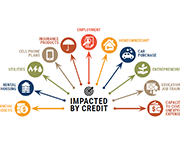

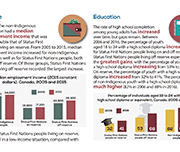

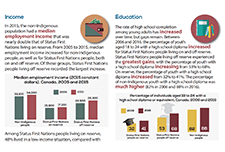

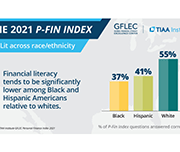

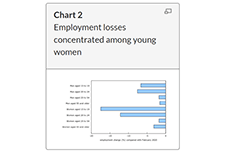

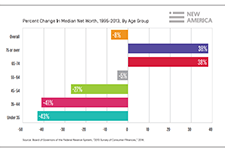

The events of 2020 revealed unvarnished truths that demand that philanthropic organizations take action to build economic well-being for all. This long-overdue moment emphasizes the critical need for strategies that provide a range of support to women and Black, Latinx, Indigenous, and Asian people, who are struggling due to deep financial disparities. Today’s disparities are built on, and exacerbated by, long-standing inequities created by structural racism, sexism, and classism, which have limited financial security and overall well-being for those affected. This brief responds to the urgency of this moment, reimagining and building on past recommendations to map more just paths to economic resilience moving forward.

Checking registration helps protect you from unqualified or fraudulent individuals. Always check the registration of any person or business trying to sell you an investment or give you investment advice by using the Canadian Securities Administrators’ National Registration Search.

Titles like financial advisor, financial planner, investment consultant, and investment specialist aren’t legally defined terms or official registration categories. Some advisers or dealers may have designations that allow them to use specific titles, such as Certified Financial Planner (CFP), Chartered Professional Accountant (CPA) or Chartered Financial Analyst (CFA). Checking registration tells you what specific products and services they are (and aren’t) qualified to offer you, regardless of title.