Resources

Presentation slides and video time stamps

View the Making the most of your money course.

View the Investing with interest booklet.

Read the presentation slides for this webinar.

Time stamps for the video:

0:50 – Welcome, introductions, and warm-up

3:10 – Making the most of your money overview

12:57 – Demo

25:26 – Investing with interest overview

40:00 – Other resources

44:04 – Q&A

Financial Health & Wealth

You worry about your family's physical, mental and spiritual health. You take care of yourself and make sure you and your family are healthy, safe and happy. Many people do not realize that you also need to be financially healthy. Financial wellness is understanding and managing your own money. Money is a big way that others control and influence our lives. Sometimes we need to depend on others to give us money and tell us what to do with money. Opening a bank account, understanding where your money is coming from, and saving money will help you to become financially independent and financially healthy. This report from The Native Women's Association of Canada covers the importance of financial health and has sections on financial information covering bank accounts, insurance, budgeting, saving, credit cards, car loans, income taxes and housing.

Making the most of your money

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share or use with your clients to help them access tools and resources to support their daily money management. Making the most of your money is an easy-to-use, accessible, online course to help people living on a low income organize their finances and explore ways to increase the amount of money coming in and reduce what is going out. This interactive course has activities, videos, handouts and resources that are also downloadable.

Make it Count

Make it Count is a parent's resource for youth money management provided by the Manitoba Securities Commission that provides activities and tips to help you incorporate youth money management lessons into your daily routine. You can easily turn errands into education.

Money management worksheets

CPA Canada has a selection of money management worksheets you can use with your clients. Goal Setting Financial Fitness Self-Assessment Values Validator Monthly Budget for Teens Role Model Self-Assessment Document Organizer Cash Flow Organizer Net Worth Worksheet Post-Secondary Student Budget

Set SMART goals that are specific, measurable, action-oriented, realistic, time-framed.

Determine how well you are currently managing your finances.

Determine the things in life that are most important to you.

Help teenagers living at home create a monthly budget.

Determine what kind of financial role model you are.

Organize your documents in preparation for filing your taxes.

Get a clear picture of your cash flow — what is coming in and what is going out

Get a snapshot of what you own (your assets) and what you owe (your liabilities)

This worksheet will help students accurately estimate the total budget they need

Financial wellness guide: questionnaire

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial goals.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

English

Soaring with savings - Tips and tools to help you save

SWS Worksheet #1 – The importance of saving (Fillable PDF)

SWS Worksheet #2 – Create a savings goal (Fillable PDF)

SWS Worksheet #3 – Savings support network (Fillable PDF)

SWS Worksheet #4 – Saving for emergencies (Fillable PDF)

SWS Worksheet #5 – Saving for unstable income (Fillable PDF)

SWS Worksheet #6 – Saving for education (Fillable PDF)

SWS Worksheet #7 – Saving for retirement (Fillable PDF)

Soaring with Savings- Full booklet

Soaring with savings - Training tools

French

Encourager l’épargne - Conseils et outils pour vous aider à épargner

Encourager l’épargne - l’aide d’animation

Ressources

CELI calculatrice, La Commission des valeurs mobilières de l’Ontario

REER, La Commission des valeurs mobilières de l’Ontario

Épargnez plus facilement, CVMO

Investir et épargner pendant une récession, La Commission des valeurs mobilières de l’Ontario

English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

Navigating Finances: Paying Down Debt vs. Investing, CIRO

Loan and Trust, FSRA

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

Financial Literacy for Black and African American Students

In honor of Black History Month, BestColleges in the United States interviewed financial expert Terrance Dedrick to help curate a financial literacy resource for Black and African Americans. This article includes links to these organizations in the United States that cater to Black and African Americans: "Brown Ambition": A popular podcast for Black and African American students covers important financial literacy topics and provides advice from others who have learned financial literacy and used it successfully. Urban Wallet: A selection of free guides and resources to help students learn about spending and budgeting, investing in cryptocurrencies, and using credit cards responsibly. Association of African American Financial Advisors (AAAFA): for Black and African American students looking to work with a financial advisor to learn more about money. Operation HOPE: This nonprofit works with students and other adults alike to provide financial dignity through financial literacy training, coaching, and other services to build confidence and resilience. Building Bread: Designed for Black students and young professionals, Building Bread provides a free financial planning course along with other low-cost advanced classes.

Money matters

Money Matters is a free introductory financial literacy program for adult learners that has been delivered to Canadians since 2011 and has reached over 80,000 adults. It was developed by ABC Life Literacy Canada in partnership with the Government of Canada and TD Bank Group and was designed by literacy practitioners. The newly released resources as part of the Money Matters program are:

Ten frugal habits to save money

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said they would put it in savings or invest it. With inflation as high as it has been in over 40 years, saving money is becoming increasingly difficult for some. This article lists ten frugal habits to help you save.

