PowerPoint, video with time stamps

Time Stamps:

Opening remarks about Prosper Canada

1:00 Land Acknowledgement & Introductions

6:43 Agenda

9:38 Your Role in supporting access to benefits

17:00 Starting conversation about money

27:45 Navigating Benefits Wayfinder

30:45 Practice

53:25 Using the Disability Benefits Compass

Powerpoint, video with time stamps

English

Introduction

Section Two: Protecting yourself

Section Three: Supporting Health and Well-being

Additional Resources

French

Introduction

Tresser la seconde mèche : se protéger

Tresser la troisième mèche : favoriser la santé et le bien-être

Tresser la troisième mèche : favoriser la santé et le bien-être

Activité 5 : Mon journal de bien-être financier

Activité 6 : Mon argent est une médecine

Activité 7 : Visualisez vos objectifs financiers

Activité 8 : Mon plan d’investissement

Activité 9 : Partagez vos rêves avec votre famille et vos amis

Ressources supplémentaires

English

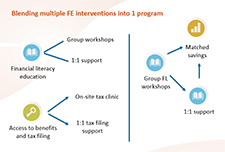

The Embedded Financial Coaching Pilot

The resources below introduce the Embedded Financial Coaching model in the context of workforce programs. They are designed to generate the interest of financial empowerment service providers and workforce programs about the promising possibilities of this model. Future phases of the toolkit will assist with initial planning and implementation stages for embedding FE into workforce programs.

- The Embedded Financial Coaching Primer gives a quick overview of the “what” and “why” of embedding financial empowerment into workforce programs

- The Integrating Financial Coaching into Employment Services Landscape Scan summarizes the literature and promising practices from the USA.

- The Literature review summarizes the promising practices to improve participant retention for multi session interventions that lead to deeper financial wellbeing outcomes (for detailed summaries refer to additional resources section).

Learn more about embedding financial empowerment

Canadian Publications

Prosperity Gateways: Cities for financial empowerment – Building the case outlines evidence for embedding FE.

US Publications

The US Department of Health and Human Services through its Office of Planning. Research and Evaluation supported MEF Associates and the Urban Institute to conduct a large-scale research project of the over 15 years of integrating financial capability and workforce programming. As part of this research project two research reports are highly relevant for attempts to replicate integrated service delivery in the Canadian context. The first report is a literature synthesis on Integrating Financial Capability into Employment Services. The second report is a summary of the approaches, motivations and types of services and participant perspectives on integrated services Understanding Financial Capability Interventions within Employment-Related Contexts for Adults with Low Incomes.

The Local Initiatives Support Corporation runs over 100 Financial Opportunity Centres across the USA. These FOCs deliver integrated financial empowerment and employment programs. A 2016 study evaluated the impacts of integrated service delivery… more recently LISC developed an Implementation Academy.

In 2015 The Administration for Children and Families, a division of the US Department of Health and Human Services, in collaboration with the Prosperity Now developed Building Financial Capability: A Planning Guide for Integrated Services. This resource is technical guide for community-based organizations that serve low- and moderate-income individuals.

Additional resources: Literature summaries

Citi Financial Capability Demonstration Project

Matched Savings Account Program Study

Financial Coaching Impact Evaluation

Pathfinders Re-Entry Mentoring Program

CFPB Financial Coaching Strategy

GreenPath Virtual Financial Coaching Pilot

Understanding Family Engagement in Home Visiting: Literature Synthesis

Study on Efficacy of Health Coaching and an Electronic Health Management Program

French

Financier intégré dans le contexte des programmes pour la main-d’œuvre

Les ressources ci-dessous présentent le modèle d’accompagnement financier intégré dans le contexte des programmes pour la main-d’œuvre. Elles ont été créées dans le cadre du projet pilote d’accompagnement financier intégré et sont destinées à susciter l’intérêt des fournisseurs de services d’autonomisation financière et des programmes d’emploi quant aux possibilités prometteuses du modèle. Les prochaines étapes de la trousse à outils contribueront à la planification initiale et aux étapes de mise en œuvre de l’intégration de l’éducation financière dans les programmes de formation de la main-d’œuvre.

- Le guide d’introduction à l’accompagnement financier intégré donne un aperçu du « quoi » et du « pourquoi » de l’intégration de l’autonomisation financière dans les programmes destinés à la main-d’œuvre.

- L’analyse documentaire sur l’intégration de l’accompagnement financier dans les programmes destinés à la main-d’œuvre présente une synthèse de la littérature et des pratiques prometteuses des États-Unis, ainsi que des connaissances acquises par les partenaires du projet d’accompagnement financier intégré.

- La revue de la littérature résume les pratiques prometteuses pour améliorer la rétention des participants dans le cadre d’interventions en plusieurs séances qui mènent à des résultats plus profonds en matière de bien-être financier.

En savoir plus sur l’intégration de l’autonomisation financière

Publications canadiennes

Sur la voie de la prospérité : les villes pour l’autonomisation financière (en anglais seulement)— Le dossier présente des données relatives à l’intégration de l’éducation financière.

Publications américaines

Le ministère de la Santé et des Services sociaux des États-Unis, par l’intermédiaire de son bureau de la planification, de la recherche et de l’évaluation a soutenu le cabinet MEF Associates et l’Urban Institute pour mener un projet de recherche de grande envergure (en anglais seulement) portant sur l’intégration des programmes de capacité financière et de main-d’œuvre sur une période de plus de 15 ans. Dans le cadre de ce projet de recherche, deux rapports de recherche sont très pertinents pour les tentatives de reproduction de la prestation de services intégrés dans le contexte canadien. Le premier rapport est une synthèse de la littérature sur l’intégration de la capacité financière dans les services d’emploi (en anglais seulement). Le deuxième rapport est un résumé des approches, des motivations et des types de services, ainsi que des points de vue des participants sur les services intégrés : Comprendre les interventions en matière de capacité financière dans les contextes liés à l’emploi pour les adultes ayant de faibles revenus (en anglais seulement).

La Local Initiatives Support Corporation (LISC) gère plus de 120 centres de ressources financières (Financial Opportunity CenterMD — FOC) à travers les États-Unis. Ces centres FOC proposent des programmes intégrés d’autonomisation financière et d’emploi depuis 2005. Une étude de 2016 a évalué les impacts de la prestation de services intégrés… La LISC a mis en œuvre un centre de ressources en ligne (en anglais seulement) pour les praticiens, qui comprend des ressources sur la prestation de services, l’accompagnement financier, leur système de gestion des clients Salesforce, ainsi que sur les opérations et l’administration. Récemment, la LISC a publié un résumé des résultats (en anglais seulement) à propos d’une académie de mise en œuvre visant à former les organismes de main-d’œuvre sur la façon d’intégrer l’accompagnement financier individuel dans leur modèle de prestation de services existant.

En 2015, l’Administration for Children and Families, une division du ministère de la Santé et des Services sociaux des États-Unis, en collaboration avec Prosperity Now, a élaboré le Guide de planification pour les services intégrés : Renforcer la capacité financière. Cette ressource est un guide technique destiné aux organismes communautaires qui s’occupent des personnes ayant de faibles revenus ou des revenus modestes.

Ressources Additionnelles : La synthèse de la littérature

Projet de démonstration de la capacité financière de Citi

L’étude portant sur le programme de compte d’épargne jumelée

L’évaluation portant sur les répercussions de l’accompagnement financier

Programme de mentorat pour la réintégration de l’organisme Pathfinders

Projet pilote d’accompagnement financier virtuel de GreenPath

L’efficacité de l’accompagnement en matière de sante et d’un programme de gestion en cyber santé

Tools and resources

Financial Education

- Dollars and sense, AFOA Canada – A suite of financial literacy workshops for Indigenous youth

- Managing your money, Prosper Canada – A series of seven worksheets to help Indigenous individuals and families to set and work towards money goals. Available in English, French, Plains Cree and Ojibwe here: Managing your Money: Tools and tips to help you meet your goals

- Financial Literacy for Indigenous Peoples, RBC – With a focus on lump sum payments this course is intended to provide knowledge about money and banking for all Indigenous Peoples .

- Financial health & wealth, NWAC – A toolkit that includes information and worksheets on financial health topics.

- Money matters, ABC Money matters – Workbooks that are tailored for Indigenous Peoples on spending plans, banking basics, borrowing money, ways to save and smart shopping.

