Making the most of your money

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share or use with your clients to help them access tools and resources to support their daily money management. Making the most of your money is an easy-to-use, accessible, online course to help people living on a low income organize their finances and explore ways to increase the amount of money coming in and reduce what is going out. This interactive course has activities, videos, handouts and resources that are also downloadable.

5 benefits of paying down debt with your tax refund

The average Canadian tax return amount in 2023 is $2,072 and that money can go a long way when it comes to meeting your financial goals. But remember, this isn’t a cash windfall; it’s YOUR money that the government borrowed from you, so Credit Canada recommends using it for needs versus wants. More specifically, consider using it to help pay down your debt.

Make it Count

Make it Count is a parent's resource for youth money management provided by the Manitoba Securities Commission that provides activities and tips to help you incorporate youth money management lessons into your daily routine. You can easily turn errands into education.

Money management worksheets

CPA Canada has a selection of money management worksheets you can use with your clients. Goal Setting Financial Fitness Self-Assessment Values Validator Monthly Budget for Teens Role Model Self-Assessment Document Organizer Cash Flow Organizer Net Worth Worksheet Post-Secondary Student Budget

Set SMART goals that are specific, measurable, action-oriented, realistic, time-framed.

Determine how well you are currently managing your finances.

Determine the things in life that are most important to you.

Help teenagers living at home create a monthly budget.

Determine what kind of financial role model you are.

Organize your documents in preparation for filing your taxes.

Get a clear picture of your cash flow — what is coming in and what is going out

Get a snapshot of what you own (your assets) and what you owe (your liabilities)

This worksheet will help students accurately estimate the total budget they need

English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

Navigating Finances: Paying Down Debt vs. Investing, CIRO

Loan and Trust, FSRA

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

Testing the use of the Mint app in an interactive personal finance module

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s effectiveness at improving students’ financial knowledge, attitudes, and behavior. Students at the George Washington University participated in a half-day budgeting workshop and were exposed to either Mint, which is a real-time, automated platform, or Excel, which is an offline, static tool. The authors found that participation in both workshops was associated with improved preparedness to have conversations about money matters with parents, a greater sense of financial autonomy, and an increased awareness of the importance of budgeting, but that participants in the Mint workshop were more likely to have a positive experience using the budgeting tool, to feel confident that they could achieve a financial goal, and to be engaged in budgeting one month after the workshop. Results show that even short financial education interventions can meaningfully influence students’ financial attitudes and behavior and that an interactive tool like Mint may have advantages over a more static tool like Excel.

2020 Financial Literacy Annual Report

The 2020 Financial Literacy Annual Report details the United States' Bureau of Consumer Financial Protection's financial literacy strategy and activities to improve the financial literacy of consumers. Congress specifically charged the Bureau with conducting financial education programs and ensuring consumers receive timely and understandable information to make responsible decisions about financial transactions. Empowering consumers to help themselves, protect their own interests, and choose the financial products and services that best fit their needs is vital to preventing consumer harm and building financial well-being. Overall, this report describes the Bureau’s efforts in a broad range of financial literacy areas relevant to consumers’ financial lives. It highlights our work, including the Bureau's:

The Pivotal Role of Human Service Practitioners in Building Financial Capability

This report shares remarks by Mae Watson Grote, Founder and CEO of The Financial Clinic, at the Coin A Better Future conference in May 2018. The journey from financial insecurity to security, and eventually, mobility—what we conceptualize and even romanticize as the quintessential American experience—is one that far too often ensnares people at the insecurity stage, particularly those communities or neighborhoods that have historically been marginalized and deliberately excluded from the traditional pathway towards prosperity. Fraught with debt and credit crises, alongside a myriad of predatory products and lending practices, to a sense of stigma and shame many Americans feel because of their economic status, financial insecurity involves navigating a world on a daily basis where everyday needs are at the mercy of unjust and uncontrollable variables.

Set a Goal: What to Save For

America Saves, a campaign managed by the nonprofit Consumer Federation of America, motivates, encourages, and supports low- to moderate-income households to save money, reduce debt, and build wealth. Information and tips for setting a savings goal, making a savings plan, how to save automatically, and other tools and resources are included.