Spending habits calculator

Use this calculator to see how changes to your spending habits can impact your budget and help you save more of your money.

Financial literacy self-assessment quiz

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other Canadians.

Start Your Investment Journey

Before you start investing, it is important to consider your budget and financial goals, and how much risk you are comfortable taking on. Like many things in life, investing comes with its own share of risks and rewards. You can do this on your own or with the help of an advisor.

Empower U Financial Coaching

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and asset building intervention (although partners also contribute to the other interventions). The Sustainable Livelihood Model identifies five distinct sets of assets including personal, human, social, physical and financial. The Empower U program activities are grounded by two overarching philosophies: Financial Empowerment (as defined by Prosper Canada) and the Sustainable Livelihood Model (adapted by the Canadian Women’s Foundation, based on the work of the University of Sussex Institute for Development Studies). Focusing on financial literacy and coaching, Empower U has developed an individual financial coaching component to the overall program.

Take the stress out of budgeting

Making a budget is one of the most helpful financial tools you can use on a regular basis. A budget can give you a clear picture of where your money is going. It’s easier to plan for the life you want, when you know how much money you have for saving, spending and paying off debt. If you’ve never made a budget, or have not created one in a long time, it can be an intimidating reality check. Don’t let stress or worry keep you from creating a budget. The best budgeting method to use is the one that works for you.

Retirement budget worksheet

Good financial planning starts with knowing what you spend. Try out this budget worksheet, prepared by the Ontario Securities Commission, to see the difference in your costs before you retire and after you stop working.

Money Mentors’ free financial education programs

Money Mentors’ free online courses are available to everyone. The 1-2 hour narrated courses make it easy to learn at your own pace. These online courses provide the same great content as our in-person presentations, but at the touch of a finger. They cover a variety of topics including budgeting, debt, credit, fraud, life events and one course even focuses on managing money and understanding credit for high school students. Read more about Money Mentors' free financial literacy presentations to provide K-12 students with money concepts and skills here.

Emerging Technology for All: Conversational AI’s Pivotal Role

This infographic is a preview of Commonwealth's research survey of 1290 lower-and moderate-income people to understand their perceptions, needs, and uses of conversational AI.

Control, Sufficiency, and Social Support Lessons from Low-income Canadians about Financial Wellbeing

This report examines how diary participants achieve the financial wellbeing that they have. The evidence we found is that low-income people work very hard to manage their finances. They endeavor to control their finances so that, as one participant said, their finances don’t control them. They must prioritize needs and wants because there is not enough for both. One participant talked about her goal of having a ‘little bit more’ than her needs so that there was a little extra for savings or small purchases or trips. Finally, we saw that family and friends are terribly important for achieving financial wellbeing because social supports can provide loans, gifts, and emotional support. Having a low-income means that banks offer few financial supports. Of course, family and friends also make demands.

Money Mentors – Savings & Debt Resources

Collection of money management resources, including how create effective budgets, realistic spending plans, deal with your debts, save more money, build a stronger credit rating, and prepare for retirement.

Testing the use of the Mint app in an interactive personal finance module

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s effectiveness at improving students’ financial knowledge, attitudes, and behavior. Students at the George Washington University participated in a half-day budgeting workshop and were exposed to either Mint, which is a real-time, automated platform, or Excel, which is an offline, static tool. The authors found that participation in both workshops was associated with improved preparedness to have conversations about money matters with parents, a greater sense of financial autonomy, and an increased awareness of the importance of budgeting, but that participants in the Mint workshop were more likely to have a positive experience using the budgeting tool, to feel confident that they could achieve a financial goal, and to be engaged in budgeting one month after the workshop. Results show that even short financial education interventions can meaningfully influence students’ financial attitudes and behavior and that an interactive tool like Mint may have advantages over a more static tool like Excel.

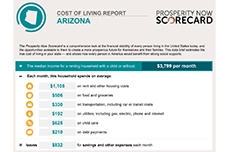

Prosperity Now Scorecard Cost-Of-Living Profiles by State

Prosperity Now has created state-level Cost-of-Living profiles as new features on their Scorecard website. The Prosperity Now Cost of Living profiles provide a comprehensive look at the financial stability of every person living in the United States. Each state profile can be downloaded and used to determine the true cost of living is in the state, based on median monthly income and discretionary spending left at the end of each month after expenses. These values determine what is left over for emergency expenses and long-term aspirational expenses. This video presents the cost of living in Georgia.

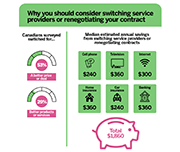

Stop Overpaying, Start Switching

In the past year, 1 in 4 Canadians surveyed renegotiated their contracts or switched providers to take advantage of better deals and services. This webpage provides information on switching or renegotiating your contract to reduce your monthly bills and get better products and services.