- Money stories, SEED – A customized money management training program for Indigenous youth.

- Financial literacy workshops for Canadians living in the North, CMHC – This workshop series will cover several areas related to purchase of a house from mortgages, to pre-approvals and home buying programs.

- Money minutes, First Nations Bank of Canada – One-minute-long recordings one a range of financial topics from budgeting to creating a rainy-day fund.

- Navigating Financial Empowerment for First Nations, First Nations Market Housing Fund – This article includes links to tools and resources to plan one’s financial journey

- Financial Capability Workbooks, NWAC

- Credit podcast, AFOA Canada – A Money Smarts podcast on how to build and keep credit in good shape

- Writing your own will: A guide for First Nations People Living on Reserve – A resource from AFOA British Columbia.

- Retirement planning, First Nations Development Institute – a tip sheet on planning for retirement for First Nations in the United States.

- Building Native Communities; Financial Skills for families, Oweesta – A financial skills curriculum that will help people make informed decisions for themselves, their family and their community.

- Financial Connect: Indigenous Workbook, Bissell Centre – a basic financial services and identification (ID) for Indigenous peoples workbook

- Retirement Planning, First Nations Development Institute – an introductory guide to retirement planning

- Building Native Communities; Financial Skills for families, Oweesta – A curriculum designed to help make informed financial decisions

- A Guide to Financial Literacy: Money and Youth , CFEE – A guide for youth, parents and teachers to learn about different aspects of financial education.

- Indigenous Business Development Toolkit, Government of Ontario – This toolkit provides business development supports, tools and information to help you start and operate a successful business.

- Back to the basics of Personal Budgeting, CandoEDO – This webinar emphasizes how developing a successful Personal Finance Plan can help self, loved ones and communities reach financial capability.

- Webinar series on Financial Literacy, NADF

Tools and resources for lump sum payments

*Not Indigenous specific resource

- It’s my life – how to build your financial wellness future, AFOA Canada – Narrated PowerPoints focusing on identifying goals, developing a financial wellness plan, getting support and consumer protection

- It’s my life – am I prepared?, AFOA Canada – These workbooks help you picture your life in 2 years how would you like to spend your money.

- Sixties Scoop, It’s my life “How to build your financial wellness future!”, AFOA Canada – Understanding Sudden Wealth and planning for it.

- Receiving a large amount of money from the government, FCAC – This resource includes links to tools on money goals, budgeting, paying debt, savings goals…)*

- What to do when you get money from the government, FCAC – Options include cashing a cheque (and information around applicable fee), direct deposit and links to tools*

- Managing a financial windfall, CIRO – With a focus on consumer protection, this resource shares ways to avoid frauds and scams but also ways to identify personal financial goals*

- You’ve just received a big amount of money. Now what?, FCAC – A cheat sheet of what to consider when receiving a large amount of money.*

- How to manage Sudden Wealth in 7 steps, Smart Asset (US) – Advice and further reading on managing a large financial windfall*

- How to manage sudden wealth, Wealth Management Canada- In this article both the emotional and financial aspects of receiving a lump sum payment are discussed*

- How to deal with Sudden Wealth Syndrome and Manage Newfound Riches, Money Crashers – This article elaborates on what sudden wealth syndrome is and how to deal with it.

- Managing large amounts of sudden wealth, Investopedia (US) – Understanding the emotional toll of receiving an unexpected sum of money and how to plan for it with caution.

- Indigenous Women in Business- A best practices approach, Aboriginal Business and Community Development Centre – Best practices to assist females entrepreneurs

Tools and resources for consumer protection

*Not Indigenous specific resource

Frauds and scams:

- Protecting your money, RBC – This module from RBC’s Financial Literacy for Indigenous Peoples course covers banks and financial institutions, protecting oneself from frauds…

Elder financial abuse:

- What every older Canadian should know about financial abuse, Federal/Provincial/Territorial Ministers Responsible for Seniors Forum – This page includes information on what financial abuse is, includes some examples and tips and safeguards you may implement to protect a loved one.*

- The many faces of financial elder abuse, Ontario Securities Commission – Learn how to identify and prevent financial elder abuse, plus where to go for help if you or an older person you know is being financially exploited.*

- Financial abuse can be elder abuse, First Nations Health Authority article outlines what elder financial abuse is, how you can help an Elder who is financially abused and where to get more information.

Research, reports and guides

- Indigenous Wealth Guide, Native Governance Center (US) – Understanding Indigenous wealth will help determine how to build Indigenous wealth.

- How Indigenous communities are regaining economic independence, CPA Canada – An increase in financial knowledge is laying the groundwork for greater autonomy.

- Indigenous Sovereign Wealth: Strengthening Indigenous Trust Knowledge, National Aboriginal Trust Officers Association – This report summarizes the results of Phase 1 of the Indigenous Sovereign Wealth Project and identifies the current issues with trusts.

- Sudden wealth – A consumer guide, Financial vulnerability task force (UK) – This guide helps readers understand the unique opportunities and challenges they could face from the acquisition of sudden wealth, how to safeguard it and what to look out for when you seek financial advice.

- Banking sector services for Indigenous Peoples, CBA – Banks in Canada recognize their responsibility to foster a more inclusive and sustainable future for Indigenous individuals, businesses and communities. This webpage outlines the services Canadian banks offer Indigenous Peoples.

- Learning by Doing: Financial Education for Native American Youth Receiving Large Lump-Sum Payouts, First Nations Development Institute – This report outlines experiential workshops offered to Shoshone youth in the US and the resultant evaluation

- Promoting Financial Empowerment Through Building Native Communities- Financial Skills for families, Oweesta – This report agues that financial education curricula, uniquely adapted to the culture and needs of the intended audience is the cornerstone of effective financial education.

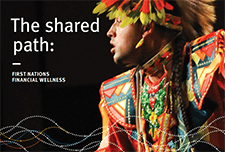

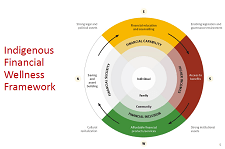

- The Shared Path: First Nations financial wellness, Prosper Canada & AFOA Canada – This report defines financial wellness in the context of First Nations Peoples and communities, reviews why it matters, provides a conceptual framework to help clarify the determinants of financial wellness, and identifies barriers, needs, best practices and principles for building the financial wellness of Indigenous individuals, families, and communities together.

- Learning by doing: Financial Education for Native American Youth receiving large Lump-Sum payments, First Nations Development Institute – A process and evaluation report for youth managing lump sum payments

Ressources et outils

Éducation financière

- Gérer votre argent: Outils et conseils pour vous aider à atteindre vos objectifs, Prospérité Canada – Une série de sept feuilles de travail pour aider les personnes et les familles autochtones à se fixer des objectifs financiers et à les atteindre. Disponible en anglais, français, cri des plaines et ojibwé.

- Littératie financière pour Autochtones, RBC – Le cours « Littératie financière pour Autochtones RBC » vous procurera les connaissances nécessaires pour prendre des décisions éclairées et pour atteindre un bien-être financier durable.

- Ateliers sur la littératie financière pour les Canadiens vivant dans le Nord, SCHL – Cette série d’ateliers couvrira plusieurs sujets liés à l’achat d’une maison, des hypothèques aux préapprobations en passant par les programmes d’achat de maisons.

- S’y retrouver dans les ressources pour l’autonomisation financière des Premières Nations, Fonds pour les habitations du marché des premières nations – Cet article contient des liens vers des outils et des ressources permettant de planifier son parcours financier.

- Boîte à outils pour le développement d’entreprises autochtones, les outils et l’information pour vous aider à démarrer et exploiter une entreprise rentable.

Outils et ressources pour les paiements forfaitaires

*Ressource qui n’est pas spécifiquement destinée aux Autochtones.

- Recevoir une grosse somme d’argent , ACFC – Cette ressource comprend des liens vers des outils sur les objectifs financiers, le budget, le remboursement des dettes, les objectifs d’épargne…*

- Que faire lorsque vous recevez de l’argent du gouvernement., ACFC – Les options comprennent l’encaissement d’un chèque (et des renseignements sur les droits applicables), le dépôt direct et des liens vers des outils.*

- Gérer une rentrée d’argent providentielle, OCRI – Cette ressource, qui met l’accent sur la protection des consommateurs, propose des moyens d’éviter les fraudes et les escroqueries, mais aussi d’identifier les objectifs financiers personnels.*

Outils et ressources pour la protection des consommateurs.