Youth Reconnect Program Guide: An Early Intervention Approach to Preventing Youth Homelessness

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth Reconnect. This document describes the key elements of the YR program model, including program elements and objectives, case examples of YR in practice, and necessary conditions for implementation. It is intended for communities who are interested in pursuing similar early intervention strategies. The key to success, regardless of the approaches taken, lies in building and nurturing community partnerships with service providers, educators, policy professionals, and young people.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Understanding the Pathways to Financial Well-Being

The National Financial Well-Being Survey Report is the second report in a series from the Understanding the Pathways to Financial Well-Being project. In order to measure and study the factors that support consumer financial well-being, in 2015, the Bureau of Consumer Financial Protection (the Bureau) contracted with Abt Associates to field a large, national survey to collect information on the financial well-being of U.S. adults. The present report uses data collected from that survey to answer a series of questions on the relationship among financial well-being and four key factors: objective financial situation, financial behavior, financial skill, and financial knowledge. In this study, we aim to enhance understanding of financial well-being and the factors that may support it by exploring these relationships.

English

Introduction to asset building

Asset building for your future (fillable PDF)

Asset building for your future (print version)

My long-term goal action plan (fillable PDF)

My long-term goal action plan (print version)

Introduction to savings accounts

Registered savings accounts

Investing in registered accounts

Seven tips to help you stick to your goals

Glossary – asset building

Resources – asset building

Making it easier to save

Types of investments and types of accounts

Investing basics

How to manage financial stress and avoid burnout

Education savings

RESPs and how they can help

Before you open an RESP

Individual, family and group RESPs

Federal education grants and bonds

Provincial education grants and bonds

Family income to receive RESP government incentives

RESP sample scenarios

Plan for your RESP bank visit

My RESP action plan (fillable PDF)

My RESP action plan (print version)

Glossary – education savings

Resources – education savings

Employment and Social Development Canada (ESDC) resources for the Canada Learning Bond (CLB):

Canada Learning Bond Application for Adult Beneficiaries

Q&A about the Canada Learning Bond for adult beneficiaries

Revised income brackets for Canada Learning Bond (July 2022 to June 2023)

French

L‘accumulation d’actifs

L’accumulation d’actifs pour votre avenir – fillable

L’accumulation d’actifs pour votre avenir – nonfillable

Mon plan d’action axé sur mon objectif à long terme – fillable

Mon plan d’action axé sur mon objectif à long terme – nonfillable

Introduction aux comptes d’épargne

Comptes d’épargne enregistrés (REEI, REEE, REER et CELI)

Investir dans les comptes enregistrés :les options et les questions à poser à votre banque

Sept conseils pour vous aider à respecter vos objectifs

Glossaire – Accumulation d’actifs

Epargne-études

Les REEE : comment peuvent-ils vous aider?

Comment choisir entre unREEE individuel, familial et collectif

Les subventions et les bons d’études du gouvernement fédéral

Les subventions et les bons d’études du gouvernement provincial

Le REEE : comment peut-il vous aider à faire fructifier vos épargnes pour les études?

Arrivez préparé à votre rendez-vous à la banque pour ouvrir un REEE

Mon plan d’action en matière de REEE – fillable

Mon plan d’action en matière de REEE – nonfillable

English

Getting started

Budgeting

The five Ws and H of budgeting

How to make a budget step by step

Income tracking sheet – PDF

Income tracking sheet – fillable PDF

Expenses tracking sheet – PDF

Expenses tracking sheet – fillable PDF

Simple budget template- PDF

Simple budget template – fillable PDF

Five different budgeting methods

Cashflow budget template – PDF

Cashflow budget template – fillable PDF

Ten ways to trim expenses

Resources

Budgeting and saving resources (as a printable handout)

Online budgeting tools and calculators:

Budget calculator – Financial Consumer Agency of Canada (FCAC)

Financial tools and calculators – Government of Canada

Get smarter about money: calculators & tools – Ontario Securities Commission (OSC)

My expenses calculator – Office of Consumer Affairs (OCA)