Review of Financial Literacy Research in Canada: An Environmental Scan and Gap Analysis

The Review of Financial Literacy Research in Canada highlights past and current advancements in financial literacy research (produced by government and non-governmental stakeholders) while identifying existing gaps within the financial landscape. The overriding goal is to help strengthen the financial well-being of all Canadians. The review contains four research priorities: managing debt, navigating the financial marketplace, building savings, and budgeting.

Budgeting resources webinar

This webinar hosted by Credit Canada features guest expert Prosper Canada's Manager of Learning and Training, Glenna Harris. She shares some of their tried-and-true resources to help get people started on budgeting and debt management. She also provides a new tool - Financial Relief Navigator - that can help connect people with income supports they might be eligible for.

How to really build financial capability

Recent years have seen an explosion in interventions designed to improve financial outcomes of participants. Yet on-the-ground evidence suggests that not all financial education programs are equally successful at achieving this aim. This paper examines the difference between interventions that work, and those than do not. It attempts to answer the question: “How do you actually build financial capability?” In doing so, we aim to help interested parties enhance the effectiveness of their programs and policies by providing them with evidence-based recommendations to drive positive outcomes in participants.

Debt settlement and financial recovery companies: too risky an option?

This report presents a study of the debt settlement and financial recovery industry and examines Canadian consumer issues from these services. Data is gathered from company websites and contracts as well as customer surveys and questionnaires completed by governmental and non-governmental organizations. A comparative study of legislation applicable to the industry is also conducted.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

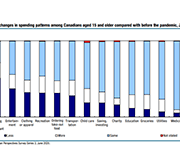

Expected changes in spending habits during the recovery period

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How our economy evolves going forward will largely depend upon the spending choices Canadians make over the coming weeks and months. This study presents results from a recent web panel survey conducted in June, looks at how spending habits may change.

COVID-19: Managing financial health in challenging times

This guide from the Financial Consumer Agency of Canada shares guidelines and financial tips to help Canadians during COVID-19. The topics include: getting through a financial emergency, where to ask questions or voice concerns, what to do if your branch closes, and more.

English

Getting started

Budgeting

The five Ws and H of budgeting

How to make a budget step by step

Income tracking sheet – PDF

Income tracking sheet – fillable PDF

Expenses tracking sheet – PDF

Expenses tracking sheet – fillable PDF

Simple budget template- PDF

Simple budget template – fillable PDF

Five different budgeting methods

Cashflow budget template – PDF

Cashflow budget template – fillable PDF

Ten ways to trim expenses

Resources

Budgeting and saving resources (as a printable handout)

Online budgeting tools and calculators:

Budget calculator – Financial Consumer Agency of Canada (FCAC)

Financial tools and calculators – Government of Canada

Get smarter about money: calculators & tools – Ontario Securities Commission (OSC)

My expenses calculator – Office of Consumer Affairs (OCA)

Tools to help when you can’t pay your bills – Consumer Financial Protection Bureau (CFPB)

Compound interest – Canadian Investment Regulatory Organization (CIRO)

Information on budgeting and saving:

An essential guide to building an emergency fund – Consumer Financial Protection Bureau (CFPB)

COVID-19: managing financial health during challenging times – Financial Consumer Agency of Canada (FCAC)

Get smarter about money: budgeting – Ontario Securities Commission (OSC)

Glossary of budgeting and saving terms – Prosper Canada

Managing your money – Financial Consumer Agency of Canada (FCAC)

My money in Canada – Prosper Canada

Setting up an emergency fund – Financial Consumer Agency of Canada (FCAC)

Preparing for financial emergencies – Ontario Securities Commission (OSC)

Planning for retirement – Ontario Securities Commission (OSC)

How to prepare for a financial emergency – Ontario Securities Commission (OSC)

Resources to help clients with money management:

Connecting families – Government of Canada

Managing your money booklet – Prosper Canada

Start small, save up – Consumer Financial Protection Bureau (CFPB)

Resources to help clients with budgeting at the grocery store:

Food sense, healthy cooking on a budget – Family Services of Greater Vancouver (FSGV)

Beating the grocery store blues – Family Services of Greater Vancouver (FSGV)

French

Matière de budget

Cinq questions à se poser en matière de budget

Comment faire un budget : un guide étape par étape

Fichier de suivi des revenus (PDF)

Fichier de suivi des revenus (PDF à remplir)

Fichier de suivi des dépenses (PDF)

Fichier de suivi des dépenses (PDF à remplir)

Modèle de budget simple (PDF)

Modèle de budget simple (PDF à remplir)

5 façons différentes de faire un budget

Budget de caisse (PDF)

Budget de caisse (PDF à remplir)

10 façons de réduire ses dépenses

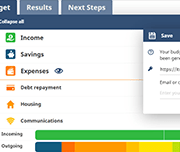

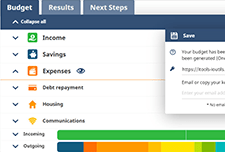

Budget Planner

The Financial Consumer Agency of Canada (FCAC)'s online tool helps you create a customized budget.