*Ressource qui n’est pas spécifiquement destinée aux Autochtones.

Les fraudes et arnaques:

- Comment gérer votre argent avec assurance, RBC – Ce module du cours Littératie financière pour Autochtones de RBC porte sur les banques et les institutions financières, la protection contre les fraudes…

Exploitation financière des personnes âgées :

- Ce que tous les Canadiens âgés devraient savoir au sujet de l’exploitation financière, Forum fédéral, provincial et territorial des ministres responsables des aînés – Cette page contient des renseignements sur ce qu’est l’exploitation financière, des exemples et des conseils, ainsi que des mesures de protection que vous pouvez mettre en œuvre pour protéger un proche.*

- Les nombreuses facettes de l’exploitation financière envers les personnes âgées, La Commission des valeurs mobilières de l’Ontario – Apprenez comment identifier et prévenir l’exploitation financière des personnes âgées, et où trouver de l’aide si vous ou une personne âgée que vous connaissez êtes victimes d’exploitation financière.*

Recherche, rapports et guides

- Des communautés autochtones regagnent leur indépendance économique, CPA Canada – De meilleures connaissances financières jettent les bases d’une plus grande autonomie.

- Services du secteur bancaire aux communautés autochtones, ABC Bancaire – Les banques du Canada reconnaissent leur responsabilité dans la promotion d’un avenir plus inclusif et durable pour les personnes, les entreprises et les communautés autochtones. Cette page Web présente les services que les banques canadiennes offrent aux Autochtones.

Resources

Handouts, videos and time stamps

Resources

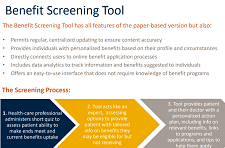

Supported tax filing (STF) model general documents

This section contains resources that describe the supported tax file model and includes sample scripts and documents relevant to both virtual and in-person supported tax filing. These documents may be customized for your own agency.

Resources specific to in-person supported tax filing

This section contains documents that have been tailored for in-person supported tax filing.

Resources specific to virtual supported tax filing

This section contains documents that have been tailored for virtual supported tax filing.

Additional resources

This section contains additional resources to support at tax time. Be sure to also review our Tax filing toolkit and Financial Coaching toolkit for other relevant resources.

Sample client profiles (WoodGreen)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Encouraging tax filing at virtual clinics

Resources

Handouts, videos and time stamps

Video and time stamps

1:59 – Welcome and introduction

7:55 – Warm up poll

10:06 – Access to benefits project overview and barriers to access

19:46 – Live demo of the Disability Benefits Compass tool

24:20 – Evaluation: what is it and project outcomes and learnings

40:48 – What’s next? What is possible? Call to action!

52:18 – Activity: Poll

54:26 – Questions and Wrap-up

Resources

Handouts, video and time stamps

Read the presentation slides for this webinar.

Time stamps for the video:

Welcome and introductions

2:52 – Goals for webinar

4:39 – Context: Benefits Wayfinder and Disability Benefits Navigator

10:46 – Intro to the Bridge to Benefits tool

19:31 – Development process

24:10 – Demo – Walkthrough of the features

40:17 – Evaluation

44:12 – How to share this tool with others/Other resources

49:12 – Questions and feedback

Resources and Tools

Managing the cost of goods and paying bills

Budgeting resources

Five different budgeting methods – Prosper Canada

Cash flow budget template – PDF – Prosper Canada

Cash flow budget template – fillable PDF – Prosper Canada

Simple budget template – PDF – Prosper Canada

Simple budget template – fillable PDF – Prosper Canada

Ten ways to trim expenses – Prosper Canada

Ways to save at the grocery store – Prosper Canada

5 budgeting app ideas – Prosper Canada

Tracking spending/bills

Expenses tracking sheet – PDF – Prosper Canada

Expenses tracking sheet – fillable PDF – Prosper Canada

Tracking fluctuating expenses – Prosper Canada

Prioritizing Bills tool – Consumer Financial Protection Bureau (CFPB)

Spending tracker tool – CFPB

Cutting expenses tool – CFPB

Online budgeting tools

Budget Planner (free) – Financial Consumer Agency of Canada (FCAC)

Budget Calculator Spreadsheet (downloadable Excel sheet) – MyMoneyCoach.ca

Spending Habits Calculator – GetSmarterAboutMoney.ca

Personal Budgeting Course (no cost) – Momentum

Pro bono support

Financial planning – Financial Planning Association of Canada (FPAC)

Debt

Action planning

Steps to debt repayment – Prosper Canada

Determining debt payoff order – Prosper Canada

Dealing with debt– Prosper Canada

Making a plan to be debt free– Government of Canada

The 4 cornerstones of debt reduction strategies & budgeting– Credit Counselling Society

Getting out of debt– Credit Counselling Society

Information for consumers on the insolvency process– Office of the Superintendent of Bankruptcy (available in multiple languages)

More resources

Options you can trust to help with your debt – Office of the Superintendent of Bankruptcy

1:1 debt counselling – Credit Counselling Canada

Sample letters to creditors – Credit Counselling Society

Ways to build or rebuild credit and manage debt course (no cost) – Momentum

How to improve your credit score: proven steps to success – Credit Canada

Housing and homelessness

Listing of agencies across Canada that may be able to help – The Canadian Alliance to End Homelessness

211 – United Way Canada

Subsidized housing in ON – Ontario Non-profit Housing Association

Benefits for housing

Housing benefits – Government of Canada

Benefits wayfinder – Prosper Canada

Factsheet: Housing insecure individuals – Government of Canada

Resources for renters

Your rights when being evicted for renovations – Community Legal Education Ontario (CLEO)

Resources for renters facing eviction – Centre for Equality Rights in Accommodation

Moving checklist – Community Legal Education Ontario (CLEO)

Ontario Renters’ guide – Community Legal Education Ontario (CLEO)

How to negotiate a repayment plan with your landlord – Community Legal Education Ontario (CLEO)

Know your rights: eviction prevention – Canadian Centre for Housing Rights

Know your rights: rental housing basics – Canadian Centre for Housing Rights

Know your rights: record keeping for tenants – Canadian Centre for Housing Rights

Rent-Geared-to-Income Subsidy – City of Toronto

An infographic that explains when rent increases are legal – CLEO

A guide that explains when landlords can apply for an above guideline rent increase (AGI), how to prepare for a hearing to fight an AGI, and what happens after the hearing – CLEO

Human Rights and Rental Housing in Ontario: A Self-Advocacy Toolkit – Canadian Centre for Housing Rights

Resources for specific groups

Housing options for seniors – Government of Canada

Toolkit for medical professionals in ON writing disability accommodation letters – Canadian Centre for Housing Rights

Friendship Centres for Indigenous people – National Association of Friendship Centres

Support services for victims of abuse – New Brunswick Government

Housing for youth – 360º (York Region)

Support for young mothers– Albion Centre (Toronto)

Newcomer Information Centre Online– Achēv

Paying your mortgage when experiencing financial difficulties– FCAC

Shelters

Housing and shelters – Salvation Army (Canada)

Disaster relief help – Canadian Red Cross (Canada)

Emergency and short-term housing in Ontario – Ontario Council of Agencies Serving Immigrants (Ontario)

For women facing domestic abuse – Shelter Safe (Canada)

Survivors of domestic violence – CAMH (Toronto)

Shelters – CAMH (Toronto)

Shelters for youth – Rest Centres (Peel Region)

Food insecurity

Access to food

Find a food bank – Food Banks Canada

Regional food banks – Website Planet

Meals on wheels – Ontario Community Support Association

211 – United Way Canada

Drop-in meal resource list for Toronto – Toronto Drop-in Network

Food exchange – Quest Vancouver

Good food organizations – Community Food Centres Canada

Akwe:go – Wasa-Nabin Student Nutrition Program – Ontario Federation of Indigenous Friendship Centres

Friendship Centres for Indigenous people – Ontario Federation of Indigenous Friendship Centres

Understanding food insecurity

Tool for older adults: rate your eating habits! – Older Adult Nutrition Screening

