Financial Literacy Month webinar final

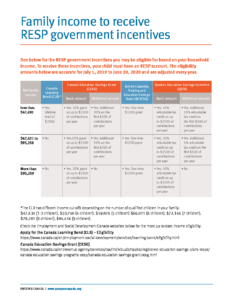

PDF of slides

Bridge to Benefits demo for Region of Durham (1)

PPT for Durham region CoP meeting

Service ON Fee Waiver program fact sheet-Birth Certificates

In B2B tool – Fee waiver program

B2B image for webinar copy

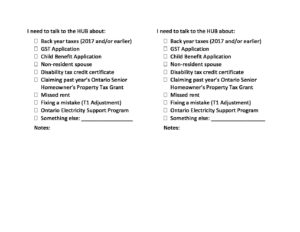

image for learning hub

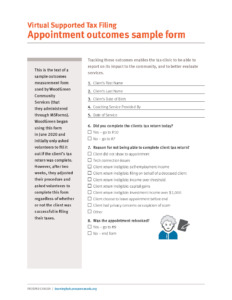

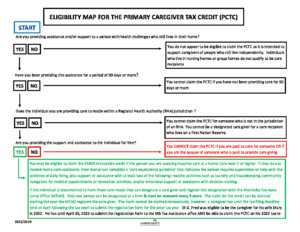

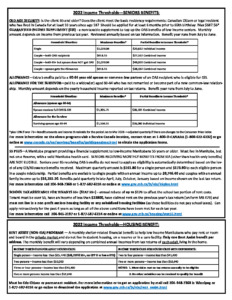

Sample MB Eligibilty Maps 22.23 CFCS

From CFCS added to Bridge to Benefits toolkit

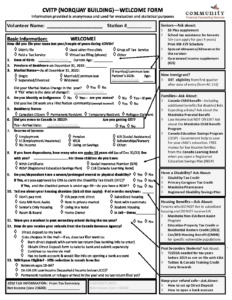

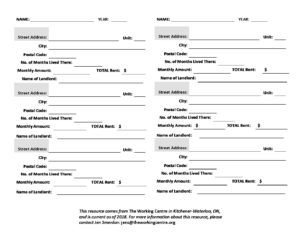

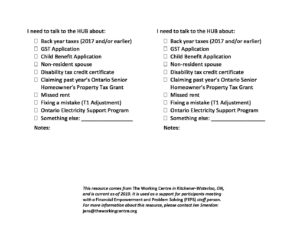

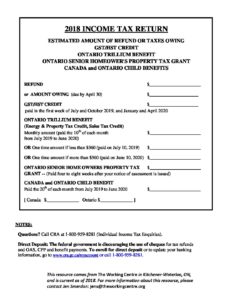

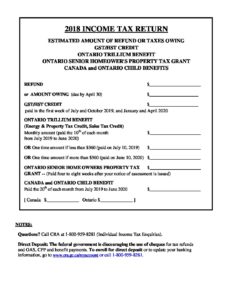

2022.23 Welcome Sheet CFCS

From CFCS -used in Bridge to Benefits toolkit

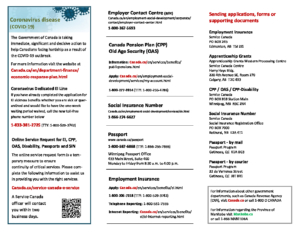

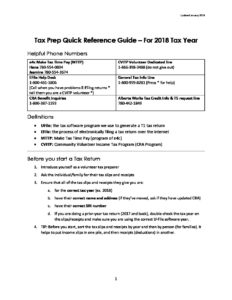

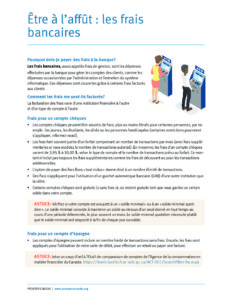

Common identification document

List of common ID required for benefits

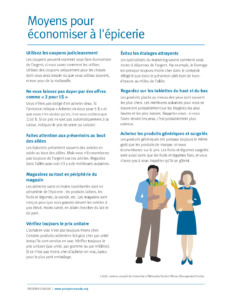

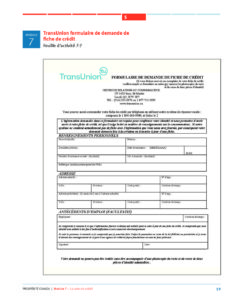

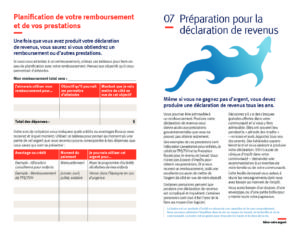

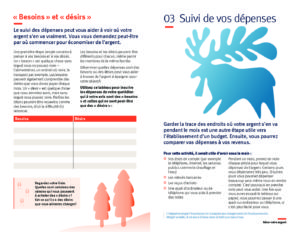

Module8_2019 FR_glossary

Used in OSC online course

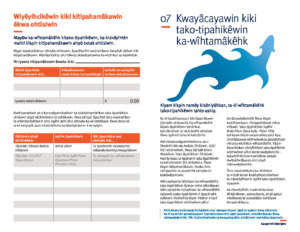

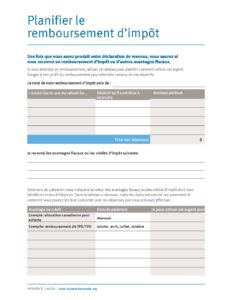

7 Habits2018 -fra-sb

French version of 7 habits of savvy spending and saving – from fin coaching but also used in OSC course

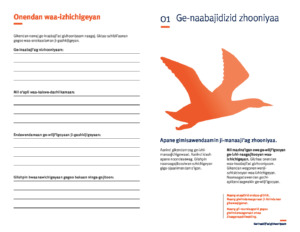

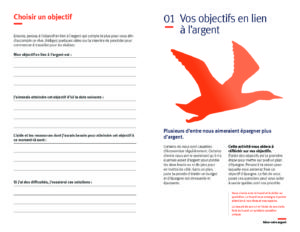

Goal Setting FR Module8_8

used for OSC online course

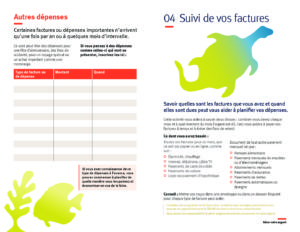

Module2_FR glossary

used for OSC online course

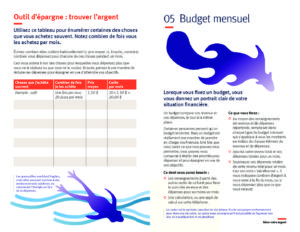

Module 5 FR glossary

used in OSC online course

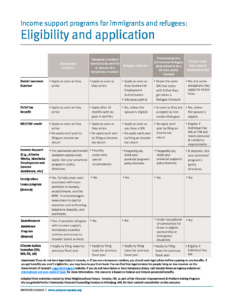

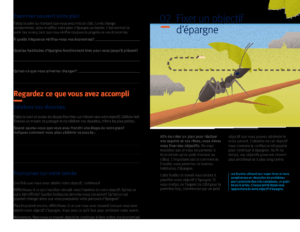

Coggle concept map

Concept map of savings tips with different coloured branches denoting some of the different types of savings strategies one can use, such as: making it automatic, buying used or second hand, and controlling impulsive spending. Examples of each saving strategy are listed using smaller branches coming from each different coloured branch.