Emergency Fund Calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Use this calculator to estimate how much money should be set aside to pay for financial emergencies.

Canadians and their money: Key findings from the 2019 Canadian Financial Capability Survey

This report provides results from the 2019 Canadian Financial Capability Survey (CFCS). It offers a first look at what Canadians are doing to take charge of their finances by budgeting, planning and saving for the future, and paying down debt. While the findings show that many Canadians are acting to improve their financial literacy and financial well-being, there are also emerging signs of financial stress for some Canadians. For example, about one third of Canadians feel they have too much debt, and a growing number are having trouble making bill, rent/mortgage and other payments on time. Over the past 5 years, about 4 in 10 Canadians found ways to increase their financial knowledge, skills and confidence. They used a wide range of methods, such as reading books or other printed material on financial issues, using online resources, and pursuing financial education through work, school or community programs. Findings from the survey support evidence that financial literacy, resources and tools are helping Canadians manage their money. For example, those who have a budget have greater financial well-being based on a number of indicators, such as managing cashflow, making bill payments and paying down debt. Further, those with a

financial plan to save are more likely to feel better prepared and more confident about their retirement.

My money in Canada

Are you a newcomer to Canada, or someone who works with newcomers? This online tool will help you explore five money modules to better manage your finances in Canada. Learn about the financial system in Canada, income and expenses, setting goals and saving, credit and credit reports, and filing taxes. Updated July 26, 2022: My money in Canada provides important information about Canada’s financial system and promotes positive money management habits to support Canadians to succeed financially. Interactive exercises and checklists support you to make informed choices and to create a customized financial plan that works for you. Originally designed to support newcomers to Canada as they settle and establish themselves financially, My money in Canada has been updated to serve all Canadians, including those who are new to Canada.

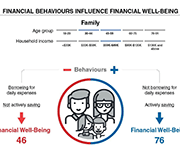

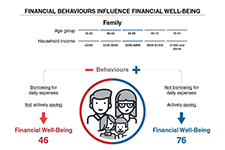

Backgrounder: Preliminary findings from Canada’s Financial Well-Being Survey

This backgrounder reports preliminary findings from a survey of financial well-being among Canadian adults. Preliminary analysis of the survey data indicates that two behaviours are particularly important in supporting the financial well-being of Canadians. First, our analysis indicates that Canadians who practice active savings behaviour have higher levels of financial resilience as well as higher levels of overall financial well-being. In other words, regardless of the amount of money someone makes, regular efforts to save for unexpected expenses and other future priorities appears to be the key to feeling and being in control of personal finances. Secondly, Canadians who often use credit to pay for daily expenses because they have run short of money have lower levels of financial well-being. While this behaviour is likely symptomatic of low levels of financial well-being, our analysis indicates that a person can substantially improve their financial resilience and financial well-being by implementing strategies to reduce the frequency of running out of money and of having to rely on credit to get by.

My money in Canada

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use. The tool is intended to be used with clients and settlement workers together, but can also be used by the client on their own if they are comfortable.

Managing spending: Ideas for financial educators

As financial educators know, making day-to-day decisions on spending money is one of the biggest challenges consumers face in keeping their financial lives in order. Many people find it difficult to manage their household finances on a daily basis, let alone over the long term. This brief from the Bureau of Consumer Financial Protection identifies a few ideas to explore causes of over-spending and ideas to help prevent it.

Consumer Insights on Managing Spending

The CFPB conducted research on consumer challenges in tracking spending and keeping to a budget. The research found that consumers aspire to manage their spending but for many reasons, many consumers spend more than intended and sometimes have\ difficulty in staying within their budgets. In addition, we found that although most people would like to use budgets and plans, they often don’t use them to guide spending decisions in the moment. Budgeting and tracking spending are often considered to be overwhelming or too much of a hassle, and even those consumers who have a budget generally do not benchmark their spending to their budget frequently or regularly.

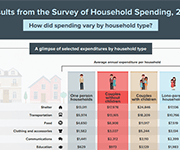

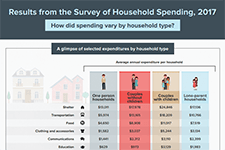

Results from the Survey of Household Spending, 2017 (Infographic)

This infographic from Statistics Canada summarizes the results of the Survey of Household Spending, 2017, including average annual expenditures by household type.