Poverty Screening (Food Insecurity) – Canadian Nutrition Society

Ressources et outils

Gérer le coût des biens et les dépenses

Ressources pour établir un budget

5 façons différentes de faire un budget – Prospérité Canada

Budget de caisse – Prospérité Canada

Modèle de budget simple – Prospérité Canada

10 façons de réduire ses dépenses – Prospérité Canada

Moyens pour économiser à l’épicerie – Prospérité Canada

Suivre les dépenses/le paiement des factures

Fichier de suivi des dépenses – Prospérité Canada

Suivi des dépenses variables – Prospérité Canada

Outils d’établissement de budget en ligne

Planificateur budgétaire – Agence de la consommation en matière financière du Canada (ACFC)

Budget mensuel – Commission des valeurs mobilières de l’Ontario

Calculateur des Habitudes de Consommation – GerezMieuxVotreArgent.ca

Vidéos d’apprentissage en ligne — Notions de base sur les finances – Agence de la consommation en matière financière du Canada (ACFC)

Consultation budgétaire – Espace Finances

Dette

Planification des mesures

Les étapes pour rembourser des dettes– Prospérité Canada

Une dette envers qui? – Prospérité Canada

Gestion de la dette : Livret complet– Prospérité Canada

Faire un plan pour gérer vos dettes– Gouvernement du Canada

Croulez-vous sous les dettes? Information sur la procédure d’insolvabilité à l’intention des consommateurs– Bureau du surintendant des faillites

Autres ressources

Des options fiables pour vous aider avec vos dettes – Bureau du surintendant des faillites

Conseil en crédit – Conseil en crédit du Canada

Exemples de lettres aux créanciers – Conseil en crédit du Canada (disponible seulement en anglais)

Emprunter de l’argent- cours (gratuit) – Plateforme de compétences ABC

Qu’est-ce qu’un pointage de crédit?– TransUnion

Associations de consommateurs de Québec – toutbiencalcule.ca

Logement et itinérance

Recherche d’aide – Alliance canadienne pour mettre fin à l’itinérance

211 – Centreaide United Way

Logement subventionné en Ontario – Association du logement sans but lucratif de l’Ontario (disponible seulement en anglais)

Prestations pour le logement

Prestations relatives au logement – Gouvernement du Canada

Orienteur en mesures d’aide – Prospérité Canada

Personnes en situation de logement précaire – Gouvernement du Canada

Accès au logement – Centre Francophone du Grand Toronto

Répertoire des ressources en hébergement communcautaire et en logement social avec soutien communautaire, Réseau d’aide aux personnes seules et itinérantes de Montréal

Ressources pour les locataires

Être expulsé de son logement en raison de rénovations – Éducation juridique communautaire Ontario

Comment s’opposer à une expulsion – Éducation juridique communautaire Ontario

Louer un logement – Éducation juridique communautaire Ontario

Comment négocier un plan de remboursement avec votre locateur – Centre ontarien de défense des droits des locataires

Votre propriétaire veut-il que vous déménagiez? – Éducation juridique communautaire Ontario

Droit du logement (vidéos) – Éducation juridique communautaire Ontario

Entretien et réparations – Éducation juridique communautaire Ontario

Déménager : Donner un préavis – Éducation juridique communautaire Ontario

Logements à loyer indexés sur le revenu – Ville de Toronto

Les comités logement et associations de locataires du Québec – Regroupement des comités logement et associations de locataires du Québec (RCLALQ) Comités logement – Le Front d’action populaire en réaménagement urbain (FRAPRU)

Ressources pour des groupes particuliers

Coût des résidences pour les aînés – Gouvernement du Canada

Trousse d’outils pour les professionnels de la santé sur la rédaction de lettres concernant des mesures d’adaptation pour une personne en situation de handicap – Centre canadien pour le droit au logement (disponible seulement en anglais)

Association nationale des centres d’amitié – L’Association nationale des centres d’amitié

Services de soutien pour les victimes de violence – Gouvernement du Nouveau-Brunswick

Logement pour les jeunes – 360º (Région de York)

Soutien aux jeunes mères– Centre Albion (Toronto)

Maison d’amitié– Maison d’amitié (Ottawa)

Payer votre hypothèque lorsque vous éprouvez des difficultés financières– ACFC

Refuges

Services d’hébergement – l’Armée du Salut (Canada)

Aide aux personnes sinistrées – La Croix-Rouge canadienne (Canada)

Logement d’urgence et à court terme en Ontario – Ontario Council of Agencies Serving Immigrants (disponible seulement en anglais)

Pour les femmes victimes de violence – Hebergementfemmes.ca (Canada)

Survivants de violence familiale – Centre de toxicomanie et de santé mentale, Toronto (disponible seulement en anglais)

Insécurité alimentaire

Accès à la nourriture

Trouver une banque alimentaire – Banques alimentaires de Canada

La Popote roulante – Croix-Rouge canadienne

211 – Centraide United Way

Organisations pour la bonne nourriture – Centres communautaires d’alimentation du Canada

Banques alimentaires – Banques alimentaires de Québec

Dépannage alimentaire – Macommunaute.ca

Comprendre l’insécurité alimentaire

Évaluez vos habitudes alimentaires ! – Vérification de l’alimentation des adultes plus âgés

Dépistage de la pauvreté (insécurité alimentaire) – Société canadienne de nutrition

Resources

Reports, presentation slides and video time stamps

Read the presentation slides for this webinar.

Download the executive summary.

Time stamps for the video:

0.38 – Welcome and housekeeping

5:59 – Canada’s financial help gap overview

35:35 – Panel discussion

1:20 – Q&A

Resources

Presentation slides and video time stamps

View the Making the most of your money course.

View the Investing with interest booklet.

Read the presentation slides for this webinar.

Time stamps for the video:

0:50 – Welcome, introductions, and warm-up

3:10 – Making the most of your money overview

12:57 – Demo

25:26 – Investing with interest overview

40:00 – Other resources

44:04 – Q&A

Resources

Handouts, slides and video time stamps

Read the presentation slides for this webinar.

Download the promotional postcard.

Download the promotional poster.

Time-stamps for the video recording:

1:26 – Welcome and introductions

3:30 – Our goals for today’s session

5:04 – Why these tools were created

7:12 – The Benefits Wayfinder and the Disability Benefits Compass

46:11 – Ways to use the Benefits Wayfinder – tax clinics

49:37 – Access to Benefits training available

Missing for those who need it most: Canada’s financial help gap

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable, appropriate and trustworthy financial help for people with low incomes is a critical but missing piece in Canada's financial services landscape. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere to a budget, set and pursue saving goals, file their taxes outside of tax season, and access income benefits. Executive summary: Canada's financial help gap L’aide qui manque pour ceux qui en ont le plus besoin Sommaire Exécutif: L’écart en matière d’aide financière au Canada

English

Soaring with savings - Tips and tools to help you save

SWS Worksheet #1 – The importance of saving (Fillable PDF)

SWS Worksheet #2 – Create a savings goal (Fillable PDF)

SWS Worksheet #3 – Savings support network (Fillable PDF)

SWS Worksheet #4 – Saving for emergencies (Fillable PDF)

SWS Worksheet #5 – Saving for unstable income (Fillable PDF)

SWS Worksheet #6 – Saving for education (Fillable PDF)

SWS Worksheet #7 – Saving for retirement (Fillable PDF)

Soaring with Savings- Full booklet

Soaring with savings - Training tools

French

Encourager l’épargne - Conseils et outils pour vous aider à épargner

Encourager l’épargne - l’aide d’animation

Ressources

CELI calculatrice, La Commission des valeurs mobilières de l’Ontario

REER, La Commission des valeurs mobilières de l’Ontario

Épargnez plus facilement, CVMO

Investir et épargner pendant une récession, La Commission des valeurs mobilières de l’Ontario

English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

Navigating Finances: Paying Down Debt vs. Investing, CIRO

Loan and Trust, FSRA

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

English

Investing with interest: tips and tools for maximizing your savings

IWI – Worksheet #1: What do you want to save for?

IWI – Worksheet #2: Tracking your income and expenses

IWI- Worksheet #3: Are you ready to invest?

IWI- Worksheet #4: What can you invest in?

IWI-Worksheet #5: Where can you get advice?