Tools to help when you can’t pay your bills – Consumer Financial Protection Bureau (CFPB)

Compound interest – Canadian Investment Regulatory Organization (CIRO)

Information on budgeting and saving:

An essential guide to building an emergency fund – Consumer Financial Protection Bureau (CFPB)

COVID-19: managing financial health during challenging times – Financial Consumer Agency of Canada (FCAC)

Get smarter about money: budgeting – Ontario Securities Commission (OSC)

Glossary of budgeting and saving terms – Prosper Canada

Managing your money – Financial Consumer Agency of Canada (FCAC)

My money in Canada – Prosper Canada

Setting up an emergency fund – Financial Consumer Agency of Canada (FCAC)

Preparing for financial emergencies – Ontario Securities Commission (OSC)

Planning for retirement – Ontario Securities Commission (OSC)

How to prepare for a financial emergency – Ontario Securities Commission (OSC)

Resources to help clients with money management:

Connecting families – Government of Canada

Managing your money booklet – Prosper Canada

Start small, save up – Consumer Financial Protection Bureau (CFPB)

Resources to help clients with budgeting at the grocery store:

Food sense, healthy cooking on a budget – Family Services of Greater Vancouver (FSGV)

Beating the grocery store blues – Family Services of Greater Vancouver (FSGV)

French

Matière de budget

Cinq questions à se poser en matière de budget

Comment faire un budget : un guide étape par étape

Fichier de suivi des revenus (PDF)

Fichier de suivi des revenus (PDF à remplir)

Fichier de suivi des dépenses (PDF)

Fichier de suivi des dépenses (PDF à remplir)

Modèle de budget simple (PDF)

Modèle de budget simple (PDF à remplir)

5 façons différentes de faire un budget

Budget de caisse (PDF)

Budget de caisse (PDF à remplir)

10 façons de réduire ses dépenses

Creating a Strong Foundation for Change

This guide is designed to be a resource for programs working with low income families to use when anticipating or implementing a new approach, such as coaching, to doing business. It helps you to systematically – and honestly – look at your foundational readiness for change, so that the improvements you want to make will take root and grow in fertile ground. Making time and space to look deeply into your organization can offer the opportunity to reconsider what quality service delivery looks like, help you discover how coaching (or other techniques) could be a tool, and plan efficiently on where it fits best into your existing context.

Canadians and their money: Key findings from the 2019 Canadian Financial Capability Survey

This report provides results from the 2019 Canadian Financial Capability Survey (CFCS). It offers a first look at what Canadians are doing to take charge of their finances by budgeting, planning and saving for the future, and paying down debt. While the findings show that many Canadians are acting to improve their financial literacy and financial well-being, there are also emerging signs of financial stress for some Canadians. For example, about one third of Canadians feel they have too much debt, and a growing number are having trouble making bill, rent/mortgage and other payments on time. Over the past 5 years, about 4 in 10 Canadians found ways to increase their financial knowledge, skills and confidence. They used a wide range of methods, such as reading books or other printed material on financial issues, using online resources, and pursuing financial education through work, school or community programs. Findings from the survey support evidence that financial literacy, resources and tools are helping Canadians manage their money. For example, those who have a budget have greater financial well-being based on a number of indicators, such as managing cashflow, making bill payments and paying down debt. Further, those with a

financial plan to save are more likely to feel better prepared and more confident about their retirement.

Financial well-being in Canada

Financial well-being is the extent to which you can comfortably meet all of your current financial commitments and needs while also having the financial resilience to continue doing so in the future. But it is not only about income. It is also about having control over your finances, being able to absorb a financial setback, being on track to meet your financial goals, and—perhaps most of all—having the financial freedom to make choices that allow you to enjoy life. The Financial Consumer Agency of Canada (FCAC) participated in a multi-country initiative that sought to measure financial well-being. FCAC conducted this survey to understand and describe the realities of Canadians across the financial well-being spectrum and help policy-makers, practitioners and Canadians themselves achieve better financial well-being. This is in keeping with the Agency’s ongoing work to monitor trends and emerging issues that affect Canadians and their finances.