Tout Bien Calcule

Pour souligner leurs 50 ans d’histoire, les Associations de consommateurs du Québec s’unissent pour offrir à la population québécoise un portail qui rassemble toute une gamme d’informations et d’outils développés au fil des années grâce à leur expertise en finances personnelles. Cette porte d’entrée donne accès à des services spécialisés en finances personnelles offerts par les associations, propose des outils adaptés, et à travers les différentes sections, offre une information claire, objective et critique afin de vous guider vers de meilleurs choix de consommation et une meilleure santé financière.

Your Money, Your Goals: Focus on People with Disabilities

This is a companion guide to the 'Your Money, Your Goals' curriculum by the Consumer Financial Protection Bureau (CFPB) in the United States. This guide- Your Money, Your Goals: Focus on People with Disabilities—contains information, tips, and tools based on the insights from people with disabilities and from organizations that serve the disability community. It is based on the core philosophy that everyone has the right to control their money and make their own financial decisions. Its specialized information and tools equip staff and volunteers to adapt training on and use of the toolkit and other resources to meet the needs of people with disabilities. It also includes information and tools to enable staff and volunteers to choose accessible locations, develop appropriate and considerate training activities, and plan to provide accommodations for diverse learning styles and other needs.

English

Financial coaching tools - Exploring client needs and priorities

Tools for exploring client priorities

Urgent vs. important – fillable PDF

Dreams for the future

Financial wheel of life

First coaching meeting checklist

My money priorities

Values worksheet

My ‘money personality’ – fillable PDF

Key coaching skills

Coaching skills: Active listening

Coaching skills: The art of acknowledgement

COACH-ing moments

Program support tools

These are some example tools to support the coach in assessing client readiness for coaching, guiding clients towards potential actions to meet their goals, and in discovering referral support in their community.

Milestones, actions, and tools

Client readiness assessment – PDF

Client readiness assessment – fillable PDF

Financial health pre-assessment – PDF

Financial health pre-assessment – fillable PDF

Developing a referrals network

Virtual tools for participant engagement

Resources:

Virtual service delivery tools

We are grateful to Family Services Greater Vancouver in British Columbia, Thunder Bay Counselling in Ontario, and SEED Winnipeg Inc. in Manitoba for their content consultation support and resource sharing.

Supporting client intake, triage, and referral in virtual financial help services

Virtual tools for participant engagement

Implementing a practice of self-care for practitioners – PDF

Implementing a practice of self-care for practitioners – fillable PDF

Participant tools:

Action plan – PDF

Action plan – fillable PDF

Contact list – PDF

Contact list – fillable PDF

Information to remember – PDF

Information to remember – fillable PDF

Action items – PDF

Action items – fillable PDF

Please note that some of the resources below were developed prior to the COVID-19 pandemic and serve as samples only. Current materials used by community agencies may have been revised to reflect updates to services and to meet public health guidelines.

Intake and assessment tools:

Intake Form – Family Services Greater Vancouver

First Financial Coaching Session Survey – Family Services Greater Vancouver

Financial Health Assessment – Thunder Bay Counselling

Financial Assessment Spreadsheet – Thunder Bay Counselling

Consent forms:

Consent to Service – Thunder Bay Counselling

Consent to Release and Obtain Information – Thunder Bay Counselling

Promotional materials:

Welcome and introduction to services brochure – Thunder Bay Counselling

Community Financial Helpline social media material (image 1, image 2, image 3) – SEED Winnipeg Inc.

Case studies and common questions

Use these case studies and common questions to practice or develop your coaching skills. Try them on your own or with your fellow staff.

Case study: Linda

Case study: Jacob

Case study: Nina

Common questions 1: “Just tell me what to do!”

Common questions 2: “There’s no point.”

Saving tools

Debt tools

Coaching conversation tips – Debt

Guide for talking to creditors

Determining debt payoff order (FC toolkit)

Debt list tool (FC toolkit) – PDF

Debt list tool (FC toolkit) – fillable PDF

Net worth tool (FC toolkit) – PDF

Net worth tool (FC toolkit) – fillable PDF

Payment arrangements worksheet (FC toolkit) – PDF

Payment arrangements worksheet (FC toolkit) – fillable PDF

Who do you owe? (FC toolkit) – PDF

Who do you owe? (FC toolkit) – fillable PDF

French

Outils de coaching financier

Fixation d‘objectifs et planification d’actions

Outils de déclaration de revenue

Income and Expense Volatility Survey Results

In this video presentation Patrick Ens from Capital One explains the impact of income and expense volatility on consumers. Capital One found that half of Canadian households surveyed experience some amount of income fluctuation month to month. This impacts their ability to save, cope with emergencies, and other aspects of their lives. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that accompanies this presentation. Pour lire les diapositives de la présentation, cliquez ici. View the full video playlist of all presentations from this symposium.

Financial well-being in America

There is wide variation in how people in the U.S. feel about their financial well-being. This report presents findings from a survey by the Consumer Financial Protection Bureau (CFPB) on the distribution of financial well-being scores for the U.S. adult population overall and for selected subgroups defined by these additional measures. These descriptive findings provide insight into which subgroups are faring relatively well and which ones are facing greater financial challenges.