IWI-Worksheet #6: Watch out for investment frauds and scams

IWI-Worksheet #7: Tips for success

Resources

Crypto Quiz, OSC

Grandparent scams and how to avoid them, OSC

Compound interest calculator, OSC

Emergency fund calculator, OSC

Tips to keep your credit card safe, OSC

Investment products, OSC

Types of fraud, OSC

Multilingual financial resources for Ontarians, OSC

Pay down debt or invest tool, OSC

Reporting fraud, OSC

Introduction to investing, OSC

Scam spotter tool, OSC

Your trusted person and why they matter, OSC

Getting Your Money Back; An Investor’s Guide to Navigating Canada’s Complaint System, FAIR Canada

Study explores Canadian attitudes about Crypto, OSC

How the stock market works, OSC

The basics of personal finance, Credit Canada

What is risk tolerance in investing, OSC

Eight common investment scams and how to spot them, OSC

4 signs of investment fraud, OSC

Evolution of the fraud pitch , Canadian Anti Fraud Centre

Saving or investing for short-term goals, OSC

Investor questionnaire, CIRO

Fees matter, MFDA

Fee calculator, OSC

Annual information about your investment fees, OSC

Investing basics, CIRO

The many faces of elder abuse, OSC

How to Read Your Account Statement and the Things to Focus on, CIRO

Long-haul scammers: Fraudsters who invest time to take your money, OSC

Cybersecurity and Fraud, CIRO

Investor’s guide: cryptocurrencies, CIRO

Artificial intelligence and investor behaviour, OSC

Loan and Trust, FSRA

Fighting Fraud 101: Smart tips for investors, First Nations Development Institute

Financial Planners and Financial Advisors, FSRA

Glossary of common investing terms, CIRO

Invest smart: Taxes and investing, CIRO

Investing charts, OSC

French

L’intérêt d’investir: Conseils et outils pour maximiser votre épargne

Ressources

Questionnaire sur les cryptoactifs, Commission des valeurs mobilières de l’Ontario

Les arnaques des grands-parents et comment les éviter, Commission des valeurs mobilières de l’Ontario

Calculatrice épargne REER, Commission des valeurs mobilières de l’Ontario

Calculatrice intérêts composés, Commission des valeurs mobilières de l’Ontario

Calculatrice fonds d’urgence, Commission des valeurs mobilières de l’Ontario

Astuces pour garder votre carte de crédit en toute sécurité, Commission des valeurs mobilières de l’Ontario

Produits d’investissement, Commission des valeurs mobilières de l’Ontario

Types de fraude, Commission des valeurs mobilières de l’Ontario

Ressources financières multilingues pour les Ontariennes et les Ontariens, Commission des valeurs mobilières de l’Ontario

Calculatrice rembourser des dettes ou investir, Commission des valeurs mobilières de l’Ontario

Signaler une escroquerie, Commission des valeurs mobilières de l’Ontario

Planification de la retraite, Commission des valeurs mobilières de l’Ontario

Questionnaire préparation des investisseurs, Commission des valeurs mobilières de l’Ontario

Introduction au placement, Commission des valeurs mobilières de l’Ontario

Outil détecteur d’escroquerie, Commission des valeurs mobilières de l’Ontario

Votre personne de confiance et les raisons qui expliquent son importance, Commission des valeurs mobilières de l’Ontario

Une étude explore les attitudes des Canadiens à l’égard de la cryptomonnaie, Commission des valeurs mobilières de l’Ontario

Le fonctionnement de la bourse, Commission des valeurs mobilières de l’Ontario

Académie d’investissement, Commission des valeurs mobilières de l’Ontario

Quelle est votre tolérance au risque en matière d’investissement? CVMO

Huit escroqueries courantes en matière d’investissement et comment les repérer, CVMO

Quatre signes de fraude liée aux placements, CVMO

Bulletin : Évolution des types de fraudes, Centre centreantifraude du Canada

Épargner ou investir pour réaliser des objectifs à court terme, CVMO

Questionnaire de l’investisseur, OCRI

Calculateur de frais, CVMO

Information annuelle sur vos frais de placement, CVMO

Principes de base en matière de placement, OCRI

Choisir un conseiller, OCRI

Les nobreuses facettes de l’exploitation financière envers les personnes âgées, CVMO

Comment lire votre relevé de compte et les éléments particuliers qu’il contient, OCRI

La cybersécurité et la fraude, OCRI

Intelligence artificielle et comportement des investisseurs, CVMO

Planificateurs financiers et conseillers financiers, ARSF

Glossaire des placements, OCRI

Investir judicieusement : les impôts et les placements, OCRI

Resources

Presentation slides and video time stamps

Read the presentation slides for this webinar.

Time stamps for the video recording:

-

- 5:20 – Start

- 6:12 – Land acknowledgement

- 7:24 – Introduction of speakers

- 9:42 – Today’s presentation

- 10:45 – Barriers to access to benefits

- 15:12 – Designing for benefit accessibility

- 21:53 – ESDC pilot project

- 32:46 –Demo of the disability benefit compass

- 44:36 – Importance of evaluation

- 50:58 – What’s next? What’s possible?

- 58:55 – Questions

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the Overview of Financial vulnerability of Low-Income Canadians: A Rising Tide

Time-stamps for the video recording:

00:00 – Start

6:05 – Agenda and Introductions

8:24 – Overview of Financial vulnerability, of low-income Canadians: A rising tide (Speaker: Eloise Duncan)

25:40 – Panel discussion: how increasing financial vulnerability is playing out in community and how policy makers should respond.

45:35 – Q&A

Resources

Presentation slides, handouts, and video time stamps

Read the presentation slides for this webinar.

Download resources provided by webinar speakers:

Time-stamps for the video recording:

3:24 – Agenda and Introductions

6:36 – Audience poll questions

9:33 – FAIR Canada presentation (speaker: Tasmin Waley)

24:07 – Ontario Securities Commission presentation (speaker: Christine Allum)

39:10 – Investor Protection Clinic at Osgoode Hall Law School (speaker: Brigitte Catellier)

51:34 – Q&A

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the handout for this webinar: Flyer for ‘Redefining Financial Vulnerability in Canada: The Embedded Experience of Households’.

Time-stamps for the video recording:

3:31 – Agenda and Introductions

7:15 – Redefining financial vulnerability in Canada (speaker: Jerry Buckland and Brenda Spotton Visano)

24:33 – Audience poll question 1

27:07– Audience poll questions 2 & 3

33:57 – Audience poll question 4

38:00 – Financial Empowerment (Speaker: Margaret Yu)

52:15– Q&A

Resources

Financial education

*Resource is not specific to Indigenous communities

Money Management:

Dollars and Sense Program– AFOA Canada

Financial workshops for youth

Managing your money – Prosper Canada

Worksheets to set and work towards money goals

Financial literacy for Indigenous Peoples – RBC

A two-hour course on financial basics

Financial health & wealth – Native Women’s Association of Canada

Financial literacy information and worksheets

Money Matters for Indigenous Peoples – ABC Literacy

Money Matters workbooks

Money moccasins – Momentum

Workshops for Indigenous peoples on assets, budgets, banking, credit and consumerism.

Money stories– SEED Winnipeg

Customized money management training program for Indigenous youth

Empower U– Esquao Institute for the Advancement of Aboriginal Women

Financial literacy program

The Game Plan – Indigenous Story Studio

Comic book on financial literacy (paid resource)

Financial Education Online*– Credit Counselling Society

Short online courses

Dollars and Sense* – Texas A&M (USA)

Online simulation for Middle and High School Students

Simple budget template* – Prosper Canada

Student budget worksheet* – FCAC

Gift planning worksheet*- Sudbury Community Service Centre

Budget planner* – Government of Canada

Building Native communities – First Nations Development Institute

Financial health & wealth: an initiative by the Native Women’s Association of Canada

Financial capability workbook 1 for Indigenous women (goal setting, mindset and savings)- NWAC

Financial capability workbook 2 for Indigenous women (income, expenses and budgets)- NWAC

Financial capability workbook 3 for Indigenous women (banking and credit)- NWAC

Debt/Credit:

Credit– AFOA Canada

A Money Smarts podcast on how to build and keep credit in good shape

Proper use of credit* – Sudbury Community Service Centre

Tips on how to build good strong credit

Collection Agencies and You*- Sudbury Community Service Centre

Tips on your rights if contacted by a collection agency

Credit report request form* – Sudbury Community Service Centre

Equifax and TransUnion request forms

Credit report sample*– FCAC

Dangers of credit* – Sudbury Community Service Centre

The dangers of the different forms of credit available

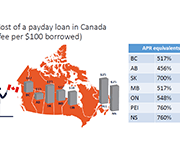

Payday loans and you* – Sudbury Community Service Centre

Understanding how pay day loans work

Debt consolidation calculator * – Ontario Securities Commission

Combine multiple debts into one and calculate how soon you could be debt free

The 4 cornerstones of debt reduction strategies & budgeting* – Credit Counselling Society

Retirement:

Low-income retirement planning* Open Policy

A background paper on maximizing GIS

Taxes and benefits

*Resource is not specific to Indigenous communities

**Tax and benefits information changes on a regular basis, we encourage you to check the CRA website for up to date information.