Incentivized Savings: An Effective Approach at Tax Time

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through a dedicated collaboration with ATB Financial, Aspire Calgary, Sunrise Community Link Resource Centre, Centre for Newcomers, and First Lutheran Church Calgary that made it all possible. This report shares results and highlights from the 2018 Tax Time Savings program. 93% of participants earned the maximum match of $500.

Backgrounder: Preliminary findings from Canada’s Financial Well-Being Survey

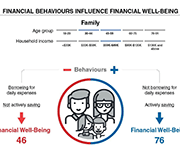

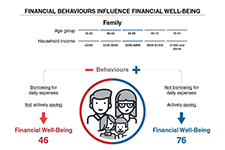

This backgrounder reports preliminary findings from a survey of financial well-being among Canadian adults. Preliminary analysis of the survey data indicates that two behaviours are particularly important in supporting the financial well-being of Canadians. First, our analysis indicates that Canadians who practice active savings behaviour have higher levels of financial resilience as well as higher levels of overall financial well-being. In other words, regardless of the amount of money someone makes, regular efforts to save for unexpected expenses and other future priorities appears to be the key to feeling and being in control of personal finances. Secondly, Canadians who often use credit to pay for daily expenses because they have run short of money have lower levels of financial well-being. While this behaviour is likely symptomatic of low levels of financial well-being, our analysis indicates that a person can substantially improve their financial resilience and financial well-being by implementing strategies to reduce the frequency of running out of money and of having to rely on credit to get by.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

Managing spending: Ideas for financial educators

As financial educators know, making day-to-day decisions on spending money is one of the biggest challenges consumers face in keeping their financial lives in order. Many people find it difficult to manage their household finances on a daily basis, let alone over the long term. This brief from the Bureau of Consumer Financial Protection identifies a few ideas to explore causes of over-spending and ideas to help prevent it.

Effective financial education: Five principles and how to use them

Because of the key role that financial education can play in people’s lives, the CFPB has conducted research over its first five years into what makes financial education effective for consumers. What do we mean by “effective?” It does not just mean training that helps people perform better on a test of financial facts. It means equipping consumers to understand the financial marketplace and make sound financial choices in pursuit of their life goals.

English

Financial coaching tools - Exploring client needs and priorities

Tools for exploring client priorities

Urgent vs. important – fillable PDF

Dreams for the future

Financial wheel of life

First coaching meeting checklist

My money priorities

Values worksheet

My ‘money personality’ – fillable PDF

Key coaching skills

Coaching skills: Active listening

Coaching skills: The art of acknowledgement

COACH-ing moments

Program support tools

These are some example tools to support the coach in assessing client readiness for coaching, guiding clients towards potential actions to meet their goals, and in discovering referral support in their community.

Milestones, actions, and tools

Client readiness assessment – PDF

Client readiness assessment – fillable PDF

Financial health pre-assessment – PDF

Financial health pre-assessment – fillable PDF

Developing a referrals network

Virtual tools for participant engagement

Resources:

Virtual service delivery tools

We are grateful to Family Services Greater Vancouver in British Columbia, Thunder Bay Counselling in Ontario, and SEED Winnipeg Inc. in Manitoba for their content consultation support and resource sharing.

Supporting client intake, triage, and referral in virtual financial help services

Virtual tools for participant engagement

Implementing a practice of self-care for practitioners – PDF

Implementing a practice of self-care for practitioners – fillable PDF

Participant tools:

Action plan – PDF

Action plan – fillable PDF

Contact list – PDF

Contact list – fillable PDF

Information to remember – PDF

Information to remember – fillable PDF

Action items – PDF

Action items – fillable PDF

Please note that some of the resources below were developed prior to the COVID-19 pandemic and serve as samples only. Current materials used by community agencies may have been revised to reflect updates to services and to meet public health guidelines.

Intake and assessment tools:

Intake Form – Family Services Greater Vancouver

First Financial Coaching Session Survey – Family Services Greater Vancouver

Financial Health Assessment – Thunder Bay Counselling

Financial Assessment Spreadsheet – Thunder Bay Counselling

Consent forms:

Consent to Service – Thunder Bay Counselling

Consent to Release and Obtain Information – Thunder Bay Counselling

Promotional materials:

Welcome and introduction to services brochure – Thunder Bay Counselling

Community Financial Helpline social media material (image 1, image 2, image 3) – SEED Winnipeg Inc.