Managing your money: Tools and tips to help you meet your goals (English)

MYM Worksheet 1: Your money goals

MYM Worksheet 1: Your money goals – Fillable PDF

MYM Worksheet 2: Tracking your regular income

MYM Worksheet 2: Tracking your regular income – Fillable PDF

MYM Worksheet 3: Tracking your spending

MYM Worksheet 3: Tracking your spending – Fillable PDF

MYM Worksheet 4: Tracking your bills

MYM Worksheet 4: Tracking your bills – Fillable PDF

MYM Worksheet 5: Monthly budgeting

MYM Worksheet 5: Monthly budgeting – Fillable PDF

MYM Worksheet 6: Setting a savings goal

MYM Worksheet 6: Setting a savings goal – Fillable PDF

MYM Worksheet 7: Preparing for tax filing

MYM Worksheet 7: Preparing for tax filing

About the ‘Managing your money’ resource

All ‘Managing your money’ worksheets

Facilitator resources (English)

Gérer votre argent: Outils et conseils pour vous aider à atteindre vos objectifs (French)

Feuille de travail #1: Vos objectifs en lien à l’argent (MYM)

Feuille de travail #2: Suivi de votre revenu régulier (MYM)

Feuille de travail #3: Suivi de vos dépenses (MYM)

Feuille de travail #4: Suivi de vos factures (MYM)

Feuille de travail #5: Budget mensuel (MYM)

Feuille de travail #6: Fixer un objectif d’épargne (MYM)

Feuille de travail #7: Préparation pour la déclaration de revenus (MYM)

Note pour les communautés et les organismes (MYM)

Feuilles de travail complètes

Ka-paminit kisôniyâm (Plains Cree)

Handout 3-12: Budgeting glossary

This handout is from Module 3 of the Financial Literacy Facilitator Resources. Glossary of budgeting terms. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-11: Resources – Money management websites

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Resource websites for money management. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-9: Financial record keeping

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Here are some important papers and records. You should keep them in a safe place and organize them so that you can find what you need. The chart shows their “shelf life” – how long you should keep them. To view full Financial Literacy Facilitator Resources, click here.

Handout 3-8: Budgeting tips

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Different types of budgeting tips to help you stay on track. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-10: Goal setting

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Take a few minutes to reflect on how this workshop relates to your life. Set one or two SMART goals for your personal budgeting and financial record-keeping. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-6: Making your own budget

This activity sheet is from Module 3 of the Financial Literacy facilitator curriculum. Steps involved in making your own budget. To view full Financial Literacy Facilitator Resources, click here

Activity sheet 3-4: Budgeting scenarios

This activity sheet is from Module 3 of the Financial Literacy facilitator curriculum. Using the Monthly Budget Worksheet, put together a budget for the person in your scenario. Feel free to make up more details. You can also change or add categories to the budget to match your person’s situation. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-3: Budgeting expense categories

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Tracking your different categories of expenses. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-2: Income sources

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. Tracking your income sources. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 3-1: The ‘B’ word – budget

This activity sheet is from Module 3 of the Financial Literacy Facilitator Resources. What do you think about when you hear the word “budget’? To view full Financial Literacy Facilitator Resources, click here.

What words or feelings come to mind?

Managing your money #5: Monthly budgeting

When you make a budget, you give yourself a clear picture of your financial situation. A budget compares your income to your expenses, all in one place. This is worksheet #5 from the booklet 'Managing your money'.

Unstuck: How to Get Out of Your Money Rut and Start Living the Life You Want. Complimentary Workbook

Your Money, Your Goals: A Financial Empowerment Toolkit for community volunteers

The goal of the Your Money, Your Goals toolkit is to make it easier for volunteers, lay counselors and workers, mentors, and coaches to help the people they serve become more financially empowered. Module 1-2: Setting goals, saving, and planning. Module 3-5: Managing income and spending money. Module 6-7: Debt and credit reports. Module 8: Money services, cards, accounts, and loans. Module 9: Protecting your money.