Tax filing:

Roundtable on Income Tax Filing Supports in First Nation communities and Indigenous organizations (presentation) – Prosper Canada & AFOA Canada

Insights on planning free tax clinics in Indigenous communities – Prosper Canada

Podcast: Host a Free Tax Clinic – AFOA Canada

How to host a tax clinic (manual) – AFOA Canada

Tax packages*– CRA

Indigenous income tax issues– CRA

COVID-19 benefits, your return and repayments– CRA

Get free tax help– CRA

Understanding Indigenous Experience with Tax Filing (2022)– CRA

Taxes and benefits for Indigenous Peoples– CRA

Benefits:

Benefits wayfinder*– Prosper Canada

Canada Learning Bond* – MySmartFUTURE, AFOA Canada

Canada Learning Bond*– Government of Canada

Podcast: Tax filing and accessing financial benefits – AFOA Canada

Webinar for Indigenous peoples: Get your benefits and credits – CRA

Canada Dental Benefit – CRA

One-time top-up to the Canada Housing Benefit– CRA

Working from home: Income tax exemption – CRA

Simplified northern residents travel deduction– CRA

Benefits and credits: Information for Indigenous peoples– CRA

Taxes and benefits:

Taxes and benefits for Indigenous peoples – CRA

Let us help you get your benefits! – CRA

Factsheet: Indigenous peoples – CRA (available in 16 languages)

Financial Connect: Indigenous workbook – Bissell Centre, e4c, Institute for the advancement of Aboriginal Women

Relevant reading & viewing

*Resource is not specific to Indigenous communities

Money Smarts -AFOA Canada

podcast series

The shared path- First Nations Financial Wellness– Prosper Canada & AFOA Canada

Financial empowerment: Personal finance for Indigenous and non-Indigenous People – Bettina Schneider

Adaptation of openly licensed textbook Person Finance v 1.0 by Saylor Academy

Report on financial health and wealth from the Native Women’s Association of Canada

Housing in First Nations Communities from the Auditor General of Canada

Access to ID:

Access to Identification for Low-Income Manitobans* – Canadian Centre for Policy Alternatives, MB

Research on what can be done to address challenges around ID

Eyeing the ID: Bio-metric Banking for Saint John* – NB Social Pediatrics and the Saint John Community Loan Fund

Identifies access to identification, as well as stringent identification requirements as the most prevalent barriers to receiving services

2022 Budget submission

Prosper Canada has submitted a budget to highlight that a plan is needed to ensure that vulnerable people are not made to repay unmanageable CERB/CRB debts, to pay back the income people lost when their refundable tax benefits were clawed back because of CERB, and to guarantee that CRB and CWLB are not clawed back from refundable tax credit payments in the 2021 and 2022 tax years.

English

For frontline staff - Quick tools you can use with clients

Starting the conversation

Here are 7 questions to help you start a conversation about money with your client. Based on what you learn about your clients’ needs, the remaining links on this page to help you find answers and next steps.

Try this coaching readiness checklist to help your client ascertain if they have the time and are interested in receiving financial coaching.

Worksheets & tip sheets

Here are some “go to” worksheets and tip sheets that frontline staff have found very helpful with their clients. They focus on budgeting, saving, and debt management – common FE needs that come up. Try them out for yourself first and see which ones might work for your clients.

The Budget Spreadsheet is an excellent tool for capturing the full picture of an individual’s financial picture. The individual inputs information according to different categories and the tool calculates totals in a summary page to show how much money is left over at the end of the month. [Thunder Bay Counselling]

The Simple budget template is an alternative monthly budget tool clients can use. It includes links to an Income tracking worksheet and Expenses tracking worksheet. [Prosper Canada / Trove]

The Urgent vs Important worksheet can help clients prioritize their spending. This, in turn, can help them save or “find money” for necessary expenses. [Prosper Canada / Trove]

Knowing how to set a SMART goal is important for planning and achieving targets. In the Set a SMART financial goal, clients learn what a SMART goal is and write SMART financial goals that are important to them. [Prosper Canada / Trove]

Making a spending plan is a worksheet clients can use to create a spending plan for each week based on money coming in and out each month. [Prosper Canada / Trove]

Making a debt action plan is a worksheet to help your clients get a handle on their debt. [Prosper Canada / Trove]

Tips for Managing Debt and Bills is a reference sheet you can give clients during tough times when managing cash flow is a challenge.

Prioritizing bills helps clients prioritize what bills to pay when it’s not possible to pay for everything. Note that this tool is from the Consumer Financial Protection Bureau (CFPB), an American government agency and includes a link to their website. Let clients know the information on the website is geared to the US context. [Consumer Financial Protection Bureau]

Online sites and tools

Here are great online tools you can also share and use in your FE work with clients.

Benefits wayfinder [benefitswayfinder.org]

Support with access to benefits is another powerful FE intervention. The Benefits wayfinder is a simple, easy to use, plain language tool that helps people on low and modest incomes find and track benefits they could get. Clients can use it on their own or with your support.

Read the Benefits wayfinder fact sheet to learn more.

Then watch the How to use this tool video. It highlights and demonstrates how to navigate through the key features of the tool.

If you would like additional training on how to support your clients with access to benefits and use the Benefits wayfinder tool in your money conversations, you can sign up for Prosper Canada’s self-directed online course and/or live workshop.

Trove [yourtrove.org]

Trove is a free bilingual website that clients can visit on their own or with your support. Many of the tools you were introduced to above can be found on Trove, along with a wealth of other user-friendly financial tools, worksheets, and education information to help clients take charge of their spending, learn about tax filing and benefits, and manage debt.

Along with a link to the Benefits wayfinder, you can also find these online tools:

- My money in Canada is a website that can help clients build healthy money habits with simple, easy to use learning modules on a range of money topics. The site also includes videos and a financial wellness checklist for clients.

- The RDSP Calculator for Canadians can be used to assess the potential of opening and contributing to a Registered Disability Savings Plan.

For managers - Tools for getting started with financial empowerment

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Tool 1. Making the case for financial empowerment

For FE to be successful, it’s critical to get buy-in from staff and stakeholders.

Below are great resources to share with key players who are new to FE. They can help you get others quickly up to speed on what FE is and the value of embedding FE as you onboard them or work to build interest in FE in your municipality.

- Prosperity Gateways Primer gives a quick overview of the “what” and “why” of embedding FE into municipal services.

- FE Brochure provides a more detailed introduction to FE and embedding FE.

- Here are three case examples you can use to show the powerful impact embedding FE into municipal services can have:

- Case example: York region

- Case example: TESS

- Case example: Edmonton

Tool 2. Getting started: the internal scan

Take the time to learn about common FE interventions. Then, assess conditions, capacity and considerations in your municipality for providing these kinds of financial help to your clients.

This tool guides you through an internal scan as you envision what embedding FE might look like in your service delivery context. Consider Tool 2: Getting started: the internal scan a starting point that will continue to evolve as you move through the process.

Tool 3. Exploring partnerships: the external scan

Municipalities do not have to deliver FE supports themselves to turn their services into Prosperity Gateways. In many cases, especially at the outset, it may be more cost-effective and less resource intensive to establish referral pathways to other local service providers or to partner with non-profit organizations, foundations, or financial service providers to deliver the financial help to meet your clients’ needs.

Use Tool 3: Exploring collaborations and partnerships to perform a scan of FE services in your local community and identify potential collaborations and partnerships.

Two additional partnership resources are ‘Elements of Integration‘ and ‘Partnership Tip Sheet‘

Tool 4. Designing the initiative: the service blueprint

Having completed an internal and external scan of barriers and opportunities, you are now ready to design an FE initiative to suit your municipality’s context. Designing the initiative is an important phase where you work out the service model, clarify partnerships, and imagine the ideal client experience.

Tool 4: Designing the initiative guides you through choosing the best service delivery model for your context and designing the client and staff journey.

