility: Why it Destabilizes Working Families and How Philanthropy Can Make a Difference

As the work environment has evolved and jobs look more different, it is important to understand the impact of these changes on income—predictability, variability, and frequency—and how this affects the opportunity for mobility. Because of the complexity of income volatility, there is a unique role for philanthropy. This brief helps grantmakers understand the enormous challenges income volatility presents in America and provides an array of strategies for philanthropy to leverage both investments and leadership to empower families to protect themselves from volatility’s worst effects.

Employer Solutions: From Emergency to Resiliency

In light of COVID-19, the financial security of workers has never been more in question. The workplace is an important delivery channel for tailored financial products and services that can help meet employee’s immediate financial needs and build long-term financial stability. The workplace is a unique platform to identify, target, and meet the specific financial needs of employees. This webinar gives funders the tools and inspiration to respond effectively to the low- and moderate-income workforce in this moment and beyond.

When a Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy

This report sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs). Data suggests that EFWPs improve employees financial stability and help create a more productive work enviroment.

Building financial capability through financial coaching: A guide for community colleges

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a variety of services that can be offered to students in a community college setting are offered. A step-by-step toolkit for implementing financial coaching services, along with recommendations, best practices, and resources is also provided.

Keys to financial inclusion (podcast series)

The Center for Disability-Inclusive Community Development’s (CDICD) Keys to Financial Inclusion podcast series brings awareness to disability-inclusive community development. The CDICD works to improve the financial health and well-being of low- and moderate-income (LMI) individuals with disabilities and their families by increasing awareness and usage of opportunities available under the Community Reinvestment Act.

Advancing Health and Wealth Integration in the Earliest Years