Case studies and common questions

Use these case studies and common questions to practice or develop your coaching skills. Try them on your own or with your fellow staff.

Case study: Linda

Case study: Jacob

Case study: Nina

Common questions 1: “Just tell me what to do!”

Common questions 2: “There’s no point.”

Saving tools

Debt tools

Coaching conversation tips – Debt

Guide for talking to creditors

Determining debt payoff order (FC toolkit)

Debt list tool (FC toolkit) – PDF

Debt list tool (FC toolkit) – fillable PDF

Net worth tool (FC toolkit) – PDF

Net worth tool (FC toolkit) – fillable PDF

Payment arrangements worksheet (FC toolkit) – PDF

Payment arrangements worksheet (FC toolkit) – fillable PDF

Who do you owe? (FC toolkit) – PDF

Who do you owe? (FC toolkit) – fillable PDF

French

Outils de coaching financier

Fixation d‘objectifs et planification d’actions

Outils de déclaration de revenue

Activity sheet 4-10: Goals (Banking and financial services)

This activity sheet is from Module 4 of the Prosper Canada Financial Literacy Facilitator resources. Take a few minutes to how this workshop relates to your life, and set one or two goals for your use of banks and other financial services. To view the full Financial Literacy Facilitator resources, click here.

A Much Closer Look: Enhancing Savings Counseling at Financial Empowerment Centers

Building savings is a fundamental strategy for empowering individuals and families with low incomes. Even relatively small amounts of savings can serve as a buffer against inevitable financial shocks that can otherwise undermine social service efforts and successes – and short-term savings offer realistic first steps toward building longer-term savings and acquiring assets. The CFE Fund conducted a research pilot at municipal Financial Empowerment Centers to better understand how clients are saving, and inform new savings indicators for financial counseling success. This report explains the insights of this research pilot, and client outcomes in savings and goal setting.

Financial well-being in America

There is wide variation in how people in the U.S. feel about their financial well-being. This report presents findings from a survey by the Consumer Financial Protection Bureau (CFPB) on the distribution of financial well-being scores for the U.S. adult population overall and for selected subgroups defined by these additional measures. These descriptive findings provide insight into which subgroups are faring relatively well and which ones are facing greater financial challenges.

Managing your money: Tools and tips to help you meet your goals (English)

MYM Worksheet 1: Your money goals

MYM Worksheet 1: Your money goals – Fillable PDF

MYM Worksheet 2: Tracking your regular income

MYM Worksheet 2: Tracking your regular income – Fillable PDF

MYM Worksheet 3: Tracking your spending

MYM Worksheet 3: Tracking your spending – Fillable PDF

MYM Worksheet 4: Tracking your bills

MYM Worksheet 4: Tracking your bills – Fillable PDF

MYM Worksheet 5: Monthly budgeting

MYM Worksheet 5: Monthly budgeting – Fillable PDF

MYM Worksheet 6: Setting a savings goal

MYM Worksheet 6: Setting a savings goal – Fillable PDF

MYM Worksheet 7: Preparing for tax filing

MYM Worksheet 7: Preparing for tax filing

About the ‘Managing your money’ resource

All ‘Managing your money’ worksheets

Facilitator resources (English)

Gérer votre argent: Outils et conseils pour vous aider à atteindre vos objectifs (French)

Feuille de travail #1: Vos objectifs en lien à l’argent (MYM)

Feuille de travail #2: Suivi de votre revenu régulier (MYM)

Feuille de travail #3: Suivi de vos dépenses (MYM)

Feuille de travail #4: Suivi de vos factures (MYM)

Feuille de travail #5: Budget mensuel (MYM)

Feuille de travail #6: Fixer un objectif d’épargne (MYM)

Feuille de travail #7: Préparation pour la déclaration de revenus (MYM)

Note pour les communautés et les organismes (MYM)