We hope this toolkit will grow and improve with use and feedback. Current ideas for upcoming tools include:

- Understanding your clients’ financial capability

- Building a successful team

- Supporting staff for success

- Setting up effective data collection and evaluation processes

Tool 5. Designing the initiative: a shadowing guide

Tool 5: A shadowing guide can help frontline staff understand the process from intake to service delivery.

Feedback / Suggestions

We’d love to hear your feedback and suggestions for tools that you would find useful. Please email: [email protected].

Learn more about FE

Canadian Publications

Prosperity Gateways: Cities for financial empowerment – Building the case outlines evidence for embedding FE.

Read the report How financial empowerment services are helping Ontarians build financial health for more supporting evidence and personal stories.

Financial Empowerment – What is it and how it helps reduce poverty [national] suggests that FE is a critical missing piece of federal government policy that can significantly boost client outcomes when it is embedded into other programs and services.

Financial Empowerment – What is it and how it helps reduce poverty [Alberta] provides an overview of provincial government action on FE in Alberta. The Alberta government adapted the national document (by the same name) to use in their internal discussions with municipal decision-makers. Create a document that you can use for your internal discussions using this as an example.

U.S. Publications

The municipal integration of FE in Canada is grounded in influential work in the US by the Cities for Financial Empowerment (CFE) Fund. Launched in 2012 in New York the CFE Fund showed that embedding FE strategies into local government infrastructure can have a “supervitamin effect” on public programs, increasing the financial stability of low to moderate income households.

- Read the pioneering article: “Municipal Financial Empowerment: A Supervitamin for Public Programs”

- Learn more about their Financial Empowerment Centers model in this 4-minute video

- Visit their website to see resources and sign up for their quarterly newsletter

- See a three-year evaluation of the model in 5 cities across the US. “An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service”

The Urban Institute examined the cost of residents’ financial insecurity to city budgets in 10 American cities in this 2017 research. Across these cities, the costs range from the tens to hundreds of millions of dollars, suggesting that cities have an economic interest in improving their residents’ financial health.

A report by JP Morgan Chase reviews municipal efforts to integrate financial capability into public services in several US locations in “A Scan of Municipal Financial Capability Efforts.”

French

Pour le personnel de première ligne — Outils rapides que vous pouvez utiliser avec les clients

Amorcer la conversation

Voici sept questions qui vous aideront à entamer une conversation à propos de l’argent avec votre client. En fonction de ce que vous avez appris sur les besoins de vos clients, les autres liens de cette page vous aideront à trouver des réponses et à connaître les prochaines étapes.

Utilisez cette liste de vérification pour aider votre client à décider s’il a le temps et s’il souhaite recevoir un accompagnement financier.

Fiches de travail et fiches de conseils

Voici quelques feuilles de travail et des feuilles de conseils que le personnel de première ligne a trouvé très utiles pour ses clients. Elles portent principalement sur la planification budgétaire, l’épargne et la gestion des dettes — les besoins courants en matière d’AF qui se présentent. Essayez-les d’abord pour vous-même et voyez ceux qui pourraient convenir à vos clients.

La feuille de calcul du budget (anglais seulement) est un excellent outil pour saisir le portrait complet de la situation financière d’un individu. La personne saisit les données selon différentes catégories et l’outil calcule les totaux dans une page de synthèse pour montrer combien d’argent il reste à la fin du mois. [Thunder Bay Counselling]

Le modèle de budget simple est un outil alternatif de budget mensuel que les clients peuvent utiliser. Il comprend des liens vers une feuille de calcul de suivi des revenus et une feuille de calcul de suivi des dépenses. [Prospérité Canada/Trove]

La feuille de calcul Urgent versus Important peut aider les clients à établir des priorités dans leurs dépenses. Cela peut ensuite les aider à économiser ou à « trouver de l’argent » pour les dépenses nécessaires. [Prospérité Canada/Trove]

Il est important de savoir comment établir un objectif INTELLIGENT pour mettre en place et atteindre des objectifs. Avec l’outil Comment établir des objectifs financiers INTELLIGENTS, les clients apprennent ce qu’est un objectif INTELLIGENT et choisissent des objectifs financiers INTELLIGENTS qui sont importants pour eux. [Prospérité Canada/Trove]

La feuille de calcul Comment établir un plan de dépenses est un outil que les clients peuvent utiliser pour créer un plan de dépenses pour chaque semaine en fonction des entrées et sorties d’argent du mois. [Prospérité Canada/Trove]

La feuille de calcul Élaboration d’un plan d’action en matière de dettes est un outil pour aider vos clients à prendre le contrôle sur leurs dettes. [Prospérité Canada/Trove]

Conseils pour la gestion des dettes et des factures est une feuille de référence que vous pouvez donner à vos clients dans les moments difficiles où la gestion des fonds est un défi.

Le classement des factures par ordre de priorité (anglais seulement) aide les clients à déterminer les factures à payer en premier lorsqu’il n’est pas possible de tout payer. Notez que cet outil provient du Consumer Financial Protection Bureau (CFPB), une agence gouvernementale américaine, et comprend un lien vers son site Web. Expliquez aux clients que les renseignements figurant sur le site Web sont adaptés au contexte américain. [Consumer Financial Protection Bureau]

Sites et outils en ligne

Voici d’excellents outils en ligne que vous pouvez également faire connaître et utiliser dans votre travail en matière d’AF avec les clients.

Orienteur en mesures d’aide [benefitswayfinder.org/fr]

L’aide à l’accès aux mesures d’aide est une autre façon puissante d’intervenir en matière d’AF. L’Orienteur en mesures d’aide est un outil simple, facile à utiliser et rédigé en langage clair qui aide les personnes à revenus faibles ou modestes à trouver et à répertorier les mesures d’aide auxquelles elles peuvent prétendre. Les clients peuvent l’utiliser seuls ou avec votre aide.

Pour en savoir plus, lisez la fiche d’information sur l’Orienteur en mesures d’aide. (anglais seulement)

Ensuite, regardez la vidéo Comment utiliser cet outil (anglais seulement). Elle explique et démontre comment naviguer à travers les principales caractéristiques de l’outil.

Si vous souhaitez obtenir une formation supplémentaire sur la façon d’aider vos clients à accéder aux mesures d’aide et d’utiliser l’Orienteur en mesures d’aide dans vos conversations au sujet de l’argent, vous pouvez vous inscrire au cours autodidacte en ligne ou à l’atelier en direct de Prospérité Canada.

Trove [yourtrove.org/fr]

Trove est un site Web bilingue gratuit que les clients peuvent visiter par eux-mêmes ou avec votre aide. La plupart des outils qui vous ont été présentés ci-dessus se trouvent sur Trove, ainsi qu’une multitude d’autres outils financiers conviviaux, des feuilles de calcul et des renseignements éducatifs pour aider les clients à prendre en charge leurs dépenses, à se renseigner sur la déclaration et les avantages fiscaux et à gérer leurs dettes.

En plus d’un lien vers l’Orienteur en mesures d’aide, vous trouverez également ces outils en ligne :

- Mon argent au Canada est un site Web qui peut aider les clients à acquérir de bonnes habitudes en matière de gestion de l’argent grâce à des modules d’apprentissage simples et faciles à utiliser sur toute une série de sujets liés à l’argent. Le site comprend également des vidéos (anglais seulement) et un questionnaire relatif au bien-être financier pour les clients.

- La calculatrice du REEI pour les Canadiens peut être utilisée pour évaluer la possibilité d’ouvrir et de cotiser à un régime enregistré d’épargne-invalidité.

Pour les gestionnaires — Outils pour démarrer avec l’autonomisation financière

The resources below focus on starting steps and tools to assist in the initial planning and implementation stages for embedding FE. Future phases of the toolkit will share resources for later stage efforts, as well as non-municipal efforts, such as public libraries and health care systems.

Outil 1. Argumenter en faveur de l’autonomisation financière.

Pour que l’AF soit un succès, il est essentiel d’obtenir l’adhésion du personnel et des intervenants.

Vous trouverez ci-dessous d’excellentes ressources à faire connaître aux acteurs clés qui ne connaissent pas encore l’AF. Elles peuvent vous aider à faire comprendre rapidement aux autres ce qu’est l’AF et la pertinence d’intégrer l’AF lorsque vous les accueillez ou lorsque vous travaillez à susciter l’intérêt pour l’AF dans votre municipalité.