English

Module 1: Exploring your relationship with money

Module 2: Income and taxes

Handout 2-1 Government benefits

Activity Sheet 2-2 Reading David’s pay stub quiz

Handout 2-3 Reading a pay stub

Handout 2-4 Filing your taxes

Activity Sheet 2-5 Maria and Fernandos story

Activity Sheet 2-6 Goal-setting

Handout 2-7 Resources

Handout 2-8 Glossary

Video: Tax Deductions Credits and Benefits (video transcript) *NEW*

Module 3: Budgeting

Activity Sheet 3-1 The “B” word-budget

Activity Sheet 3-2 Income sources

Activity Sheet 3-3 Expense categories

Activity Sheet 3-4 Budgeting scenarios

Activity Sheet 3-5 Monthly budget worksheet

Activity Sheet 3-6 Making your own budget

Handout 3-7 Budgeting strategies

Handout 3-8 Budgeting tips

Handout 3-9 Financial record keeping

Activity Sheet 3-10 Goal-setting

Handout 3-11 Resources

Handout 3-12 Glossary

Module 4: Banking and financial services

Handout 4-1 Banks and credit unions

Handout 4-2 Deposit insurance at credit unions in different provinces

Activity Sheet 4-3 Banks and banking services quiz

Handout 4-4 Banks accounts and services

Handout 4-5 Choosing a bank and choosing an account

Handout 4-6 Opening a bank account

Handout 4-7 What are my rights?

Handout 4-8 Alternative financial services

Activity Sheet 4-9 Comparing alternative financial services to banking services

Activity Sheet 4-10 Goal-setting

Handout 4-11 Resources

Handout 4-12 Glossary

Getting government payments by direct deposit

Module 5: Saving

Activity Sheet 5-1 Setting savings goals

Activity Sheet 5-2 Needs and wants

Activity Sheet 5-3 Finding money

Handout 5-4 Compound interest

Activity Sheet 5-5 Enzo and Tess

Handout 5-6 Introduction to saving and investing

Handout 5-7 Saving and investing tools (basic)

Handout 5-8 Saving and investing tools (detailed)

Handout 5-9 Preparing for old age

Handout 5-10 Saving and investment support

Activity Sheet 5-11 Goal-setting

Handout 5-12 Resources

Handout 5-13 Glossary

Interest rates and how they impact your finances, CIRO

Benefits of having a financial plan, CIRO

Module 7: Credit reporting

Handout 7-1 Credit bureaus

Handout 7-2 Credit reports

Handout 7-3 Sample Equifax credit report

Handout 7-4 Reading a credit report

Handout 7-5 Credit scores

Activity Sheet 7-6 Equifax credit report request form

Activity Sheet 7-7 TransUnion credit report request form

Handout 7-8 Correcting common errors on credit reports

Activity Sheet 7-9 Credit score scenarios

Handout 7-10 Ways to improve your credit score

Activity Sheet 7-11 Goal-setting

Handout 7-12 Resources

Handout 7-13 Glossary

Module 8: Debt

Activity Sheet 8-1 How much is TOO much

Activity Sheet 8-2 Debt do’s and don’ts

Activity Sheet 8-3 Ladder of debt repayment options

Handout 8-4 Steps to debt repayment

Handout 8-5 Dealing with creditors

Handout 8-6 Collection rules

Activity Sheet 8-7 Collection role play

Activity Sheet 8-8 Goal-setting

Handout 8-9 Resources

Handout 8-10 Glossary

Video: Debt Solutions (video transcript)*NEW*

Module 9: Consumerism

Activity Sheet 9-1 Consumer quiz

Handout 9-2 Advertising techniques and sales tactics

Handout 9-3 Smart shopping tips

Activity Sheet 9-4 Find a better deal

Handout 9-5 Cell phone information

Activity Sheet 9-6 Cell phone checklist

Handout 9-7 Common types of frauds and scams

Handout 9-8 Tips to protect yourself from fraud and scams

Handout 9-9 Dealing with consumer problems

Handout 9-10 Complaint letter

Handout 9-11 Making a complaint about an investment

Activity Sheet 9-12 Rate your financial knowledge part 2

Activity Sheet 9-13 Goal setting

Handout 9-14 Resources

Handout 9-15 Glossary

CERB and other COVID-19 scams

Protect yourself against fraud during COVID-19

Types of fraud

Fraud prevention month

The many faces of elder abuse

Pensions, FSRA

Credit Unions and Deposit Insurance, FSRA

French

Module 1 : Explorer votre relation avec l’argent

Feuille d’activité 1-1 « Trouvez quelqu’un qui… »

Feuille d’activité 1-2 « L’argent c’est… »

Feuille d’activité 1-3 Messages relatifs à l’argent

Feuille d’activité 1-4 Imaginez un peu

Feuille d’activité 1-5 Évaluer vos connaissances financières

Feuille d’activité 1-6 Comment établir des objectifs INTELLLIGENTS

Feuille d’activité 1-7 Établissement d’objectifs

Module 2 : Revenus et impôts

Document 2-1 Prestations gouvernementales

Feuille d’activité 2-2 « Lire le relevé de paie de Jeanne (questionnaire) »

Document 2-2 Lire un relevé de paie

Document 2-3 La déclaration de revenus

Feuille d’activité 2-4 « Le cas de Maria et Fernando »

Feuille d’activité 2-5 « Établissement d’objectifs »

