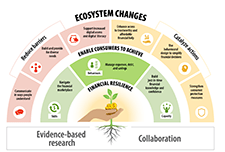

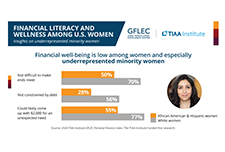

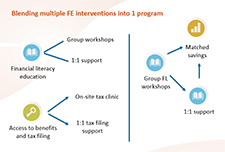

When women living on low incomes are able to access effective Financial Literacy Education (FLE) programs, they will be better positioned to fully participate in economic life, help build a stronger economy, and improve the quality of life for themselves, their families, and their communities.

This needs assessment was part of Families Canada’s 3-year project titled “Increasing financial literacy opportunities for women living on low incomes: An action plan for change.” Partners included the Canadian Credit Union Association and Vancity. Funding was generously provided by the Department for Women and Gender Equality. The project seeks to ensure organizations have the information they need to adapt their existing financial literacy initiatives and programs to better meet the needs of women living on low incomes.