● L’abécédaire des passerelles pour la prospérité (anglais seulement) donne un aperçu de « qu’est-ce que c’est » et du « pourquoi » au sujet de l’intégration de l’AF dans les services municipaux.

● La brochure de l’AF (anglais seulement) fournit une introduction plus détaillée à l’AF et à l’intégration de l’AF.

● Voici trois exemples de cas que vous pouvez utiliser pour montrer l’impact puissant que peut avoir l’intégration de l’AF dans les services municipaux :

o Exemple de cas : Région de York

o Exemple de cas : Services sociaux et d’emploi de Toronto

o Exemple de cas : Edmonton

Outil 2. Commencer : l’analyse interne

Prenez le temps de vous renseigner sur les types d’interventions courantes en matière d’AF. Ensuite, évaluez les conditions, la capacité et les considérations dans votre municipalité pour fournir ces types d’aide financière à vos clients.

Cet outil vous guide à travers une analyse interne qui vous permet d’envisager ce que pourrait être l’intégration de l’AF dans votre contexte de prestation de services.

Considérez l’outil 2 : Commencer : l’analyse interne un point de départ qui continuera à évoluer à mesure que vous avancerez dans le processus.

Outil 3. Explorer les partenariats : l’analyse externe

Les municipalités ne sont pas obligées de fournir elles-mêmes des mesures d’aides en matière d’AF pour transformer leurs services en passerelles pour la prospérité. Dans de nombreux cas, surtout au début, il peut être plus rentable et moins exigeant sur le plan des ressources d’établir des liens de référence vers d’autres prestataires de services locaux ou de s’associer à des organismes à but non lucratif, des fondations ou des prestataires de services financiers pour fournir l’aide financière répondant aux besoins de vos clients.

Utilisez l’outil 3 : Explorer les collaborations et les partenariats pour effectuer une analyse des services en matière d’AF dans votre communauté locale et identifier les collaborations et partenariats potentiels.

Deux autres ressources à propos du partenariat sont les « Éléments de l’intégration » et les « Conseils pour le partenariat » .

Outil 4. Concevoir l’initiative : le plan de service

Après avoir effectué une analyse interne et externe des obstacles et des opportunités, vous êtes maintenant prêt à concevoir une initiative d’AF adaptée au contexte de votre municipalité. La conception de l’initiative est une phase importante où vous élaborez le modèle de service, clarifiez les partenariats et imaginez l’expérience client idéale.

L’outil 4 : Conception de l’initiative vous guide dans le choix du meilleur modèle de prestation de services pour votre contexte et dans la conception du parcours du client et du personnel.

Nous espérons que cette boîte à outils se développera et s’améliorera avec l’utilisation et les commentaires. Les idées actuelles pour les outils à venir incluent :

- Comprendrela capacité financière de vos clients

- Mettresur pied une équipe performante

- Soutenirle personnel pour qu’il réussisse

- Mettreen place des processus efficaces de collecte de données et d’évaluation

Outil 5. Concevoir l’initiative : un guide d’observation

L’outil 5 : Un guide d’observation peut aider le personnel de première ligne à comprendre le processus, de l’accueil à la mise en œuvre du service.

Commentaires et suggestions

Nous serions ravis d’entendre vos commentaires et vos suggestions d’outils que vous trouveriez utiles. Veuillez nous envoyer un courriel : [email protected].

En savoir plus en matière d’AF

Publications canadiennes

Passerelles de prospérité : Les villes pour l’autonomisation financière — établir le dossier (anglais seulement) décrit les preuves qui sont pour l’intégration de l’AF.

Lisez le rapport intitulé Comment les services d’autonomisation financière aident les Ontariens à renforcer leur santé financière (anglais seulement) pour obtenir plus de preuves et de récits personnels.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [national] (anglais seulement) suggère que l’autonomisation financière est une pièce manquante essentielle de la politique du gouvernement fédéral qui peut considérablement améliorer les conditions de vie des clients lorsqu’elle est intégrée à d’autres programmes et services.

Le document Autonomisation financière — qu’est-ce que c’est et comment cela aide à réduire la pauvreté [Alberta] (anglais seulement) donne un aperçu de la démarche du gouvernement provincial en matière d’AF en Alberta. Le gouvernement de l’Alberta a adapté le document national (du même nom) pour l’utiliser dans ses discussions internes avec les décideurs municipaux. Créez un document que vous pourrez utiliser pour vos discussions internes en utilisant cet exemple.

Publications américaines

L’intégration municipale de l’AF au Canada est fondée sur les travaux influents réalisés aux États-Unis par le Fonds Cities for Financial Empowerment (CFE). Lancé en 2012 à New York, le Fonds CFE Fund a montré que l’intégration de stratégies d’AF dans l’infrastructure des gouvernements locaux peut avoir un « effet super vitaminé » sur les programmes publics, en augmentant la stabilité financière des ménages à revenu faible ou modéré.

- Lisez l’article pionnier : « Municipal Financial Empowerment: A Supervitamin for Public Programs » (anglais seulement)

- Apprenez-en davantage sur leur modèle de centres d’autonomisation financière (anglais seulement) dans cette vidéo de quatre minutes.

- Visitez leur site Web (anglais seulement) pour voir les ressources et vous inscrire à leur infolettre trimestrielle.

- Découvrez une évaluation de trois ans du modèle dans cinq villes des États-Unis. « An Evaluation of Financial Empowerment Centers – Building People’s Financial Stability as a Public Service » (anglais seulement)

L’Urban Institute a examiné le coût de l’insécurité financière des résidents sur les budgets municipaux de dix villes américaines dans cette recherche de 2017 (anglais seulement). Dans ces villes, les coûts vont de dizaines à des centaines de millions de dollars, ce qui suggère que les villes ont un intérêt économique à améliorer la santé financière de leurs résidents.

Un rapport de JP Morgan Chase passe en revue les efforts déployés par les municipalités pour intégrer la capacité financière dans les services publics dans plusieurs villes américaines dans « A Scan of Municipal Financial Capability Efforts » (anglais seulement).

Resources

Opening and Welcome

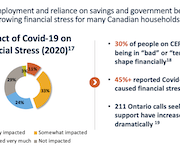

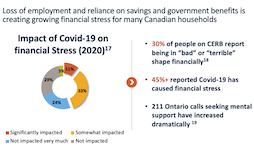

Session: Tackling pandemic hardship: The financial impact of COVID-19 on low-income households

Tackling pandemic hardship: The financial impact of COVID-19 on low-income households – YouTube

Download summary and detailed reports: The financial resilience and financial well-being of Canadians with low incomes: insights and analysis to support the financial empowerment sector

Download slide deck: The differential impact of the pandemic on low income families

Booth Chats: Big ideas for a more equitable recovery

Resolve Financial and Credit Counselling

Video Pitch: Booth chat: Jeri Bittorf, Resolve Financial and Credit Counselling Services Coordinator – YouTube

Slide Deck: K3C Credit Counselling (ablefinancialempowerment.org)

Seniors Financial Empowerment Network

Video Pitch: Booth Chat: Sarah Ramsey, City of Edmonton, Community Development Social Worker – YouTube

Seneca College

Video Pitch: Booth Chat: Varinder Gill, Seneca College, Professor & Program Co-ordinator – YouTube

Prosper Canada: Integrating Financial Empowerment into Ontario Works

Video Pitch: Booth Chat: Ana Fremont, Prosper Canada Manager, Program Delivery and Integration – YouTube

Slide Deck: Thunder Bay Financial Empowerment Integration (ablefinancialempowerment.org)

Prosper Canada: Prosperity Gateways – Cities for Financial Empowerment, Toronto Public Library

Video Pitch: Booth Chat: John Stephenson, Manager, Program Delivery and Integration – YouTube

Slide Deck: PowerPoint Presentation (ablefinancialempowerment.org)

Session: Measuring the divide: Has COVID-19 widened economic disparities for Canada’s BIPOC communities

Download slide deck: Income Support During COVID-19and ongoing challenges

Download slide deck: Re thinking income adequacy in the COVID-19 recovery

Session: Financial wellness and healing: Can building financial wellness help Indigenous communities?

Session recording: Financial wellness and healing: Can building financial wellness help Indigenous communities? – YouTube

Download slide deck: Indigenous Financial Literacy: Behaviour Insights from an Indigenous Perspective

Download slide deck: Financial wellness and Indigenous Healing

Session: When money meets race: Addressing systemic racism through financial empowerment