Document 2-6 Ressource

Document 2-7 Glossaire

Déductions, crédits d’impôt et avantages fiscaux – Transcription de la vidéo **NOUVEAU**

Module 3 : L’établissement d’un budget

Feuille d’activité 3-1 Le mot qui commence par un « B » – budget

Feuille d’activité 3-2 Sources de revenus

Feuille d’activité 3-3 Catégories de dépenses

Feuille d’activité 3-4 Scénarios de budget

Feuille d’activité 3-5 feuille de travail pour le budget mensuel

Feuille d’activité 3-6 feuille de travail pour le budget mensuel

Document 3-7 Les stratégies budgétaires

Document 3-8 Conseils budgétaires

Document 3-9 Tenue des dossiers financiers

Feuille d’activité 3-10 Établissement d’objectifs

Document 3-11 Ressources

Document 3-12 Glossaire

Module 4 : Services bancaires et financiers

Document 4-1 Banques et caisses populaires ou coopératives de crédit

Document 4-2 Assurance-dépôts dans les caisses populaires ou coopératives de crédit selon les provinces.

Feuille d’activité 4-3 Questionnaire sure les banques et les services bancaires

Document 4-4 Comptes et services bancaires

Document 4-5 Choisir une banque et un compte

Document 4-6 Ouverture d’un compte de banque

Document 4-7 Quels sont mes droits?

Document 4-8 Services financiers parallèles

Feuille d’activité 4-9 Comparaison des services financiers parallèles avec les services bancaires classiques

Feuille d’activité 4-10 Établissement d’objectifs

Document 4-11 Ressources

Document 4-12 Glossaire

Obtention des paiements gouvernementaux par dépôt direct

Module 5 : L’épargne

Feuille d’activité 5-1 Établissement d’objectifs d’épargne

Feuille d’activité 5-2 Besoins et désirs

Feuille d’activité 5-3 Trouver l’argent

Document 5-4 Intérêt composé

Feuille d’activité 5-5 Bill et Bob

Document 5-6 Outils d’épargne (notions de base)

Document 5-7 Outils d’épargne (notions détaillées)

Feuille d’activité 5-8 Questionnaire sur les outils d’épargne

Feuille d’activité 5-9 Etablissement d’objectifs

Document 5-10 Ressources

Document 5-11 Glossaire

L’avantage d’avoir un plan financier

Module 6 : Les notions de base du crédit

Module 7 : Rapports de solvabilité

Document 7-1 Les bureaux de crédit

Document 7-2 Les dossiers de crédit

Document 7-3 Exemple d’un dossier de crédit d’Equifax

Document 7-4 La lecture d’un dossier de crédit

Document 7-5 Les pointages de crédit

Feuille d’activité 7-6 Equifax demande de mon historique de crédit

Feuille d’activité 7-7 TransUnion formulaire de demande de fiche de crédit

Document 7-8 Corriger les erreurs communes inscrites sur les dossiers de crédit.

Feuille d’activité 7-9 Les scenarios sur le pointage de crédit

Document 7-10 Façons d’améliorer votre pointage de crédit

Feuille d’activité 7-11 L’établissement d’objectifs

Document 7-12 Ressources

Module 8 : Les dettes

Feuille d’activité 8-1 Quel montant faut-il éviter de dépasser?

Feuille d’activité 8-2 À faire et à éviter

Feuille d’activité 8-3 L’échelle des options de remboursement des dettes

Document 8-4 Les étapes pour rembourser des dettes

Document 8-5 Traiter avec les créanciers

Document 8-6 Règles en matière de recouvrement

Feuille d’activité 8-7 Jeu de rôle – Recouvrement

Feuille d’activité 8-8 Établissement d’objectifs

Document 8-9 Ressources

Document 8-10 Glossaire

Les dettes – Transcription de la vidéo **NOUVEAU**

Module 9 : Le consumérisme

Feuille d’activité 9-1 Questionnaire du consommateur

Document 9-2 Techniques de publicité et tactiques de vente

Document 9-3 Conseils pour magasiner de manière intelligente

Feuille d’activité 9-4 Trouver la meilleure aubaine

Document 9-5 Information sur le téléphone cellulaire

Feuille d’activité 9-6 Liste de vérification du téléphone cellulaire

Document 9-7 Les fraudes et les arnaques communes

Document 9-8 Gérer des problèmes de consommation

Feuille d’activité 9-9 Lettre de plainte

Feuille d’activité 9-10 Évaluez vos connaissances financières, partie 2

Feuille d’activité 9-11 Établir des objectifs

Document 9-12 Ressources

Document 9-13 Glossaire

Escroqueries liées à la PCU et autres fraudes courantes durant la pandémie de COVID-19

Protégez-vous contre la fraude durant la pandémie de COVID-19

Types de fraude

Mois de la prévention de la fraude

Les régimes de retraite

Assurance-dépôts et credit unions, ARSF