Feuilles de travail complètes

Ka-paminit kisôniyâm (Plains Cree)

Activity sheet 9-11: Consumerism goal setting

This activity sheet is from Module 9 of the Financial Literacy Facilitator Resources. Setting goals related to consumerism. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 8-8: Goal setting

This activity sheet is from Module 8 of the Financial Literacy Facilitator Resources. Goal setting for debt. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-11: Goal setting and credit reports

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. Practice setting goals related to credit reports. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 5-1: Setting savings goals

This activity sheet is from Module 5 of the Financial Literacy Facilitator Resources. Steps to setting a savings goal. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-10: Goal setting

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Take a few minutes to reflect on how this workshop relates to your life. Set one or two SMART goals for your personal budgeting and financial record-keeping. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 2-6: Income and taxes

This activity sheet is from Module 2 of the Financial Literacy Facilitator Resources from Prosper Canada. Goal setting for filing your income taxes. To view full Financial Literacy Facilitator Resources, click here.

Managing your money #6: Setting a savings goal

Setting a savings goal means that you have decided how much money you can put away, and what you are going to save for. This activity can help you write down some money goals and when you would like to achieve them. You can build savings by putting aside small amounts on a regular basis. This is worksheet #6 from the booklet 'Managing your money'.

Unstuck: How to Get Out of Your Money Rut and Start Living the Life You Want. Complimentary Workbook

Financial Coaching: An Asset-Building Strategy

Financial coaching is a promising strategy to help people improve their financial well-being, but is often not yet universally understood. Practitioners are turning to coaching strategies to better facilitate behaviour change as opposed to the disappointing results often found when only financial education or financial access programs are introduced. Shared insights on financial coaching can help shape collective action by funders seeking to facilitate greater financial capability among targeted populations.

Your Money, Your Goals: A Financial Empowerment Toolkit for community volunteers

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money. Module 6-7: Debt and credit reports. Module 8: Money services, cards, accounts, and loans. Module 9: Protecting your money.

English

Module 1: Exploring your relationship with money

Module 2: Income and taxes

Handout 2-1 Government benefits

Activity Sheet 2-2 Reading David’s pay stub quiz

Handout 2-3 Reading a pay stub

Handout 2-4 Filing your taxes

Activity Sheet 2-5 Maria and Fernandos story

Activity Sheet 2-6 Goal-setting

Handout 2-7 Resources

Handout 2-8 Glossary

Video: Tax Deductions Credits and Benefits (video transcript) *NEW*

Module 3: Budgeting

Activity Sheet 3-1 The “B” word-budget

Activity Sheet 3-2 Income sources

Activity Sheet 3-3 Expense categories

Activity Sheet 3-4 Budgeting scenarios

Activity Sheet 3-5 Monthly budget worksheet

Activity Sheet 3-6 Making your own budget

Handout 3-7 Budgeting strategies

Handout 3-8 Budgeting tips

Handout 3-9 Financial record keeping

Activity Sheet 3-10 Goal-setting

Handout 3-11 Resources

Handout 3-12 Glossary

Module 4: Banking and financial services

Handout 4-1 Banks and credit unions

Handout 4-2 Deposit insurance at credit unions in different provinces

Activity Sheet 4-3 Banks and banking services quiz

Handout 4-4 Banks accounts and services

Handout 4-5 Choosing a bank and choosing an account

Handout 4-6 Opening a bank account

Handout 4-7 What are my rights?

Handout 4-8 Alternative financial services

Activity Sheet 4-9 Comparing alternative financial services to banking services

Activity Sheet 4-10 Goal-setting

Handout 4-11 Resources

Handout 4-12 Glossary

Getting government payments by direct deposit

Module 5: Saving

Activity Sheet 5-1 Setting savings goals

Activity Sheet 5-2 Needs and wants

Activity Sheet 5-3 Finding money

Handout 5-4 Compound interest

Activity Sheet 5-5 Enzo and Tess

Handout 5-6 Introduction to saving and investing

Handout 5-7 Saving and investing tools (basic)

Handout 5-8 Saving and investing tools (detailed)

Handout 5-9 Preparing for old age

Handout 5-10 Saving and investment support

Activity Sheet 5-11 Goal-setting

Handout 5-12 Resources

Handout 5-13 Glossary

Interest rates and how they impact your finances, CIRO

Benefits of having a financial plan, CIRO

Module 7: Credit reporting

Handout 7-1 Credit bureaus

Handout 7-2 Credit reports

Handout 7-3 Sample Equifax credit report

Handout 7-4 Reading a credit report

Handout 7-5 Credit scores

Activity Sheet 7-6 Equifax credit report request form

Activity Sheet 7-7 TransUnion credit report request form

Handout 7-8 Correcting common errors on credit reports

Activity Sheet 7-9 Credit score scenarios

Handout 7-10 Ways to improve your credit score

Activity Sheet 7-11 Goal-setting

Handout 7-12 Resources

Handout 7-13 Glossary

Module 8: Debt

Activity Sheet 8-1 How much is TOO much

Activity Sheet 8-2 Debt do’s and don’ts

Activity Sheet 8-3 Ladder of debt repayment options

Handout 8-4 Steps to debt repayment

Handout 8-5 Dealing with creditors

Handout 8-6 Collection rules

Activity Sheet 8-7 Collection role play

Activity Sheet 8-8 Goal-setting

Handout 8-9 Resources

Handout 8-10 Glossary

Video: Debt Solutions (video transcript)*NEW*

Module 9: Consumerism

Activity Sheet 9-1 Consumer quiz

Handout 9-2 Advertising techniques and sales tactics

Handout 9-3 Smart shopping tips

Activity Sheet 9-4 Find a better deal

Handout 9-5 Cell phone information

Activity Sheet 9-6 Cell phone checklist

Handout 9-7 Common types of frauds and scams

Handout 9-8 Tips to protect yourself from fraud and scams

Handout 9-9 Dealing with consumer problems

Handout 9-10 Complaint letter

Handout 9-11 Making a complaint about an investment

Activity Sheet 9-12 Rate your financial knowledge part 2

Activity Sheet 9-13 Goal setting

Handout 9-14 Resources

Handout 9-15 Glossary

CERB and other COVID-19 scams

Protect yourself against fraud during COVID-19

Types of fraud

Fraud prevention month

The many faces of elder abuse

Pensions, FSRA

Credit Unions and Deposit Insurance, FSRA

French

Module 1 : Explorer votre relation avec l’argent

Feuille d’activité 1-1 « Trouvez quelqu’un qui… »

Feuille d’activité 1-2 « L’argent c’est… »

Feuille d’activité 1-3 Messages relatifs à l’argent

Feuille d’activité 1-4 Imaginez un peu

Feuille d’activité 1-5 Évaluer vos connaissances financières

Feuille d’activité 1-6 Comment établir des objectifs INTELLLIGENTS

Feuille d’activité 1-7 Établissement d’objectifs

Module 2 : Revenus et impôts

Document 2-1 Prestations gouvernementales

Feuille d’activité 2-2 « Lire le relevé de paie de Jeanne (questionnaire) »

Document 2-2 Lire un relevé de paie

Document 2-3 La déclaration de revenus

Feuille d’activité 2-4 « Le cas de Maria et Fernando »

Feuille d’activité 2-5 « Établissement d’objectifs »

Document 2-6 Ressource

Document 2-7 Glossaire

Déductions, crédits d’impôt et avantages fiscaux – Transcription de la vidéo **NOUVEAU**

Module 3 : L’établissement d’un budget

Feuille d’activité 3-1 Le mot qui commence par un « B » – budget

Feuille d’activité 3-2 Sources de revenus

Feuille d’activité 3-3 Catégories de dépenses

Feuille d’activité 3-4 Scénarios de budget

Feuille d’activité 3-5 feuille de travail pour le budget mensuel

Feuille d’activité 3-6 feuille de travail pour le budget mensuel

Document 3-7 Les stratégies budgétaires

Document 3-8 Conseils budgétaires

Document 3-9 Tenue des dossiers financiers

Feuille d’activité 3-10 Établissement d’objectifs

Document 3-11 Ressources

Document 3-12 Glossaire

Module 4 : Services bancaires et financiers

Document 4-1 Banques et caisses populaires ou coopératives de crédit

Document 4-2 Assurance-dépôts dans les caisses populaires ou coopératives de crédit selon les provinces.

Feuille d’activité 4-3 Questionnaire sure les banques et les services bancaires

Document 4-4 Comptes et services bancaires

Document 4-5 Choisir une banque et un compte

Document 4-6 Ouverture d’un compte de banque

Document 4-7 Quels sont mes droits?

Document 4-8 Services financiers parallèles

Feuille d’activité 4-9 Comparaison des services financiers parallèles avec les services bancaires classiques

Feuille d’activité 4-10 Établissement d’objectifs

Document 4-11 Ressources

Document 4-12 Glossaire

Obtention des paiements gouvernementaux par dépôt direct

Module 5 : L’épargne

Feuille d’activité 5-1 Établissement d’objectifs d’épargne

Feuille d’activité 5-2 Besoins et désirs

Feuille d’activité 5-3 Trouver l’argent

Document 5-4 Intérêt composé

Feuille d’activité 5-5 Bill et Bob

Document 5-6 Outils d’épargne (notions de base)

Document 5-7 Outils d’épargne (notions détaillées)

Feuille d’activité 5-8 Questionnaire sur les outils d’épargne

Feuille d’activité 5-9 Etablissement d’objectifs

Document 5-10 Ressources

Document 5-11 Glossaire

L’avantage d’avoir un plan financier

Module 6 : Les notions de base du crédit

Module 7 : Rapports de solvabilité

Document 7-1 Les bureaux de crédit

Document 7-2 Les dossiers de crédit

Document 7-3 Exemple d’un dossier de crédit d’Equifax

Document 7-4 La lecture d’un dossier de crédit

Document 7-5 Les pointages de crédit

Feuille d’activité 7-6 Equifax demande de mon historique de crédit

Feuille d’activité 7-7 TransUnion formulaire de demande de fiche de crédit

Document 7-8 Corriger les erreurs communes inscrites sur les dossiers de crédit.

Feuille d’activité 7-9 Les scenarios sur le pointage de crédit

Document 7-10 Façons d’améliorer votre pointage de crédit

Feuille d’activité 7-11 L’établissement d’objectifs

Document 7-12 Ressources

Module 8 : Les dettes

Feuille d’activité 8-1 Quel montant faut-il éviter de dépasser?

Feuille d’activité 8-2 À faire et à éviter

Feuille d’activité 8-3 L’échelle des options de remboursement des dettes

Document 8-4 Les étapes pour rembourser des dettes

Document 8-5 Traiter avec les créanciers

Document 8-6 Règles en matière de recouvrement

Feuille d’activité 8-7 Jeu de rôle – Recouvrement

Feuille d’activité 8-8 Établissement d’objectifs

Document 8-9 Ressources

Document 8-10 Glossaire

Les dettes – Transcription de la vidéo **NOUVEAU**

Module 9 : Le consumérisme

Feuille d’activité 9-1 Questionnaire du consommateur

Document 9-2 Techniques de publicité et tactiques de vente

Document 9-3 Conseils pour magasiner de manière intelligente

Feuille d’activité 9-4 Trouver la meilleure aubaine

Document 9-5 Information sur le téléphone cellulaire

Feuille d’activité 9-6 Liste de vérification du téléphone cellulaire

Document 9-7 Les fraudes et les arnaques communes

Document 9-8 Gérer des problèmes de consommation

Feuille d’activité 9-9 Lettre de plainte

Feuille d’activité 9-10 Évaluez vos connaissances financières, partie 2

Feuille d’activité 9-11 Établir des objectifs

Document 9-12 Ressources

Document 9-13 Glossaire

Escroqueries liées à la PCU et autres fraudes courantes durant la pandémie de COVID-19

Protégez-vous contre la fraude durant la pandémie de COVID-19

Types de fraude

Mois de la prévention de la fraude

Les régimes de retraite

Assurance-dépôts et credit unions, ARSF